Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Frequency<br />

Frequency<br />

Frequency<br />

Frequency<br />

India Venture Capital and Private Equity Report 2014<br />

banks and financial institutions (fund of funds, insurance, etc.). However in the US, close to half of the<br />

commitments to the VCPE asset class have been from pension funds. Pension funds being long term sources of<br />

funding with defined cash inflows and outflows can be ideal sources for VCPE funds. However, the regulatory<br />

environment in India prevents the domestic pension funds to invest in VCPE funds. The share of pension funds<br />

in the commitments in India has been from foreign pension funds. Another category of LPs that contribute to<br />

substantial commitments in the US are the foundations and university endowments. University endowments<br />

in India are not very large that can allocate a portion of it to PE. Further, universities in India are commonly set<br />

up as trusts and societies, and the regulations that govern these structures also do not facilitate investment in<br />

VCPE funds. Liberalisation of the regulations would result in inflow by domestic capital from these LPs.<br />

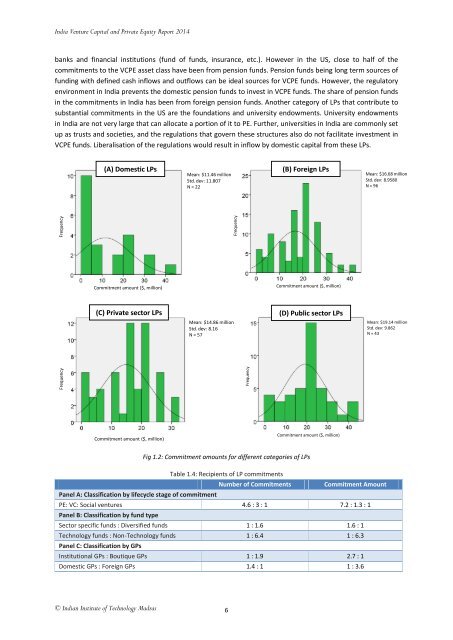

(A) Domestic LPs<br />

Mean: $11.46 million<br />

Std. dev: 11.807<br />

N = 22<br />

(B) Foreign LPs<br />

Mean: $16.68 million<br />

Std. dev: 8.9580<br />

N = 96<br />

Commitment amount ($, million)<br />

Commitment amount ($, million)<br />

(C) Private sector LPs<br />

(D) Public sector LPs<br />

Mean: $14.86 million<br />

Std. dev: 8.16<br />

N = 57<br />

Mean: $19.14 million<br />

Std. dev: 9.862<br />

N = 43<br />

Commitment amount ($, million)<br />

Commitment amount ($, million)<br />

Fig 1.2: Commitment amounts for different categories of LPs<br />

Table 1.4: Recipients of LP commitments<br />

Number of Commitments<br />

Commitment Amount<br />

Panel A: Classification by lifecycle stage of commitment<br />

PE: VC: Social ventures 4.6 : 3 : 1 7.2 : 1.3 : 1<br />

Panel B: Classification by fund type<br />

Sector specific funds : Diversified funds 1 : 1.6 1.6 : 1<br />

Technology funds : Non-Technology funds 1 : 6.4 1 : 6.3<br />

Panel C: Classification by GPs<br />

Institutional GPs : Boutique GPs 1 : 1.9 2.7 : 1<br />

Domestic GPs : Foreign GPs 1.4 : 1 1 : 3.6<br />

© Indian Institute of Technology Madras<br />

6