Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

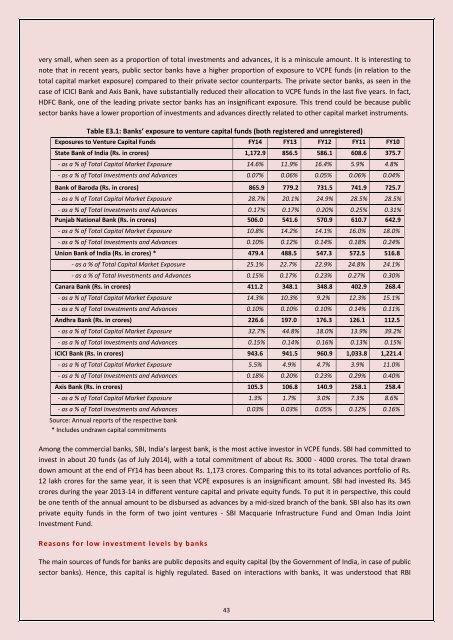

very small, when seen as a proportion of total investments and advances, it is a miniscule amount. It is interesting to<br />

note that in recent years, public sector banks have a higher proportion of exposure to VCPE funds (in relation to the<br />

total capital market exposure) compared to their private sector counterparts. The private sector banks, as seen in the<br />

case of ICICI Bank and Axis Bank, have substantially reduced their allocation to VCPE funds in the last five years. In fact,<br />

HDFC Bank, one of the leading private sector banks has an insignificant exposure. This trend could be because public<br />

sector banks have a lower proportion of investments and advances directly related to other capital market instruments.<br />

Table E3.1: Banks’ exposure to venture capital funds (both registered and unregistered)<br />

Exposures to Venture Capital Funds FY14 FY13 FY12 FY11 FY10<br />

State Bank of India (Rs. in crores) 1,172.9 856.5 586.1 608.6 375.7<br />

- as a % of Total Capital Market Exposure 14.6% 11.9% 16.4% 5.9% 4.8%<br />

- as a % of Total Investments and Advances 0.07% 0.06% 0.05% 0.06% 0.04%<br />

Bank of Baroda (Rs. in crores) 865.9 779.2 731.5 741.9 725.7<br />

- as a % of Total Capital Market Exposure 28.7% 20.1% 24.9% 28.5% 28.5%<br />

- as a % of Total Investments and Advances 0.17% 0.17% 0.20% 0.25% 0.31%<br />

Punjab National Bank (Rs. in crores) 506.0 541.6 570.9 610.7 642.9<br />

- as a % of Total Capital Market Exposure 10.8% 14.2% 14.1% 16.0% 18.0%<br />

- as a % of Total Investments and Advances 0.10% 0.12% 0.14% 0.18% 0.24%<br />

Union Bank of India (Rs. in crores) * 479.4 488.5 547.3 572.5 516.8<br />

- as a % of Total Capital Market Exposure 25.1% 22.7% 22.9% 24.8% 24.1%<br />

- as a % of Total Investments and Advances 0.15% 0.17% 0.23% 0.27% 0.30%<br />

Canara Bank (Rs. in crores) 411.2 348.1 348.8 402.9 268.4<br />

- as a % of Total Capital Market Exposure 14.3% 10.3% 9.2% 12.3% 15.1%<br />

- as a % of Total Investments and Advances 0.10% 0.10% 0.10% 0.14% 0.11%<br />

Andhra Bank (Rs. in crores) 226.6 197.0 176.3 126.1 112.5<br />

- as a % of Total Capital Market Exposure 32.7% 44.8% 18.0% 13.9% 39.2%<br />

- as a % of Total Investments and Advances 0.15% 0.14% 0.16% 0.13% 0.15%<br />

ICICI Bank (Rs. in crores) 943.6 941.5 960.9 1,033.8 1,221.4<br />

- as a % of Total Capital Market Exposure 5.5% 4.9% 4.7% 3.9% 11.0%<br />

- as a % of Total Investments and Advances 0.18% 0.20% 0.23% 0.29% 0.40%<br />

Axis Bank (Rs. in crores) 105.3 106.8 140.9 258.1 258.4<br />

- as a % of Total Capital Market Exposure 1.3% 1.7% 3.0% 7.3% 8.6%<br />

- as a % of Total Investments and Advances 0.03% 0.03% 0.05% 0.12% 0.16%<br />

Source: Annual reports of the respective bank<br />

* Includes undrawn capital commitments<br />

Among the commercial banks, SBI, India’s largest bank, is the most active investor in VCPE funds. SBI had committed to<br />

invest in about 20 funds (as of July 2014), with a total commitment of about Rs. 3000 - 4000 crores. The total drawn<br />

down amount at the end of FY14 has been about Rs. 1,173 crores. Comparing this to its total advances portfolio of Rs.<br />

12 lakh crores for the same year, it is seen that VCPE exposures is an insignificant amount. SBI had invested Rs. 345<br />

crores during the year 2013-14 in different venture capital and private equity funds. To put it in perspective, this could<br />

be one tenth of the annual amount to be disbursed as advances by a mid-sized branch of the bank. SBI also has its own<br />

private equity funds in the form of two joint ventures - SBI Macquarie Infrastructure Fund and Oman India Joint<br />

Investment Fund.<br />

Reasons for low investment levels by b anks<br />

The main sources of funds for banks are public deposits and equity capital (by the Government of India, in case of public<br />

sector banks). Hence, this capital is highly regulated. Based on interactions with banks, it was understood that RBI<br />

43