Annual Report 2010-11

Annual Report 2010-11 - Kribhco

Annual Report 2010-11 - Kribhco

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

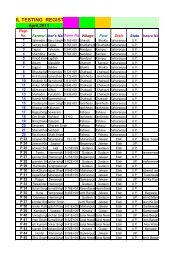

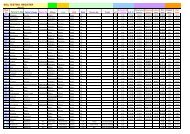

SCHEDULE - 24<br />

NOTES FORMING PART OF THE STATEMENT OF ACCOUNTS<br />

FOR THE YEAR ENDED MARCH 31, 20<strong>11</strong><br />

1. CAPITAL COMMITMENTS<br />

Estimated Value of contracts remaining to be executed on Capital Account (Net of Advances and<br />

Letters of Credit for capital items) and not provided for is `38,604.02 lakh (Previous Year `27,860.56<br />

lakh).<br />

2. CONTINGENT LIABILITIES<br />

(i)<br />

As on<br />

31.03.20<strong>11</strong><br />

Claims against the Society not acknowledged as debts<br />

(a) Claims against Society/Disputed Liabilities 172.95 16.00<br />

(b) Disputed liability relating to Tax matters 2,785.63 2,680.50<br />

(c) Disputed liability relating to labour matters 16,286.22 14,541.68<br />

(d) Court cases/ Arbitration with Contractors/ Suppliers 1,279.27 3,887.91<br />

(ii) Guarantees/Counter Guarantees and Letters of Credit given by 8<strong>11</strong>7.19 32,518.06<br />

Banks on behalf of the Society<br />

(iii)<br />

As on<br />

31.03.<strong>2010</strong><br />

Total 20,524.07 21,126.09<br />

Guarantees/Counter Guarantees to lenders and others given by<br />

the Society in respect of Joint Ventures/ Subsidiaries (including<br />

Surety Bonds and Letter of Comfort). 1,34,233.01 1,20,624.56<br />

3. DEFERRED TAX ASSET / LIABILITY<br />

Deferred tax has been worked out in consonance with Accounting Standard 22 - "Accounting for<br />

Taxes on Income", issued by the Institute of Chartered Accountants of India. Major elements of<br />

Liability:<br />

deferred tax liabilities/assets created for tax effects of timing difference are as under:<br />

As on<br />

31.03.20<strong>11</strong><br />

• Depreciation 6,169.12 5,855.81<br />

Sub-total 6,169.12 5,855.81<br />

Assets:<br />

• Provision for Employees benefits allowable on payment basis 3,615.77 3,637.38<br />

• Provision for Doubtful Debts/Advances <strong>11</strong>3.67 149.20<br />

• Provision for Wage Revision - 298.20<br />

• Provision & Other Expenses allowable on payment basis 189.68 107.72<br />

Sub-total 3,919.12 4,192.50<br />

Net Deferred Tax Liability / (Asset) 2,250.00 1,663.31<br />

Net Deferred Tax Liability charged to Profit and Loss Account 586.69 1,160.42<br />

( ` inlakh)<br />

( ` inlakh)<br />

As on<br />

31.03.<strong>2010</strong><br />

54