Pen People Mar 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Pen</strong>insula outlook <strong>2018</strong>:<br />

Stocks and<br />

real estate<br />

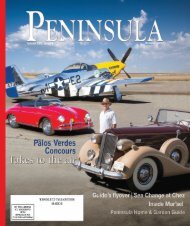

<strong>Pen</strong>insula Realtors Darin DeRenzis, Les Fishman and Heidi Mackenbach with financial analyst Joe Gagnon. Photo by Brad Jacobson (CivicCouch.com)<br />

by Stuart Chaussee<br />

<strong>Pen</strong>insula finance and real estate experts weigh in<br />

on the bull market and housing appreciation<br />

Until about a year and a half ago this was one of the most hated stock<br />

bull markets in history – few wanted to believe. We had fears of deflation,<br />

recession, Brexit and plenty of political uncertainty. The fear<br />

of losing money, still fresh in the minds of many investors pummeled during<br />

the 2008-2009 crash, kept enthusiasm relatively low. But, over the past year<br />

or so we have witnessed a change in investor behavior that is reminiscent<br />

of late-stage bubble action – we saw a melt-up in prices. More recently,<br />

however, markets have come under pressure as investors come to grips with<br />

a fairly substantial uptick in interest rates and the prospect of an accelerating<br />

economy.<br />

The sharp rise in the market since late 2016 has pushed stocks to the second<br />

highest valuation in history. With the CAPE Ratio (cyclically-adjusted<br />

price-to-earnings) now sitting at 32, even when factoring in the February<br />

declines, the only more expensive market in history was the 2000 Dot-Com<br />

Bubble, when valuations hit about 30 percent higher than where they currently<br />

stand. So, there shouldn’t be much debate about whether or not<br />

stocks are back in bubble territory. But, when will the party end? Well, if<br />

we get through this current volatility and stocks find a floor, and if the bubble<br />

once again starts to exhibit euphoric investor behavior, then we may<br />

well see another 20 percent to 30 percent increase over the next couple of<br />

years. It sounds ridiculous and quite optimistic I know, but this would be<br />

fairly typical price action of a bubble. If this plays out as history would suggest,<br />

it would take the Dow Jones up over 30,000 in what could be one last<br />

flurry of price acceleration as speculators embrace greed and throw money<br />

blindly at the market. Jeremy Grantham (the well-respected institutional<br />

money manager at GMO) recently wrote about investor behavior when<br />

markets are in bubble territory and others, including Robert Shiller (Yale<br />

economist) and Bill Miller (well-known fund manager) have echoed similar<br />

thoughts about the current market exhibiting signs of speculative behavior.<br />

It is important to note that the euphoria that had been missing during this<br />

long bull market finally started to show in 2017. And, it’s worth noting that<br />

any temporary weakness we may get, may indeed be fleeting. We are in a<br />

<strong>Mar</strong>ch <strong>2018</strong> • <strong>Pen</strong>insula 17