Past Reports

2014vcpa

2014vcpa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

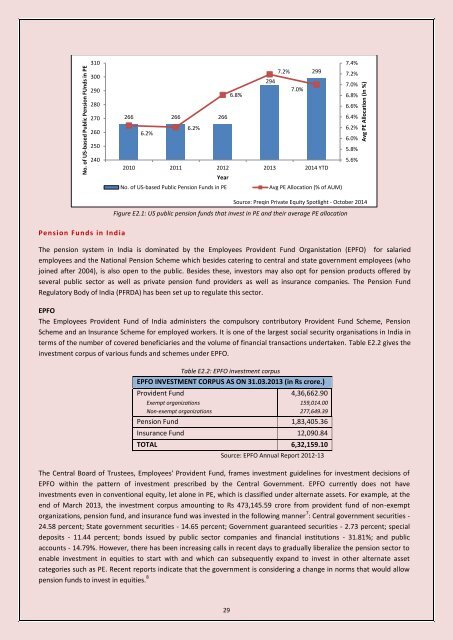

No. of US-based Public Pension FUnds in PE<br />

310<br />

300<br />

290<br />

280<br />

270<br />

260<br />

250<br />

240<br />

7.2% 299<br />

294<br />

7.0%<br />

6.8%<br />

266 266 266<br />

6.2%<br />

6.2%<br />

2010 2011 2012 2013 2014 YTD<br />

Year<br />

No. of US-based Public Pension Funds in PE<br />

Avg PE Allocation (% of AUM)<br />

7.4%<br />

7.2%<br />

7.0%<br />

6.8%<br />

6.6%<br />

6.4%<br />

6.2%<br />

6.0%<br />

5.8%<br />

5.6%<br />

Avg PE Allocation (in %)<br />

Source: Preqin Private Equity Spotlight - October 2014<br />

Figure E2.1: US public pension funds that invest in PE and their average PE allocation<br />

Pension Funds in Ind ia<br />

The pension system in India is dominated by the Employees Provident Fund Organistation (EPFO) for salaried<br />

employees and the National Pension Scheme which besides catering to central and state government employees (who<br />

joined after 2004), is also open to the public. Besides these, investors may also opt for pension products offered by<br />

several public sector as well as private pension fund providers as well as insurance companies. The Pension Fund<br />

Regulatory Body of India (PFRDA) has been set up to regulate this sector.<br />

EPFO<br />

The Employees Provident Fund of India administers the compulsory contributory Provident Fund Scheme, Pension<br />

Scheme and an Insurance Scheme for employed workers. It is one of the largest social security organisations in India in<br />

terms of the number of covered beneficiaries and the volume of financial transactions undertaken. Table E2.2 gives the<br />

investment corpus of various funds and schemes under EPFO.<br />

Table E2.2: EPFO investment corpus<br />

EPFO INVESTMENT CORPUS AS ON 31.03.2013 (in Rs crore.)<br />

Provident Fund<br />

Exempt organizations<br />

Non-exempt organizations<br />

4,36,662.90<br />

159,014.00<br />

277,649.39<br />

Pension Fund 1,83,405.36<br />

Insurance Fund 12,090.84<br />

TOTAL 6,32,159.10<br />

Source: EPFO Annual Report 2012-13<br />

The Central Board of Trustees, Employees' Provident Fund, frames investment guidelines for investment decisions of<br />

EPFO within the pattern of investment prescribed by the Central Government. EPFO currently does not have<br />

investments even in conventional equity, let alone in PE, which is classified under alternate assets. For example, at the<br />

end of March 2013, the investment corpus amounting to Rs 473,145.59 crore from provident fund of non-exempt<br />

organizations, pension fund, and insurance fund was invested in the following manner 7 : Central government securities -<br />

24.58 percent; State government securities - 14.65 percent; Government guaranteed securities - 2.73 percent; special<br />

deposits - 11.44 percent; bonds issued by public sector companies and financial institutions - 31.81%; and public<br />

accounts - 14.79%. However, there has been increasing calls in recent days to gradually liberalize the pension sector to<br />

enable investment in equities to start with and which can subsequently expand to invest in other alternate asset<br />

categories such as PE. Recent reports indicate that the government is considering a change in norms that would allow<br />

pension funds to invest in equities. 8<br />

29