Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Exhibit 5<br />

Direct Investments from LPs:<br />

An indication of change<br />

Direct LP investments: What ar e they?<br />

LPs, domestic and foreign alike, traditionally routed their investments in PE through the VCPE funds. The VCPE funds are<br />

managed by the GPs whose duties and responsibilities spanned beyond collection of funds to getting involved in the<br />

proper operation of the investee companies and making the portfolio companies profitable. But somehow the<br />

performance of the GPs in ameliorating the performance of the investee companies have failed to yield the desired<br />

results, creating an overall sense of dissatisfaction among the LPs (see Exhibit 6 on the returns earned in various<br />

investments). The extra cost that the LPs have to bear in the form of fund management fees as well as sharing of profits<br />

(known as carry income) with the GPs aggravated the discontent of the LPs. As a result, the LPs have started making<br />

investments in companies directly, rather than through a VCPE fund, thereby bypassing the GPs. These direct<br />

investments are getting more popular among the LPs with time as they have realized the benefits attainable by<br />

separating the GPs from the investment chain. In such direct investments, the returns from the investments can be<br />

savoured directly by the LPs. Also by bypassing the GPs from the investment chain, the LPs can now be involved in the<br />

day to day activities of the companies and monitor their investee companies more closely. Thus, the direct investment<br />

by the LPs in the companies is gaining popularity and many LPs are slowly starting to follow this path while also<br />

investing in the regular path, i.e. through funds. Included within direct investments is a category called co-investments,<br />

where LPs co-invest in a company along with the VCPE funds in which they have invested.<br />

Trends in Dir ect LP investmen ts<br />

The data used in the analysis was collected from VCC Edge, the VC and PE investment data base from VC Circle. The<br />

dataset that was used in the analysis comprised a total of 836 deals involving 96 LPs in 655 different companies. Among<br />

these 655 companies, 146 were co-investments, i.e., LPs have invested directly as well as through the VCPE funds in<br />

which they have invested. Out of the 836 deals, investment details were available for only 419 of these deals. Our<br />

dataset indicated that the total direct investment in companies by LPs have been to the tune of $17 billion in these 419<br />

deals. The average investment size in a direct investment was $7.76 million (after removing outlier investments), and<br />

the average stake acquired has been 14.59%. In terms of exit patterns, our data set showed that a high proportion of<br />

the exits (>95%) were through secondary sale. Though investments were seen in both listed and unlisted companies, a<br />

majority of the deals were in unlisted companies.<br />

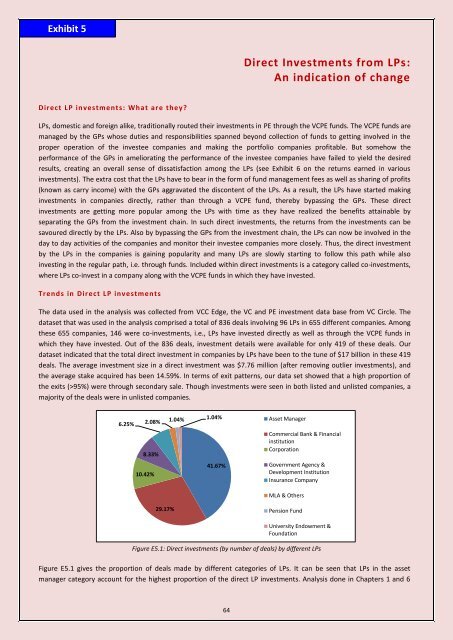

6.25% 2.08% 1.04% 1.04% Asset Manager<br />

8.33%<br />

10.42%<br />

41.67%<br />

Commercial Bank & Financial<br />

institution<br />

Corporation<br />

Government Agency &<br />

Development Institution<br />

Insurance Company<br />

MLA & Others<br />

29.17%<br />

Pension Fund<br />

University Endowment &<br />

Foundation<br />

Figure E5.1: Direct investments (by number of deals) by different LPs<br />

Figure E5.1 gives the proportion of deals made by different categories of LPs. It can be seen that LPs in the asset<br />

manager category account for the highest proportion of the direct LP investments. Analysis done in Chapters 1 and 6<br />

64