070917_KPGHL_Annual Report 2017_final_PREVIEW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements | For the Year Ended 30 June <strong>2017</strong><br />

12 Intangible Assets continued<br />

Impairment testing<br />

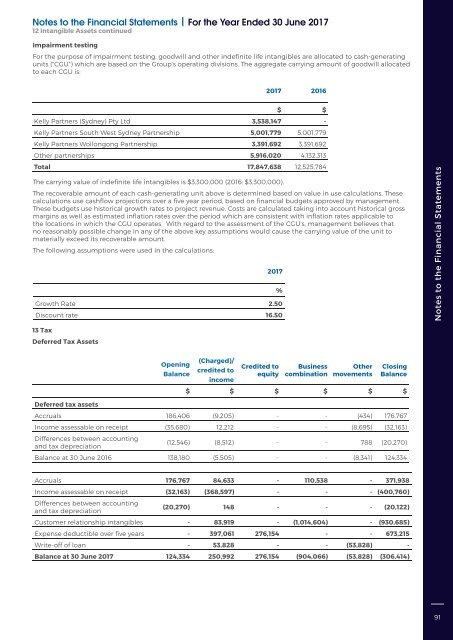

For the purpose of impairment testing, goodwill and other indefinite life intangibles are allocated to cash-generating<br />

units ("CGU") which are based on the Group's operating divisions. The aggregate carrying amount of goodwill allocated<br />

to each CGU is:<br />

<strong>2017</strong> 2016<br />

$ $<br />

Kelly Partners (Sydney) Pty Ltd 3,538,147 -<br />

Kelly Partners South West Sydney Partnership 5,001,779 5,001,779<br />

Kelly Partners Wollongong Partnership 3,391,692 3,391,692<br />

Other partnerships 5,916,020 4,132,313<br />

Total 17,847,638 12,525,784<br />

The carrying value of indefinite life intangibles is $3,300,000 (2016: $3,300,000).<br />

The recoverable amount of each cash-generating unit above is determined based on value in use calculations. These<br />

calculations use cashflow projections over a five year period, based on financial budgets approved by management.<br />

These budgets use historical growth rates to project revenue. Costs are calculated taking into account historical gross<br />

margins as well as estimated inflation rates over the period which are consistent with inflation rates applicable to<br />

the locations in which the CGU operates. With regard to the assessment of the CGU's, management believes that<br />

no reasonably possible change in any of the above key assumptions would cause the carrying value of the unit to<br />

materially exceed its recoverable amount.<br />

The following assumptions were used in the calculations:<br />

<strong>2017</strong><br />

Growth Rate 2.50<br />

Discount rate 16.50<br />

%<br />

Notes to the Financial Statements<br />

13 Tax<br />

Deferred Tax Assets<br />

Opening<br />

Balance<br />

(Charged)/<br />

credited to<br />

income<br />

Credited to<br />

equity<br />

Business<br />

combination<br />

Other<br />

movements<br />

Closing<br />

Balance<br />

$ $ $ $ $ $<br />

Deferred tax assets<br />

Accruals 186,406 (9,205) - - (434) 176,767<br />

Income assessable on receipt (35,680) 12,212 - - (8,695) (32,163)<br />

Differences between accounting<br />

and tax depreciation<br />

(12,546) (8,512) - - 788 (20,270)<br />

Balance at 30 June 2016 138,180 (5,505) - - (8,341) 124,334<br />

Accruals 176,767 84,633 - 110,538 - 371,938<br />

Income assessable on receipt (32,163) (368,597) - - - (400,760)<br />

Differences between accounting<br />

and tax depreciation<br />

(20,270) 148 - - - (20,122)<br />

Customer relationship intangibles - 83,919 - (1,014,604) - (930,685)<br />

Expense deductible over five years - 397,061 276,154 - - 673,215<br />

Write-off of loan - 53,828 - - (53,828) -<br />

Balance at 30 June <strong>2017</strong> 124,334 250,992 276,154 (904,066) (53,828) (306,414)<br />

91