Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TEXAS LAND / Lifestyle Issue<br />

“Now’s a good time to check for unreleased liens, so there’s not a<br />

headache or roadblock if you want to get a loan secured by that<br />

property,” Ormiston says.<br />

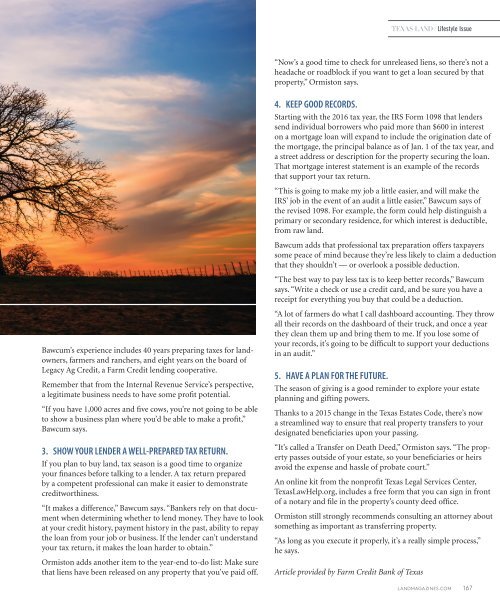

Bawcum’s experience includes 40 years preparing taxes for landowners,<br />

farmers and ranchers, and eight years on the board of<br />

Legacy Ag Credit, a Farm Credit lending cooperative.<br />

Remember that from the Internal Revenue Service’s perspective,<br />

a legitimate business needs to have some profit potential.<br />

“If you have 1,000 acres and five cows, you’re not going to be able<br />

to show a business plan where you’d be able to make a profit,”<br />

Bawcum says.<br />

3. SHOW YOUR LENDER A WELL-PREPARED TAX RETURN.<br />

If you plan to buy land, tax season is a good time to organize<br />

your finances before talking to a lender. A tax return prepared<br />

by a competent professional can make it easier to demonstrate<br />

creditworthiness.<br />

“It makes a difference,” Bawcum says. “Bankers rely on that document<br />

when determining whether to lend money. They have to look<br />

at your credit history, payment history in the past, ability to repay<br />

the loan from your job or business. If the lender can’t understand<br />

your tax return, it makes the loan harder to obtain.”<br />

Ormiston adds another item to the year-end to-do list: Make sure<br />

that liens have been released on any property that you’ve paid off.<br />

4. KEEP GOOD RECORDS.<br />

Starting with the <strong>2016</strong> tax year, the IRS Form 1098 that lenders<br />

send individual borrowers who paid more than $600 in interest<br />

on a mortgage loan will expand to include the origination date of<br />

the mortgage, the principal balance as of Jan. 1 of the tax year, and<br />

a street address or description for the property securing the loan.<br />

That mortgage interest statement is an example of the records<br />

that support your tax return.<br />

“This is going to make my job a little easier, and will make the<br />

IRS’ job in the event of an audit a little easier,” Bawcum says of<br />

the revised 1098. For example, the form could help distinguish a<br />

primary or secondary residence, for which interest is deductible,<br />

from raw land.<br />

Bawcum adds that professional tax preparation offers taxpayers<br />

some peace of mind because they’re less likely to claim a deduction<br />

that they shouldn’t — or overlook a possible deduction.<br />

“The best way to pay less tax is to keep better records,” Bawcum<br />

says. “Write a check or use a credit card, and be sure you have a<br />

receipt for everything you buy that could be a deduction.<br />

“A lot of farmers do what I call dashboard accounting. They throw<br />

all their records on the dashboard of their truck, and once a year<br />

they clean them up and bring them to me. If you lose some of<br />

your records, it’s going to be difficult to support your deductions<br />

in an audit.”<br />

5. HAVE A PLAN FOR THE FUTURE.<br />

The season of giving is a good reminder to explore your estate<br />

planning and gifting powers.<br />

Thanks to a 2015 change in the Texas Estates Code, there’s now<br />

a streamlined way to ensure that real property transfers to your<br />

designated beneficiaries upon your passing.<br />

“It’s called a Transfer on Death Deed,” Ormiston says. “The property<br />

passes outside of your estate, so your beneficiaries or heirs<br />

avoid the expense and hassle of probate court.”<br />

An online kit from the nonprofit Texas Legal Services Center,<br />

TexasLawHelp.org, includes a free form that you can sign in front<br />

of a notary and file in the property’s county deed office.<br />

Ormiston still strongly recommends consulting an attorney about<br />

something as important as transferring property.<br />

“As long as you execute it properly, it’s a really simple process,”<br />

he says.<br />

Article provided by Farm Credit Bank of Texas<br />

LANDMAGAZINES.COM<br />

167