TOTT 5 April 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>April</strong> 5, <strong>2018</strong> ADVERTISING / NEWSDESK: (046) 624 4356 Find us on Facebook<br />

Talk of the Town 9<br />

Easter bunny comes early to Happy Hours<br />

LOUISE KNOWLES<br />

THE last day of the school<br />

term was a treat for the<br />

children of Happy Hours<br />

Pre-primary who staged an<br />

Easter egg hunt after their<br />

school concert last<br />

We d n e s d ay.<br />

The older children sang for<br />

their parents and were very<br />

sweet, happy and<br />

well-mannered, while the<br />

younger ones needed to eat.<br />

Principal Tracy Lloyd<br />

explained the “I Spy” E a st e r<br />

egg hunt to everybody.<br />

“They get a piece of paper<br />

and a pencil and they have to<br />

look for all the pictures, like<br />

Easter eggs, a baskets of<br />

eggs, an Easter bunny or a<br />

bunch of carrots and they can<br />

get help from their parents.”<br />

The children enjoyed<br />

themselves with their parents<br />

before ending school for the<br />

first day of the Easter<br />

h o l i d ay s .<br />

All nine provinces will be on<br />

holiday until the second term<br />

begins next Tu e s d ay.<br />

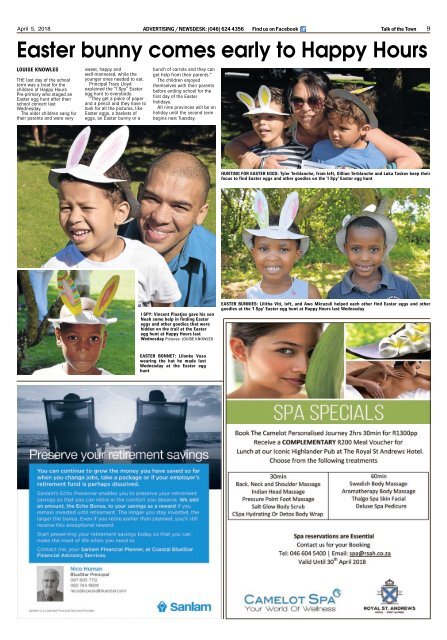

HUNTING FOR EASTER EGGS: Tyler Terblanche, from left, Gillian Terblanche and Luka Taskov keep their<br />

focus to find Easter eggs and other goodies on the ‘I Spy’ Easter egg hunt<br />

I SPY: Vincent Plaatjes gave his son<br />

Noah some help in finding Easter<br />

eggs and other goodies that were<br />

hidden on the trail at the Easter<br />

egg hunt at Happy Hours last<br />

Wednesday Pictures: LOUISE KNOWLES<br />

EASTER BUNNIES: Lilitha Viti, left, and Awo Mkrazuli helped each other find Easter eggs and other<br />

goodies at the ‘I Spy’ Easter egg hunt at Happy Hours last Wednesday<br />

EASTER BONNET: Lilonke Vuso<br />

wearing the hat he made last<br />

Wednesday at the Easter egg<br />

hunt<br />

,