Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

India Venture Capital and Private Equity Report 2014<br />

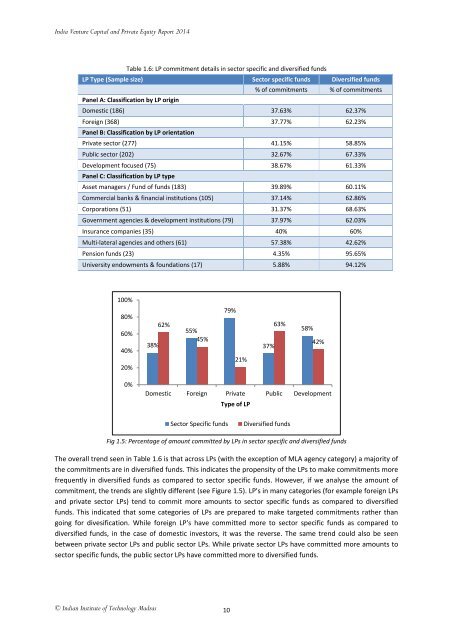

Table 1.6: LP commitment details in sector specific and diversified funds<br />

LP Type (Sample size) Sector specific funds Diversified funds<br />

% of commitments % of commitments<br />

Panel A: Classification by LP origin<br />

Domestic (186) 37.63% 62.37%<br />

Foreign (368) 37.77% 62.23%<br />

Panel B: Classification by LP orientation<br />

Private sector (277) 41.15% 58.85%<br />

Public sector (202) 32.67% 67.33%<br />

Development focused (75) 38.67% 61.33%<br />

Panel C: Classification by LP type<br />

Asset managers / Fund of funds (183) 39.89% 60.11%<br />

Commercial banks & financial institutions (105) 37.14% 62.86%<br />

Corporations (51) 31.37% 68.63%<br />

Government agencies & development institutions (79) 37.97% 62.03%<br />

Insurance companies (35) 40% 60%<br />

Multi-lateral agencies and others (61) 57.38% 42.62%<br />

Pension funds (23) 4.35% 95.65%<br />

University endowments & foundations (17) 5.88% 94.12%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

38%<br />

62%<br />

55%<br />

45%<br />

79%<br />

21%<br />

37%<br />

63%<br />

58%<br />

42%<br />

0%<br />

Domestic Foreign Private Public Development<br />

Type of LP<br />

Sector Specific funds<br />

Diversified funds<br />

Fig 1.5: Percentage of amount committed by LPs in sector specific and diversified funds<br />

The overall trend seen in Table 1.6 is that across LPs (with the exception of MLA agency category) a majority of<br />

the commitments are in diversified funds. This indicates the propensity of the LPs to make commitments more<br />

frequently in diversified funds as compared to sector specific funds. However, if we analyse the amount of<br />

commitment, the trends are slightly different (see Figure 1.5). LP's in many categories (for example foreign LPs<br />

and private sector LPs) tend to commit more amounts to sector specific funds as compared to diversified<br />

funds. This indicated that some categories of LPs are prepared to make targeted commitments rather than<br />

going for divesification. While foreign LP's have committed more to sector specific funds as compared to<br />

diversified funds, in the case of domestic investors, it was the reverse. The same trend could also be seen<br />

between private sector LPs and public sector LPs. While private sector LPs have committed more amounts to<br />

sector specific funds, the public sector LPs have committed more to diversified funds.<br />

© Indian Institute of Technology Madras<br />

10