070917_KPGHL_Annual Report 2017_final_PREVIEW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements | For the Year Ended 30 June <strong>2017</strong><br />

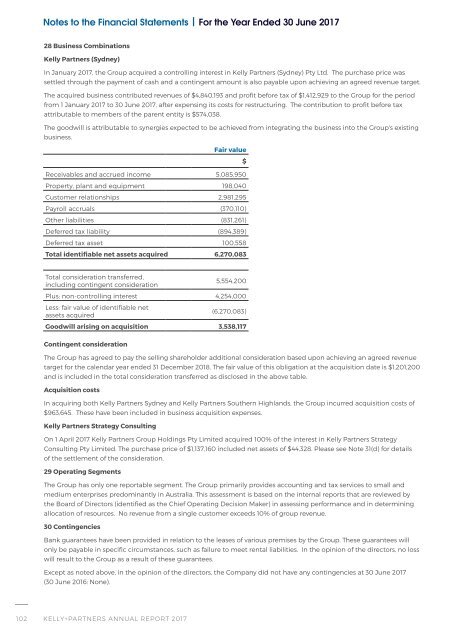

28 Business Combinations<br />

Kelly Partners (Sydney)<br />

In January <strong>2017</strong>, the Group acquired a controlling interest in Kelly Partners (Sydney) Pty Ltd. The purchase price was<br />

settled through the payment of cash and a contingent amount is also payable upon achieving an agreed revenue target.<br />

The acquired business contributed revenues of $4,840,193 and profit before tax of $1,412,929 to the Group for the period<br />

from 1 January <strong>2017</strong> to 30 June <strong>2017</strong>, after expensing its costs for restructuring. The contribution to profit before tax<br />

attributable to members of the parent entity is $574,038.<br />

The goodwill is attributable to synergies expected to be achieved from integrating the business into the Group's existing<br />

business.<br />

Fair value<br />

$<br />

Receivables and accrued income 5,085,950<br />

Property, plant and equipment 198,040<br />

Customer relationships 2,981,295<br />

Payroll accruals (370,110)<br />

Other liabilities (831,261)<br />

Deferred tax liability (894,389)<br />

Deferred tax asset 100,558<br />

Total identifiable net assets acquired 6,270,083<br />

Total consideration transferred,<br />

including contingent consideration<br />

5,554,200<br />

Plus: non-controlling interest 4,254,000<br />

Less: fair value of identifiable net<br />

assets acquired<br />

(6,270,083)<br />

Goodwill arising on acquisition 3,538,117<br />

Contingent consideration<br />

The Group has agreed to pay the selling shareholder additional consideration based upon achieving an agreed revenue<br />

target for the calendar year ended 31 December 2018. The fair value of this obligation at the acquisition date is $1,201,200<br />

and is included in the total consideration transferred as disclosed in the above table.<br />

Acquisition costs<br />

In acquiring both Kelly Partners Sydney and Kelly Partners Southern Highlands, the Group incurred acquisition costs of<br />

$963,645. These have been included in business acquisition expenses.<br />

Kelly Partners Strategy Consulting<br />

On 1 April <strong>2017</strong> Kelly Partners Group Holdings Pty Limited acquired 100% of the interest in Kelly Partners Strategy<br />

Consulting Pty Limited. The purchase price of $1,137,160 included net assets of $44,328. Please see Note 31(d) for details<br />

of the settlement of the consideration.<br />

29 Operating Segments<br />

The Group has only one reportable segment. The Group primarily provides accounting and tax services to small and<br />

medium enterprises predominantly in Australia. This assessment is based on the internal reports that are reviewed by<br />

the Board of Directors (identified as the Chief Operating Decision Maker) in assessing performance and in determining<br />

allocation of resources. No revenue from a single customer exceeds 10% of group revenue.<br />

30 Contingencies<br />

Bank guarantees have been provided in relation to the leases of various premises by the Group. These guarantees will<br />

only be payable in specific circumstances, such as failure to meet rental liabilities. In the opinion of the directors, no loss<br />

will result to the Group as a result of these guarantees.<br />

Except as noted above, in the opinion of the directors, the Company did not have any contingencies at 30 June <strong>2017</strong><br />

(30 June 2016: None).<br />

102 KELLY+PARTNERS ANNUAL REPORT <strong>2017</strong>