070917_KPGHL_Annual Report 2017_final_PREVIEW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Kelly Partners Group<br />

Holdings Limited and<br />

Controlled Entities<br />

Directors' <strong>Report</strong><br />

30 June <strong>2017</strong><br />

The directors present their report, together with the financial statements, on the consolidated entity (referred to<br />

hereafter as the 'consolidated entity') consisting of Kelly Partners Group Holdings Limited (referred to hereafter as the<br />

'company' or 'parent entity') and the entities it controlled at the end of, or during, the year ended 30 June <strong>2017</strong>.<br />

Directors<br />

The following persons were directors of Kelly Partners Group Holdings Limited during the whole of the financial year<br />

and up to the date of this report, unless otherwise stated:<br />

Brett Kelly<br />

Stephen Rouvray (appointed 2 May <strong>2017</strong>)<br />

Pauline Michelakis (appointed 2 May <strong>2017</strong>)<br />

Paul Kuchta (appointed 2 May <strong>2017</strong>)<br />

Ryan Macnamee (appointed 2 May <strong>2017</strong>)<br />

Principal activities<br />

During the financial year the principal continuing activities of the consolidated entity were the provision of chartered<br />

accounting services, predominantly to private businesses and high net worth individuals.<br />

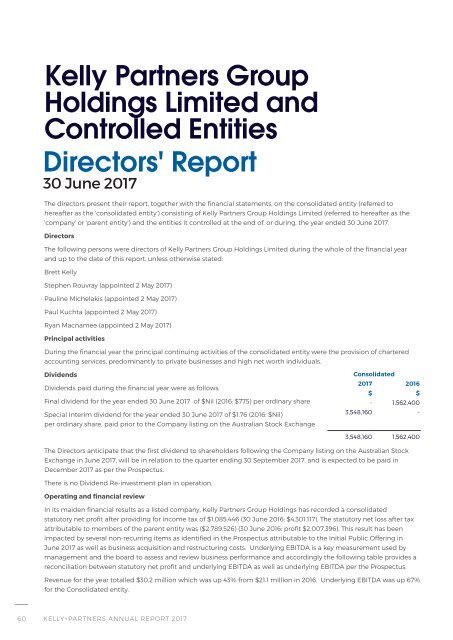

Dividends<br />

Dividends paid during the financial year were as follows:<br />

Final dividend for the year ended 30 June <strong>2017</strong> of $Nil (2016: $775) per ordinary share<br />

Special Interim dividend for the year ended 30 June <strong>2017</strong> of $1.76 (2016: $Nil)<br />

per ordinary share, paid prior to the Company listing on the Australian Stock Exchange<br />

Consolidated<br />

<strong>2017</strong> 2016<br />

$ $<br />

- 1,562,400<br />

3,548,160 -<br />

3,548,160 1,562,400<br />

The Directors anticipate that the first dividend to shareholders following the Company listing on the Australian Stock<br />

Exchange in June <strong>2017</strong>, will be in relation to the quarter ending 30 September <strong>2017</strong>, and is expected to be paid in<br />

December <strong>2017</strong> as per the Prospectus.<br />

There is no Dividend Re-investment plan in operation.<br />

Operating and financial review<br />

In its maiden financial results as a listed company, Kelly Partners Group Holdings has recorded a consolidated<br />

statutory net profit after providing for income tax of $1,085,446 (30 June 2016: $4,301,117). The statutory net loss after tax<br />

attributable to members of the parent entity was ($2,789,526) (30 June 2016: profit $2,007,396). This result has been<br />

impacted by several non-recurring items as identified in the Prospectus attributable to the Initial Public Offering in<br />

June <strong>2017</strong> as well as business acquisition and restructuring costs. Underlying EBITDA is a key measurement used by<br />

management and the board to assess and review business performance and accordingly the following table provides a<br />

reconciliation between statutory net profit and underlying EBITDA as well as underlying EBITDA per the Prospectus.<br />

Revenue for the year totalled $30.2 million which was up 43% from $21.1 million in 2016. Underlying EBITDA was up 67%<br />

for the Consolidated entity.<br />

60 KELLY+PARTNERS ANNUAL REPORT <strong>2017</strong>