Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

India Venture Capital and Private Equity Report 2014<br />

India, the crowd funding phenomenon has grown exponentially in the US and other markets since the 2008<br />

financial crisis.<br />

The crowd funding concept<br />

If a company needs to raise one crore rupees from the market, there are multiple means to achieve this goal.<br />

The well-established (and regulated) paths include issuing stock in the stock market and issuing bonds. But<br />

what if the company is unable to qualify under all the regulation required? Is it not possible to raise one crore<br />

rupees by raising just one rupee from one crore people? Now consider it from another perspective. For a retail<br />

investor, is it possible to invest one Rupee in one hundred companies rather than One hundred Rupees in one<br />

company?<br />

Welcome to the world of Crowd funding, that connects these two sides. Any individual with a need to raise<br />

money (or any company for that matter) with minimal regulation and no previous record can now raise money<br />

on crowd funding websites on the internet. Crowd funding has become an umbrella term describing the use of<br />

small amounts of money, obtained from a large number of individuals or organizations, to fund a project or a<br />

business through an online web-based platform. 21 IOSCO (International Organization of Securities<br />

Commissions) indicates four different types of crowd funding – donation crowd funding, reward crowd<br />

funding, peer-to-peer lending, and equity crowd funding. 22 The peer-to-peer lending and equity crowd funding<br />

have been collectively referred to as financial return crowd funding. An estimated $6.4 billion has been raised<br />

till September 2013 since the inception of the financial return crowd funding market in 2006. Being the oldest<br />

market, the US accounts for 51% of the global market. This is followed by China at 28% and UK at 17%. China<br />

and South Korea make up 95% of the total Asian market. 23<br />

The equity crowd funding segment in the financial return crowd funding, however, is not very large. In the UK,<br />

this segment is estimated between $25 to $80 million. There are few platforms that are operating solely in the<br />

equity crowd funding platform. Some examples of the sole equity crowd funding platforms are: Syndicate<br />

Room, Crowdcube, and Seedrs in the UK; Honglingchuangtou and AngelCrunch in China 24 . A 2013 study<br />

indicated the broad demographics of investors in the financial return crowd funding market. The study showed<br />

that most of the lenders are between 40 and 60 years, and almost 90% were experienced investors in<br />

securities. The median investment size was £50, and the median number of investments is 35, and the median<br />

total investment was £2000. The study showed that relatively experienced retail investors invested small<br />

amounts of money in a large number of projects. 25 Table 5.2 shows some of the leading platforms in equity<br />

crowd funding globally.<br />

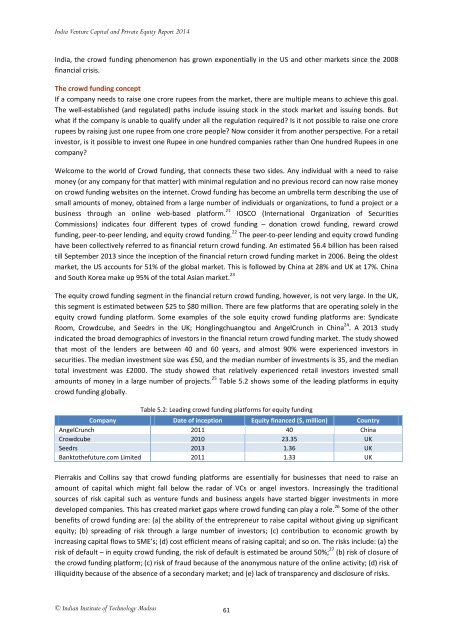

Table 5.2: Leading crowd funding platforms for equity funding<br />

Company Date of inception Equity financed ($, million) Country<br />

AngelCrunch 2011 40 China<br />

Crowdcube 2010 23.35 UK<br />

Seedrs 2013 1.36 UK<br />

Banktothefuture.com Limited 2011 1.33 UK<br />

Pierrakis and Collins say that crowd funding platforms are essentially for businesses that need to raise an<br />

amount of capital which might fall below the radar of VCs or angel investors. Increasingly the traditional<br />

sources of risk capital such as venture funds and business angels have started bigger investments in more<br />

developed companies. This has created market gaps where crowd funding can play a role. 26 Some of the other<br />

benefits of crowd funding are: (a) the ability of the entrepreneur to raise capital without giving up significant<br />

equity; (b) spreading of risk through a large number of investors; (c) contribution to economic growth by<br />

increasing capital flows to SME’s; (d) cost efficient means of raising capital; and so on. The risks include: (a) the<br />

risk of default – in equity crowd funding, the risk of default is estimated be around 50%; 27 (b) risk of closure of<br />

the crowd funding platform; (c) risk of fraud because of the anonymous nature of the online activity; (d) risk of<br />

illiquidity because of the absence of a secondary market; and (e) lack of transparency and disclosure of risks.<br />

© Indian Institute of Technology Madras<br />

61