PROGRESS REPORT

1LLMfQ4

1LLMfQ4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40 <strong>PROGRESS</strong> <strong>REPORT</strong> PROGRAM LEVEL <strong>PROGRESS</strong> <strong>REPORT</strong> 41<br />

Rural Financial Services:<br />

Input Voucher System<br />

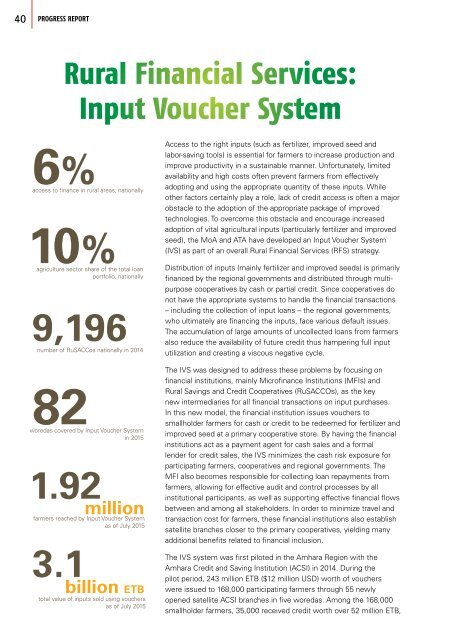

6%<br />

access to finance in rural areas, nationally<br />

10%<br />

agriculture sector share of the total loan<br />

portfolio, nationally<br />

9,196<br />

number of RuSACCos nationally in 2014<br />

82<br />

woredas covered by Input Voucher System<br />

in 2015<br />

1.92<br />

3.1<br />

million<br />

farmers reached by Input Voucher System<br />

as of July 2015<br />

billion ETB<br />

total value of inputs sold using vouchers<br />

as of July 2015<br />

Access to the right inputs (such as fertilizer, improved seed and<br />

labor-saving tools) is essential for farmers to increase production and<br />

improve productivity in a sustainable manner. Unfortunately, limited<br />

availability and high costs often prevent farmers from effectively<br />

adopting and using the appropriate quantity of these inputs. While<br />

other factors certainly play a role, lack of credit access is often a major<br />

obstacle to the adoption of the appropriate package of improved<br />

technologies. To overcome this obstacle and encourage increased<br />

adoption of vital agricultural inputs (particularly fertilizer and improved<br />

seed), the MoA and ATA have developed an Input Voucher System<br />

(IVS) as part of an overall Rural Financial Services (RFS) strategy.<br />

Distribution of inputs (mainly fertilizer and improved seeds) is primarily<br />

financed by the regional governments and distributed through multipurpose<br />

cooperatives by cash or partial credit. Since cooperatives do<br />

not have the appropriate systems to handle the financial transactions<br />

– including the collection of input loans – the regional governments,<br />

who ultimately are financing the inputs, face various default issues.<br />

The accumulation of large amounts of uncollected loans from farmers<br />

also reduce the availability of future credit thus hampering full input<br />

utilization and creating a viscous negative cycle.<br />

The IVS was designed to address these problems by focusing on<br />

financial institutions, mainly Microfinance Institutions (MFIs) and<br />

Rural Savings and Credit Cooperatives (RuSACCOs), as the key<br />

new intermediaries for all financial transactions on input purchases.<br />

In this new model, the financial institution issues vouchers to<br />

smallholder farmers for cash or credit to be redeemed for fertilizer and<br />

improved seed at a primary cooperative store. By having the financial<br />

institutions act as a payment agent for cash sales and a formal<br />

lender for credit sales, the IVS minimizes the cash risk exposure for<br />

participating farmers, cooperatives and regional governments. The<br />

MFI also becomes responsible for collecting loan repayments from<br />

farmers, allowing for effective audit and control processes by all<br />

institutional participants, as well as supporting effective financial flows<br />

between and among all stakeholders. In order to minimize travel and<br />

transaction cost for farmers, these financial institutions also establish<br />

satellite branches closer to the primary cooperatives, yielding many<br />

additional benefits related to financial inclusion.<br />

The IVS system was first piloted in the Amhara Region with the<br />

Amhara Credit and Saving Institution (ACSI) in 2014. During the<br />

pilot period, 243 million ETB ($12 million USD) worth of vouchers<br />

were issued to 168,000 participating farmers through 55 newly<br />

opened satellite ACSI branches in five woredas. Among the 168,000<br />

smallholder farmers, 35,000 received credit worth over 52 million ETB,<br />

100% of which was repaid in full before the loan<br />

maturity dates. Most importantly, smallholder<br />

farmers’ application of fertilizer in the woredas<br />

in Amhara where the IVS was piloted increased<br />

by 30%, as compared to an increase of 15% in<br />

woredas without the system.<br />

In 2015, the IVS was scaled-up in Amhara to 73<br />

woredas, and piloted in 6 woredas in SNNP and<br />

3 woredas in Tigray, with plans to include Oromia<br />

in 2016. In the 2015 planting season (by July<br />

2015), almost 1.76 million smallholder farmers<br />

utilized the system to purchase inputs worth<br />

2.95 billion ETB ($141 million USD) in Amhara<br />

alone. Of this amount, almost 500 million ETB<br />

($24 million USD) was on a credit basis to almost<br />

400,000 smallholders. In addition, ACSI has been<br />

establishing 800 new satellite branches for this<br />

initiative who have already managed to mobilize<br />

more than 71 million ETB ($3.5 million USD) in<br />

savings from over 74,000 farmers.<br />

In the Tigray pilot, RuSACCOs were used to issue<br />

input vouchers on cash worth over 39 million ETB<br />

($1.87 million USD) for almost 35,000 smallholder<br />

farmers by July 2015. In SNNP, Omo Microfinance<br />

was used to issue input vouchers worth over 115<br />

million ETB ($5.52 million USD), reaching nearly<br />

71,000 smallholders – almost 60,000 of whom<br />

also received credit worth over 52 million ETB<br />

($2.49 million USD).<br />

To facilitate implementation of the IVS, training<br />

on the overall system and on financial awareness<br />

was given to more than 4,200 experts in Amhara,<br />

645 in Tigray, and 1,000 in SNNP.<br />

A financial awareness campaign was also<br />

delivered through radio programs in all<br />

four regions, leveraging Fana Broadcasting<br />

Corporation. Activities are also underway to<br />

automate the IVS, and to upgrade the system<br />

from a paper-based platform to one using an<br />

electronic “e-voucher”, in order to save costs and<br />

streamline the process. The e-voucher system<br />

has already been tested by recording over 200<br />

transactions in parallel with the manual system,<br />

in advance of a larger pilot planned for the 2016<br />

irrigation and belg season.<br />

Since its inception, the input voucher system<br />

has vastly simplified the process of input<br />

purchases and improved access to credit. It has<br />

also helped to improve the savings culture of<br />

rural communities and is assisting smallholder<br />

farmers in planning their input purchases in<br />

advance of planting seasons. Furthermore, since<br />

the credit offered to farmers under the voucher<br />

system now provides farmers with more flexible<br />

terms to repay their loans, they have additional<br />

options in storing and selling grain when prices<br />

are attractive, rather than being forced to sell<br />

immediately after harvest when prices are at their<br />

lowest. Finally, the system has brought financial<br />

institutions further into rural areas, increasing<br />

the likelihood of farmers repaying their loans and<br />

expanding access to savings and other financial<br />

products while easing the burden on regional<br />

governments’ budgets.