PROGRESS REPORT

1LLMfQ4

1LLMfQ4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

54 <strong>PROGRESS</strong> <strong>REPORT</strong> PROGRAM LEVEL <strong>PROGRESS</strong> <strong>REPORT</strong> 55<br />

Systems<br />

Key Success Areas<br />

Input & Output Markets<br />

Why is transformation needed in this program area?<br />

The transformation of subsistence agricultural<br />

production into a commercially oriented system<br />

requires efficient and timely delivery of quality inputs<br />

to farmers at competitive prices. It also requires<br />

transparent output markets that provide signals to the<br />

farmers, allowing them to make informed decisions on<br />

what to produce and at what quality standards, as well<br />

as where and when to sell their outputs.<br />

Currently, the Ethiopian agricultural markets are<br />

characterized by extended marketing chains between<br />

producers and consumers, with each actor adding<br />

costs (though some add only limited value to the<br />

initial products produced by farmers). These elongated<br />

marketing chains often result in lower farm gate prices<br />

achieved by smallholders and increased retail prices<br />

to consumers. In some commodities, such as specific<br />

fruits and vegetables, the oligopolistic nature of the<br />

market structure involves few intermediary buyers who<br />

collude to control a significant aspect of the supply<br />

chain, thus reaping the largest portion of the benefit.<br />

Objectives of the GTP I Transformation Agenda Deliverables<br />

The main objectives of the Input & Output Markets<br />

Program during GTP I were to create greater<br />

transparency and improve specific aspects of input<br />

and output marketing for the benefit of smallholders<br />

and consumers. More specifically, the program<br />

aimed to: develop a transparent market information<br />

system for price discovery; reduce market transaction<br />

Overall Performance Summary<br />

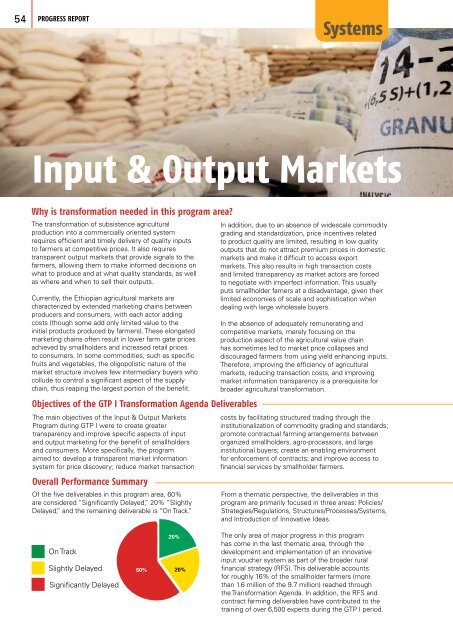

Of the five deliverables in this program area, 60%<br />

are considered “Significantly Delayed,” 20% “Slightly<br />

Delayed,” and the remaining deliverable is “On Track.”<br />

In addition, due to an absence of widescale commodity<br />

grading and standardization, price incentives related<br />

to product quality are limited, resulting in low quality<br />

outputs that do not attract premium prices in domestic<br />

markets and make it difficult to access export<br />

markets. This also results in high transaction costs<br />

and limited transparency as market actors are forced<br />

to negotiate with imperfect information. This usually<br />

puts smallholder famers at a disadvantage, given their<br />

limited economies of scale and sophistication when<br />

dealing with large wholesale buyers.<br />

In the absence of adequately remunerating and<br />

competitive markets, merely focusing on the<br />

production aspect of the agricultural value chain<br />

has sometimes led to market price collapses and<br />

discouraged farmers from using yield enhancing inputs.<br />

Therefore, improving the efficiency of agricultural<br />

markets, reducing transaction costs, and improving<br />

market information transparency is a prerequisite for<br />

broader agricultural transformation.<br />

costs by facilitating structured trading through the<br />

institutionalization of commodity grading and standards;<br />

promote contractual farming arrangements between<br />

organized smallholders, agro-processors, and large<br />

institutional buyers; create an enabling environment<br />

for enforcement of contracts; and improve access to<br />

financial services by smallholder farmers.<br />

From a thematic perspective, the deliverables in this<br />

program are primarily focused in three areas: Policies/<br />

Strategies/Regulations, Structures/Processes/Systems,<br />

and Introduction of Innovative Ideas.<br />

Of the five deliverables in the I/O Markets Program<br />

area, only one (20%) is deemed to be “On Track.”<br />

Deliverable 28 (Develop and Implement Key<br />

Components of a Rural Financial Services (RFS)<br />

Strategy) aims to address the critical shortfall in<br />

financial services to Ethiopia’s rural sector, exhibited<br />

by poor access to financial institutions and insufficient<br />

liquidity to meet the credit demand of smallholder<br />

farmers. Significant progress has been made under<br />

this deliverable. A Rural Financial Services Strategy<br />

has been developed and submitted to the Financial<br />

Inclusion Council for endorsement.<br />

Meanwhile, a number of the components of the<br />

strategy are in the process of implementation. A<br />

major component of the strategy is the Input Voucher<br />

System (IVS) which aims to streamline an inefficient<br />

input marketing system by shifting the credit and cash<br />

handling from multi-purpose cooperatives to qualified<br />

financial institutions (MFIs and RUSACCOs) through<br />

voucher-based transactions. The system was piloted<br />

in the Oromia and Amhara Regions in 2013 and 2014<br />

and is currently being scaled-up in Amhara, with pilots<br />

underway in Tigray and SNNP in 2015.<br />

Encouraging results have been seen in this deliverable,<br />

including: 1) the money from credit/cash fertilizer<br />

sales is being collected and flows through the<br />

system more efficiently; 2) farmers who want to buy<br />

inputs on credit and who are credit worthy are able<br />

to get sufficient credit to buy the whole package of<br />

recommended technologies; 3) loans, especially in<br />

Amhara, disbursed through ACSI have been collected<br />

fully with zero default; 4) coops receive commissions<br />

for the marketing of the inputs on time; and 5) financial<br />

institutions (MFIs and RUSACCOs) are increasing their<br />

membership and mobilizing a substantial amount of<br />

savings from the rural areas.<br />

For instance, in the Amhara Region during 2007 E.C<br />

(2013/14), the Amhara Credit and Savings Institute<br />

(ACSI) opened more than 50 new satellite offices in<br />

five pilot woredas to implement the voucher system.<br />

This resulted in more than 74,000 farmers opening new<br />

savings accounts and depositing nearly 72 million ETB<br />

in new savings in the satellite branches.<br />

The voucher system was scaled-up to 73 woredas in<br />

Amhara during 2008 E.C (2014/15) with ACIS opening<br />

more than 800 new satellite branches and employing<br />

more than 4,000 new staff members. By July 2015,<br />

more than 1.76 million farmers in Amhara alone had<br />

used the IVS to purchase 2.95 billion ETB worth of<br />

inputs. In the piloted regions of Oromia, SNNP and<br />

Tigray, 179 million ETB worth of fertilizer has been<br />

distributed to approximately 84,000 farmers using this<br />

new system.<br />

On Track<br />

Slightly Delayed<br />

Significantly Delayed<br />

20%<br />

60% 20%<br />

The only area of major progress in this program<br />

has come in the last thematic area, through the<br />

development and implementation of an innovative<br />

input voucher system as part of the broader rural<br />

financial strategy (RFS). This deliverable accounts<br />

for roughly 16% of the smallholder farmers (more<br />

than 1.6 million of the 9.7 million) reached through<br />

the Transformation Agenda. In addition, the RFS and<br />

contract farming deliverables have contributed to the<br />

training of over 6,500 experts during the GTP I period.