070917_KPGHL_Annual Report 2017_final_PREVIEW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Strategy<br />

Kelly+Partners has seven strategic priorities:<br />

+ + Private SME business owners in Greater Sydney - Since inception, Kelly+Partners’ focus has been building<br />

accounting teams that can materially improve the financial situation of private SMEs and their owners. These clients<br />

are “sticky” given that they desire long term relationships with their accountants.<br />

+ + Recurring business lines - Kelly+Partners focuses on business lines that are predictable and recurring in nature<br />

which include accounting and taxation. We regard audit as commoditised, and it represents less than 5% of our total<br />

revenue. Approximately 85% of Kelly+Partners revenues are generated from accounting and taxation services.<br />

+ + Premium service and prices - The Operating Businesses deliver high-quality service levels with a strong focus on<br />

clients. We maximise value for clients using our proprietary processes and systems. The network benefits from strong<br />

client loyalty with an annual client churn of 2%.<br />

+ + Network expansion under a strong single-brand - Kelly+Partners has a long and successful track record of profitable<br />

network expansion using an owner-driver model. Key synergies include a combination of higher cost efficiency,<br />

active management of debtors and cashflow, and increased revenue opportunities. In addition, the adoption of a<br />

strong single-brand provides proven benefits for future business development, overall staff culture, and in particular,<br />

recruitment of talented team members.<br />

+ + Ongoing system growth - Accounting and taxation services are driven by increasing tax complexity and compliance<br />

in Australia. The SME subset of the accounting market represents approximately 60% (or $12 billion pa) 1 of total<br />

industry revenues, and the role of intermediating the relationship between this client subset and the ATO will become<br />

more important over time.<br />

+ + Marketing and Advertising - The Company invests significantly in its brand through regular advertising and marketing<br />

campaigns. This has included television, radio, and newspaper advertisements and this is expected to continue in the<br />

future. These marketing and advertising campaigns are expected to continue to build awareness of the Kelly+Partners<br />

brand, as well as attract prospective clients and potential new Operating Business opportunities.<br />

+ + Property and Leases - Kelly+Partners owns a majority interest in a property on the Central Coast which is leased to the<br />

Kelly Partners Central Coast Partnership. All other offices operate in a leased office with lease terms varying from<br />

3-5 years.<br />

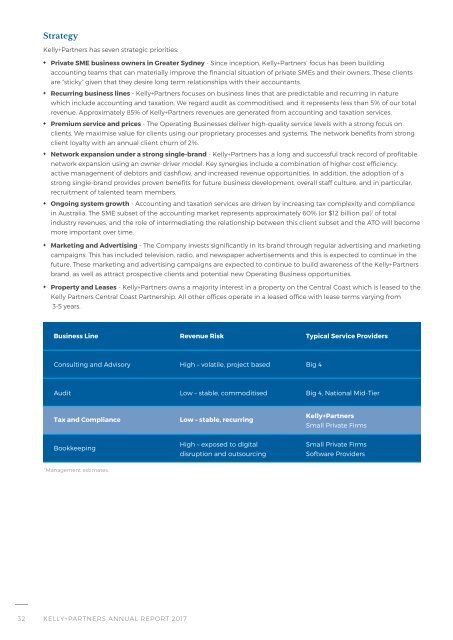

Business Line Revenue Risk Typical Service Providers<br />

Consulting and Advisory High – volatile, project based Big 4<br />

Audit Low – stable, commoditised Big 4, National Mid-Tier<br />

Tax and Compliance<br />

Low – stable, recurring<br />

Kelly+Partners<br />

Small Private Firms<br />

Bookkeeping<br />

High – exposed to digital<br />

disruption and outsourcing<br />

Small Private Firms<br />

Software Providers<br />

1<br />

Management estimates.<br />

32 KELLY+PARTNERS ANNUAL REPORT <strong>2017</strong>