070917_KPGHL_Annual Report 2017_final_PREVIEW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements | For the Year Ended 30 June <strong>2017</strong><br />

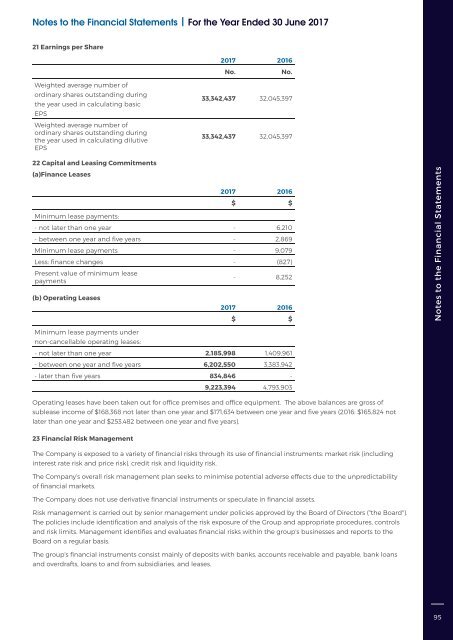

21 Earnings per Share<br />

<strong>2017</strong> 2016<br />

No.<br />

No.<br />

Weighted average number of<br />

ordinary shares outstanding during<br />

the year used in calculating basic<br />

EPS<br />

Weighted average number of<br />

ordinary shares outstanding during<br />

the year used in calculating dilutive<br />

EPS<br />

33,342,437 32,045,397<br />

33,342,437 32,045,397<br />

22 Capital and Leasing Commitments<br />

(a)Finance Leases<br />

(b) Operating Leases<br />

<strong>2017</strong> 2016<br />

$ $<br />

Minimum lease payments:<br />

- not later than one year - 6,210<br />

- between one year and five years - 2,869<br />

Minimum lease payments - 9,079<br />

Less: finance changes - (827)<br />

Present value of minimum lease<br />

payments<br />

- 8,252<br />

<strong>2017</strong> 2016<br />

$ $<br />

Notes to the Financial Statements<br />

Minimum lease payments under<br />

non-cancellable operating leases:<br />

- not later than one year 2,185,998 1,409,961<br />

- between one year and five years 6,202,550 3,383,942<br />

- later than five years 834,846 -<br />

9,223,394 4,793,903<br />

Operating leases have been taken out for office premises and office equipment. The above balances are gross of<br />

sublease income of $168,368 not later than one year and $171,634 between one year and five years (2016: $165,824 not<br />

later than one year and $253,482 between one year and five years).<br />

23 Financial Risk Management<br />

The Company is exposed to a variety of financial risks through its use of financial instruments: market risk (including<br />

interest rate risk and price risk), credit risk and liquidity risk.<br />

The Company‘s overall risk management plan seeks to minimise potential adverse effects due to the unpredictability<br />

of financial markets.<br />

The Company does not use derivative financial instruments or speculate in financial assets.<br />

Risk management is carried out by senior management under policies approved by the Board of Directors ("the Board").<br />

The policies include identification and analysis of the risk exposure of the Group and appropriate procedures, controls<br />

and risk limits. Management identifies and evaluates financial risks within the group's businesses and reports to the<br />

Board on a regular basis.<br />

The group's financial instruments consist mainly of deposits with banks, accounts receivable and payable, bank loans<br />

and overdrafts, loans to and from subsidiaries, and leases.<br />

95