2fnoNyY

2fnoNyY

2fnoNyY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Thought Leadership<br />

Considerations for reducing risk &<br />

increasing returns<br />

There are several ways to make SEIS investments,<br />

for example as an individual business angel or as<br />

a consortium of angels; through crowdfunding or<br />

through subscribing to a fund. Useful questions<br />

when considering SEIS investments are:<br />

• how can I construct a portfolio of several investments<br />

across companies and sectors?<br />

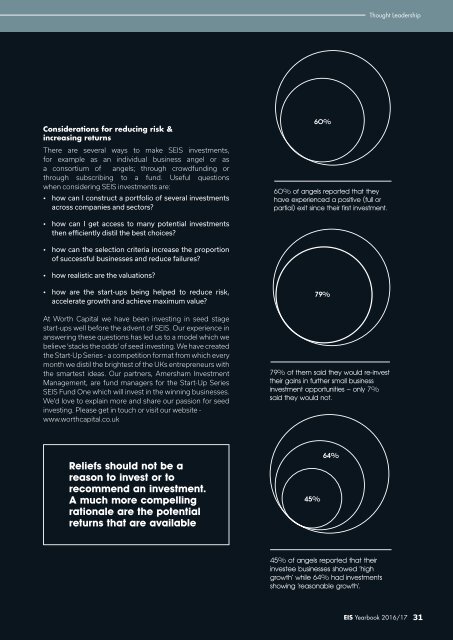

60%<br />

60% of angels reported that they<br />

have experienced a positive (full or<br />

partial) exit since their first investment.<br />

• how can I get access to many potential investments<br />

then efficiently distil the best choices?<br />

• how can the selection criteria increase the proportion<br />

of successful businesses and reduce failures?<br />

• how realistic are the valuations?<br />

• how are the start-ups being helped to reduce risk,<br />

accelerate growth and achieve maximum value?<br />

At Worth Capital we have been investing in seed stage<br />

start-ups well before the advent of SEIS. Our experience in<br />

answering these questions has led us to a model which we<br />

believe ‘stacks the odds’ of seed investing. We have created<br />

the Start-Up Series - a competition format from which every<br />

month we distil the brightest of the UKs entrepreneurs with<br />

the smartest ideas. Our partners, Amersham Investment<br />

Management, are fund managers for the Start-Up Series<br />

SEIS Fund One which will invest in the winning businesses.<br />

We’d love to explain more and share our passion for seed<br />

investing. Please get in touch or visit our website -<br />

www.worthcapital.co.uk<br />

79%<br />

79% of them said they would re-invest<br />

their gains in further small business<br />

investment opportunities – only 7%<br />

said they would not.<br />

Reliefs should not be a<br />

reason to invest or to<br />

recommend an investment.<br />

A much more compelling<br />

rationale are the potential<br />

returns that are available<br />

45%<br />

64%<br />

45% of angels reported that their<br />

investee businesses showed ‘high<br />

growth’ while 64% had investments<br />

showing ‘reasonable growth’.<br />

EIS Yearbook 2016/17<br />

31