2fnoNyY

2fnoNyY

2fnoNyY

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Investment Spotlight<br />

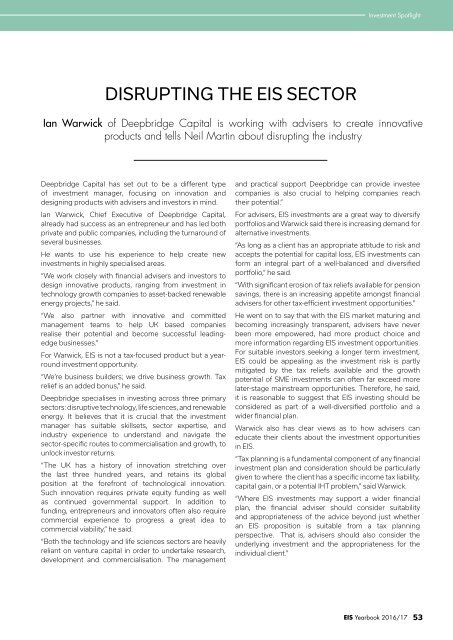

DISRUPTING THE EIS SECTOR<br />

Ian Warwick of Deepbridge Capital is working with advisers to create innovative<br />

products and tells Neil Martin about disrupting the industry<br />

Deepbridge Capital has set out to be a different type<br />

of investment manager, focusing on innovation and<br />

designing products with advisers and investors in mind.<br />

Ian Warwick, Chief Executive of Deepbridge Capital,<br />

already had success as an entrepreneur and has led both<br />

private and public companies, including the turnaround of<br />

several businesses.<br />

He wants to use his experience to help create new<br />

investments in highly specialised areas.<br />

“We work closely with financial advisers and investors to<br />

design innovative products, ranging from investment in<br />

technology growth companies to asset-backed renewable<br />

energy projects,” he said.<br />

“We also partner with innovative and committed<br />

management teams to help UK based companies<br />

realise their potential and become successful leadingedge<br />

businesses.”<br />

For Warwick, EIS is not a tax-focused product but a yearround<br />

investment opportunity.<br />

“We’re business builders; we drive business growth. Tax<br />

relief is an added bonus,” he said.<br />

Deepbridge specialises in investing across three primary<br />

sectors: disruptive technology, life sciences, and renewable<br />

energy. It believes that it is crucial that the investment<br />

manager has suitable skillsets, sector expertise, and<br />

industry experience to understand and navigate the<br />

sector-specific routes to commercialisation and growth, to<br />

unlock investor returns.<br />

“The UK has a history of innovation stretching over<br />

the last three hundred years, and retains its global<br />

position at the forefront of technological innovation.<br />

Such innovation requires private equity funding as well<br />

as continued governmental support. In addition to<br />

funding, entrepreneurs and innovators often also require<br />

commercial experience to progress a great idea to<br />

commercial viability,” he said.<br />

“Both the technology and life sciences sectors are heavily<br />

reliant on venture capital in order to undertake research,<br />

development and commercialisation. The management<br />

and practical support Deepbridge can provide investee<br />

companies is also crucial to helping companies reach<br />

their potential.”<br />

For advisers, EIS investments are a great way to diversify<br />

portfolios and Warwick said there is increasing demand for<br />

alternative investments.<br />

“As long as a client has an appropriate attitude to risk and<br />

accepts the potential for capital loss, EIS investments can<br />

form an integral part of a well-balanced and diversified<br />

portfolio,” he said.<br />

“With significant erosion of tax reliefs available for pension<br />

savings, there is an increasing appetite amongst financial<br />

advisers for other tax-efficient investment opportunities.”<br />

He went on to say that with the EIS market maturing and<br />

becoming increasingly transparent, advisers have never<br />

been more empowered, had more product choice and<br />

more information regarding EIS investment opportunities.<br />

For suitable investors seeking a longer term investment,<br />

EIS could be appealing as the investment risk is partly<br />

mitigated by the tax reliefs available and the growth<br />

potential of SME investments can often far exceed more<br />

later-stage mainstream opportunities. Therefore, he said,<br />

it is reasonable to suggest that EIS investing should be<br />

considered as part of a well-diversified portfolio and a<br />

wider financial plan.<br />

Warwick also has clear views as to how advisers can<br />

educate their clients about the investment opportunities<br />

in EIS.<br />

“Tax planning is a fundamental component of any financial<br />

investment plan and consideration should be particularly<br />

given to where the client has a specific income tax liability,<br />

capital gain, or a potential IHT problem,” said Warwick.<br />

“Where EIS investments may support a wider financial<br />

plan, the financial adviser should consider suitability<br />

and appropriateness of the advice beyond just whether<br />

an EIS proposition is suitable from a tax planning<br />

perspective. That is, advisers should also consider the<br />

underlying investment and the appropriateness for the<br />

individual client.”<br />

EIS Yearbook 2016/17<br />

53