588b1c58c8a68278cfc28555

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

30 Days to a better man<br />

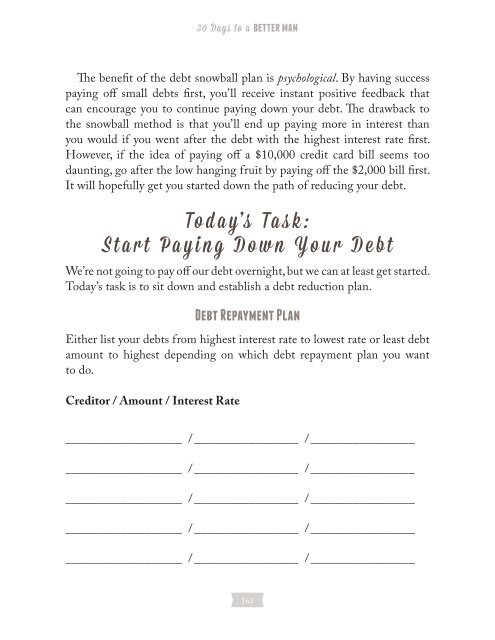

The benefit of the debt snowball plan is psychological. By having success<br />

paying off small debts first, you’ll receive instant positive feedback that<br />

can encourage you to continue paying down your debt. The drawback to<br />

the snowball method is that you’ll end up paying more in interest than<br />

you would if you went after the debt with the highest interest rate first.<br />

However, if the idea of paying off a $10,000 credit card bill seems too<br />

daunting, go after the low hanging fruit by paying off the $2,000 bill first.<br />

It will hopefully get you started down the path of reducing your debt.<br />

Today’s Task:<br />

Start Paying Down Your Debt<br />

We’re not going to pay off our debt overnight, but we can at least get started.<br />

Today’s task is to sit down and establish a debt reduction plan.<br />

Debt Repayment Plan<br />

Either list your debts from highest interest rate to lowest rate or least debt<br />

amount to highest depending on which debt repayment plan you want<br />

to do.<br />

Creditor / Amount / Interest Rate<br />

___________________ / _________________ / _________________<br />

___________________ / _________________ / _________________<br />

___________________ / _________________ / _________________<br />

___________________ / _________________ / _________________<br />

___________________ / _________________ / _________________<br />

162