2fnoNyY

2fnoNyY

2fnoNyY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

are acting as security trustees or<br />

agents needs to be established, along<br />

with the level of due diligence that has<br />

been carried out on the company.<br />

For example, each bond on the<br />

Downing Crowd platform goes<br />

through Downing’s full due diligence<br />

process, drawing on over 20 years of<br />

investment management experience.<br />

A full Offer Document is issued<br />

for each fundraise, outlining the<br />

risk and returns and independent<br />

analysis is available through an<br />

in:review report.<br />

So, is crowdfunding advisable?<br />

Despite the compelling attraction<br />

of certain types of crowdfunding, it<br />

has not traditionally been considered<br />

advisable for a number of reasons,<br />

not least because of scepticism of the<br />

quality of the offers/valuations, issues<br />

with regulation and permissions.<br />

However, we are seeing an increasing<br />

number of enquiries from advisers<br />

interested in the opportunities for<br />

their clients, which suggests the tide<br />

is turning on how intermediaries<br />

view of this area of the alternative<br />

finance market.<br />

We believe that the key challenges for<br />

advisers are evaluating each client’s<br />

overall portfolio and appetite for risk,<br />

understanding the crowdfunding<br />

opportunities available and the levels<br />

of risk involved, and then assessing<br />

whether the returns are sufficiently<br />

acceptable for the level of risk taken.<br />

Debt-based crowdfunding is<br />

regulated by the FCA, which gives a<br />

further layer of investor protection.<br />

So as long as firms have the correct<br />

permissions to advise on these<br />

investments and advisers have the<br />

appropriate qualifications (located to<br />

the right), they are permitted to give<br />

advice on these opportunities.<br />

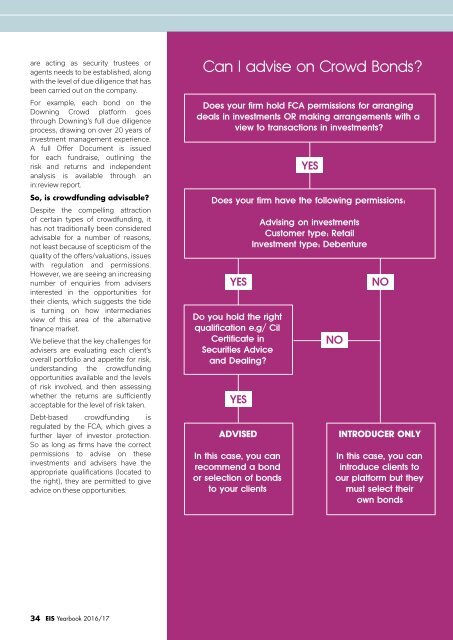

Can I advise on Crowd Bonds?<br />

Does your firm hold FCA permissions for arranging<br />

deals in investments OR making arrangements with a<br />

view to transactions in investments?<br />

Does your firm have the following permissions:<br />

YES<br />

Do you hold the right<br />

qualification e.g/ Cil<br />

Certificate in<br />

Securities Advice<br />

and Dealing?<br />

YES<br />

ADVISED<br />

In this case, you can<br />

recommend a bond<br />

or selection of bonds<br />

to your clients<br />

YES<br />

Advising on investments<br />

Customer type: Retail<br />

Investment type: Debenture<br />

NO<br />

NO<br />

INTRODUCER ONLY<br />

In this case, you can<br />

introduce clients to<br />

our platform but they<br />

must select their<br />

own bonds<br />

34 EIS Yearbook 2016/17