588b1c58c8a68278cfc28555

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

30 Days to a better man<br />

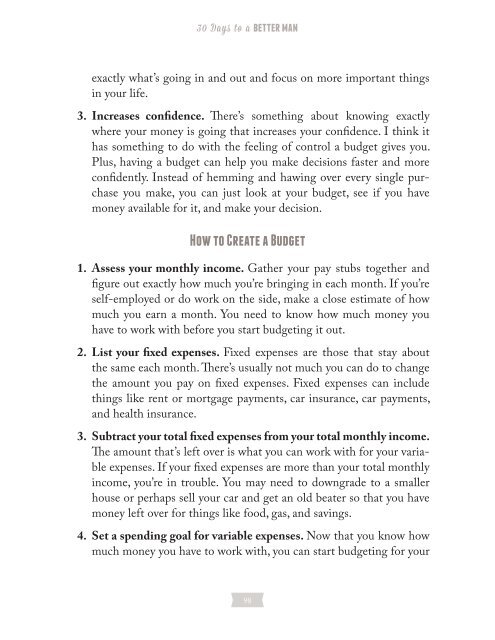

exactly what’s going in and out and focus on more important things<br />

in your life.<br />

3. Increases confidence. There’s something about knowing exactly<br />

where your money is going that increases your confidence. I think it<br />

has something to do with the feeling of control a budget gives you.<br />

Plus, having a budget can help you make decisions faster and more<br />

confidently. Instead of hemming and hawing over every single purchase<br />

you make, you can just look at your budget, see if you have<br />

money available for it, and make your decision.<br />

How to Create a Budget<br />

1. Assess your monthly income. Gather your pay stubs together and<br />

figure out exactly how much you’re bringing in each month. If you’re<br />

self-employed or do work on the side, make a close estimate of how<br />

much you earn a month. You need to know how much money you<br />

have to work with before you start budgeting it out.<br />

2. List your fixed expenses. Fixed expenses are those that stay about<br />

the same each month. There’s usually not much you can do to change<br />

the amount you pay on fixed expenses. Fixed expenses can include<br />

things like rent or mortgage payments, car insurance, car payments,<br />

and health insurance.<br />

3. Subtract your total fixed expenses from your total monthly income.<br />

The amount that’s left over is what you can work with for your variable<br />

expenses. If your fixed expenses are more than your total monthly<br />

income, you’re in trouble. You may need to downgrade to a smaller<br />

house or perhaps sell your car and get an old beater so that you have<br />

money left over for things like food, gas, and savings.<br />

4. Set a spending goal for variable expenses. Now that you know how<br />

much money you have to work with, you can start budgeting for your<br />

98