Annual Report 2010-11

Annual Report 2010-11 - Kribhco

Annual Report 2010-11 - Kribhco

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

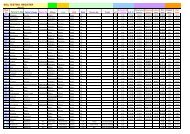

vi) Experience adjustments<br />

Year ended<br />

31.03.20<strong>11</strong><br />

Year ended<br />

31.03.<strong>2010</strong><br />

Gratuity<br />

(i) Plan Assets- Loss/(Gain) - 159.27<br />

(ii) Obligations- Loss/(Gain) 757.58 1,357.63<br />

Leave Encashment (Obligations)-Loss/(Gain) (1,270.85) (2,028.76)<br />

( ` inlakh)<br />

B) Provision for long service award, farewell gift and travel to home town on superannuation<br />

amounting to `527.05 lakhs (Previous Year Nil) have been made on the basis of actuarial<br />

valuation at the year end and expensed to Profit & Loss Account.<br />

C) The Society pays fixed contribution to provident fund at predetermined rates to a separate<br />

trust, which invests the funds in permitted securities. Contribution to family pension scheme is<br />

paid to the appropriate authorities. The contribution of `1,544.15 lakhs (Previous year<br />

`1,882.50 lakhs) to the funds for the year is recognized as expense and is charged to the Profit &<br />

Loss Account. The obligation of the Society is to make such fixed contribution and to ensure a<br />

minimum rate of return to the members as specified by Government of India. As per report of<br />

the actuary, liability is recognized for `126.18 lakhs (Previous Year Nil) for expected shortfall<br />

between fair value of PF Trust Assets and present obligations determined as per actuarial<br />

valuation made at the year end.<br />

13. OPERATING LEASE<br />

The Society's significant leasing arrangements are in respect of Operating Lease of premises for<br />

offices of the Society and residential use of employees. These leasing agreements are usually<br />

renewable on mutually agreed terms but are cancelable. These payments are shown as "Rent,<br />

Rates and Taxes" in Schedule - 20 of 'Manufacturing, Administration, Distribution and Other<br />

Expenses.'<br />

14. PRIMARY SEGMENT - BUSINESS SEGMENT<br />

i) Business Segment: The Society's operating business are organized and managed according to<br />

the nature of products and services provided. The three identified segments are 'Urea and<br />

Ammonia-Manufactured', 'Imported Fertilizers' and 'Other Products'. The 'Urea and Ammonia-<br />

Manufactured' segment includes manufacture and marketing of Urea and Ammonia.<br />

'Imported Fertilizers' segment includes trading of Imported OMIFCO Urea, Imported<br />

Phosphatic/ Potasic Fertilizers. 'Other Products' segment includes Trading and Manufacturing<br />

of bio-fertilizers, seeds, pesticides, indigenous fertilizers, agro inputs, argon gas etc.<br />

ii) Segment Accounting Policies: Direct revenue and expenses are allocated to respective<br />

segments. Indirect revenue and expenses are allocated amongst the segments on a reasonable<br />

basis. Segment Assets include all operating assets used by segment comprising Fixed Assets,<br />

58