Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

India Venture Capital and Private Equity Report 2014<br />

an attractive career choice as an alternative to the more traditional ‘safe employment’ options in established<br />

companies. Academic incubators are attractive as they provide access to latest technological developments<br />

and also an intellectual environment that promotes innovation and excellence, along with a network of<br />

contacts in the industry and scientific establishments. In addition to infrastructure and space, they are also<br />

able to provide business support services and also crucially, access to individually targeted mentoring and<br />

training schemes. Moreover, such incubators are also geared towards addressing the needs of diverse startups<br />

spanning various maturity stages, operational cycles and industry or market segments. For fresh or<br />

returning entrepreneurs, this provides an ideal platform to create, grow and transform their ventures to<br />

successful businesses.<br />

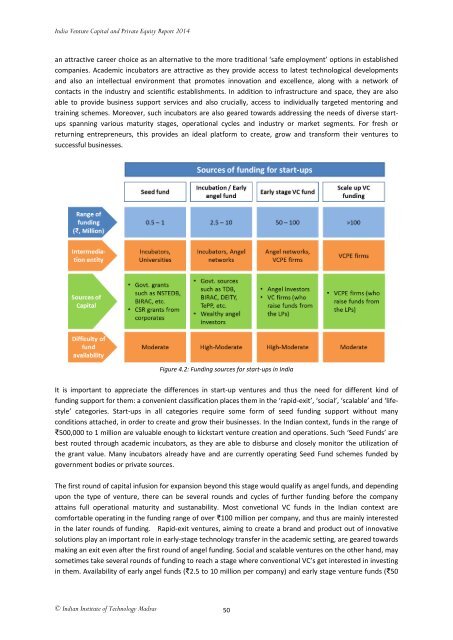

Figure 4.2: Funding sources for start-ups in India<br />

It is important to appreciate the differences in start-up ventures and thus the need for different kind of<br />

funding support for them: a convenient classification places them in the ‘rapid-exit’, ‘social’, ‘scalable’ and ‘lifestyle’<br />

categories. Start-ups in all categories require some form of seed funding support without many<br />

conditions attached, in order to create and grow their businesses. In the Indian context, funds in the range of<br />

₹500,000 to 1 million are valuable enough to kickstart venture creation and operations. Such ‘Seed Funds’ are<br />

best routed through academic incubators, as they are able to disburse and closely monitor the utilization of<br />

the grant value. Many incubators already have and are currently operating Seed Fund schemes funded by<br />

government bodies or private sources.<br />

The first round of capital infusion for expansion beyond this stage would qualify as angel funds, and depending<br />

upon the type of venture, there can be several rounds and cycles of further funding before the company<br />

attains full operational maturity and sustanability. Most convetional VC funds in the Indian context are<br />

comfortable operating in the funding range of over ₹100 million per company, and thus are mainly interested<br />

in the later rounds of funding. Rapid-exit ventures, aiming to create a brand and product out of innovative<br />

solutions play an important role in early-stage technology transfer in the academic setting, are geared towards<br />

making an exit even after the first round of angel funding. Social and scalable ventures on the other hand, may<br />

sometimes take several rounds of funding to reach a stage where conventional VC’s get interested in investing<br />

in them. Availability of early angel funds (₹2.5 to 10 million per company) and early stage venture funds (₹50<br />

© Indian Institute of Technology Madras<br />

50