Course Guide 2018-19 Full-time Courses and Apprenticeships

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

48<br />

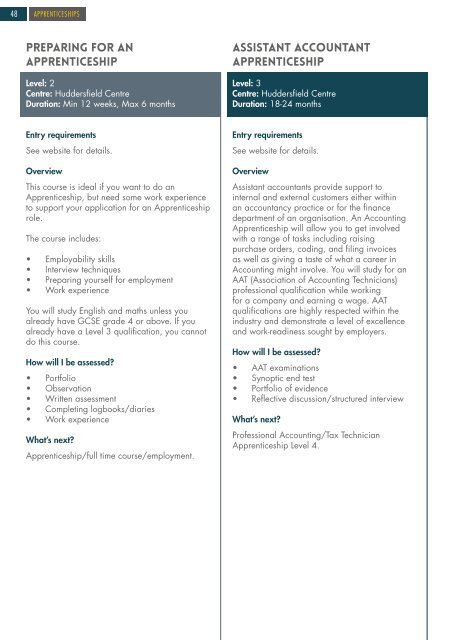

APPRENTICESHIPS<br />

Preparing for an<br />

Apprenticeship<br />

Level: 2<br />

Centre: Huddersfield Centre<br />

Duration: Min 12 weeks, Max 6 months<br />

Assistant Accountant<br />

Apprenticeship<br />

Level: 3<br />

Centre: Huddersfield Centre<br />

Duration: 18-24 months<br />

Entry requirements<br />

See website for details.<br />

Overview<br />

This course is ideal if you want to do an<br />

Apprenticeship, but need some work experience<br />

to support your application for an Apprenticeship<br />

role.<br />

The course includes:<br />

• Employability skills<br />

• Interview techniques<br />

• Preparing yourself for employment<br />

• Work experience<br />

You will study English <strong>and</strong> maths unless you<br />

already have GCSE grade 4 or above. If you<br />

already have a Level 3 qualification, you cannot<br />

do this course.<br />

How will I be assessed?<br />

• Portfolio<br />

• Observation<br />

• Written assessment<br />

• Completing logbooks/diaries<br />

• Work experience<br />

What’s next?<br />

Apprenticeship/full <strong>time</strong> course/employment.<br />

Entry requirements<br />

See website for details.<br />

Overview<br />

Assistant accountants provide support to<br />

internal <strong>and</strong> external customers either within<br />

an accountancy practice or for the finance<br />

department of an organisation. An Accounting<br />

Apprenticeship will allow you to get involved<br />

with a range of tasks including raising<br />

purchase orders, coding, <strong>and</strong> filing invoices<br />

as well as giving a taste of what a career in<br />

Accounting might involve. You will study for an<br />

AAT (Association of Accounting Technicians)<br />

professional qualification while working<br />

for a company <strong>and</strong> earning a wage. AAT<br />

qualifications are highly respected within the<br />

industry <strong>and</strong> demonstrate a level of excellence<br />

<strong>and</strong> work-readiness sought by employers.<br />

How will I be assessed?<br />

• AAT examinations<br />

• Synoptic end test<br />

• Portfolio of evidence<br />

• Reflective discussion/structured interview<br />

What’s next?<br />

Professional Accounting/Tax Technician<br />

Apprenticeship Level 4.