Annual Report 2010-11

Annual Report 2010-11 - Kribhco

Annual Report 2010-11 - Kribhco

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

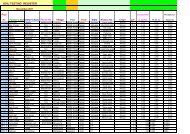

9. CURRENT ASSETS, LOANS AND ADVANCES<br />

i) Balances of some of the contractors/customers/suppliers/receivable/payable and deposits with<br />

others are subject to confirmation/reconciliation and consequential adjustments, if any, which in<br />

the opinion of management would not be material.<br />

ii) In the opinion of the management, the value of Current Assets, Loans and Advances on<br />

realisation in the ordinary course of business will not be less than the value at which these are<br />

stated.<br />

10. PROFIT AND LOSS ACCOUNT<br />

Provision for Taxation has been made after considering provisions of the agreement between the<br />

Republic of India and the Sultanate of Oman for the Avoidance of Double Taxation in respect of<br />

dividend received from Oman India Fertilizer Company SAOC (OMIFCO) by the Permanent<br />

Establishment of Society in the form of a branch in Oman.<br />

<strong>11</strong>. SUBSIDY FROM GOVERNMENT OF INDIA<br />

i) Nitrogenous fertilisers are under the concession scheme as notified by Government of India<br />

(GOI) from time to time. The concession on nitrogenous fertilisers has been accounted for<br />

keeping in view the practice in the industry, norms, parameters and guidelines fixed/followed by<br />

Fertiliser Industry Co-ordination Committee (FICC) from time to time, pending notification by the<br />

FICC. On fixation of final concession price, necessary adjustments, if any, has been made in the<br />

accounts for the year in which such price is fixed.<br />

ii) Concession on imported phosphatic fertilisers has been accounted for based on the concession<br />

rate as notified by Govt. of India under Nutrient Based Subsidy Scheme (NBS).<br />

iii) Freight Subsidy has been accounted for in terms of the schemes notified by GOI/FICC.<br />

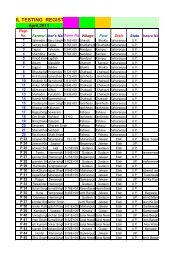

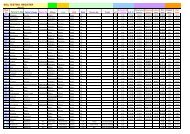

12. EMPLOYEE BENEFITS<br />

A) Disclosures as required under Accounting Standard 15 (Revised) "Employee Benefits", issued by<br />

the Institute of Chartered Accountants of India, in respect of Defined Benefit Obligations are as<br />

under:-<br />

i) The principal actuarial assumptions used are as below -<br />

Year ended<br />

31.03.20<strong>11</strong><br />

Year ended<br />

31.03.<strong>2010</strong><br />

i) Method Used Projected Unit Credit Method<br />

ii) Discount Rate 8.00% 8.00%<br />

iii) Expected rate of return on Plan Assets-Gratuity Fund 9.45% 9.45%<br />

iv) Expected rate of increase in Compensation Level 6.00% 6.00%<br />

The estimate of future salary increase considered in actuarial valuation, take account of inflation,<br />

seniority, promotion and other relevant factors, such as supply and demand in the employment<br />

market.<br />

56