West Bengal Panchayat (Zilla Parishad and Panchayat Samiti ...

West Bengal Panchayat (Zilla Parishad and Panchayat Samiti ...

West Bengal Panchayat (Zilla Parishad and Panchayat Samiti ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(10) The counterfoil of cheques shall be initiated by the officer who signs the cheque <strong>and</strong> by the<br />

Accountant or any other employee duly authorized in this behalf.<br />

(11) All cheques shall have written across them in words, at right angles to the top a sum a little in<br />

excess of the amount for which they are issued. Thus **under rupees thirty* 1 only will mean that the<br />

cheque is for a sum a little less than rupees thirty.<br />

(12) Correction, erasing <strong>and</strong> overwriting in a cheque shall not be made as a general rule. If,<br />

however, minor corrections are to be made, all such corrections shall be made by deleting the original<br />

entry relating to the amount, date or payee <strong>and</strong> the deletion shall be attested by the Drawing Officer<br />

with signature.<br />

(13) Every cheque other than cheques involving expenditure on establishment, office expense<br />

honorarium or remuneration <strong>and</strong> travelling allowance of the <strong>Zilla</strong> <strong>Parishad</strong> or the <strong>Panchayat</strong> <strong>Samiti</strong><br />

employees, office bearers <strong>and</strong> members shall be drawn in favour of the person to whom the money is<br />

actually due.<br />

(14) Delivery of cheques shall be made only to the payee or his representative duly authorized by<br />

him in writing in this behalf.<br />

(15) Cheques for payment of money to the officers of the State Government shall always be made<br />

"Account Payee only - not negotiable" or "Order" if required for administrative convenience.<br />

(16) Payment of sums deducted at source on account of Income Tax, Profession Tax, recoveries on<br />

General Provident Fund, Loans etc. of the <strong>Zilla</strong> <strong>Parishad</strong> or the <strong>Panchayat</strong> <strong>Samiti</strong> employees shall be credited<br />

to the Treasury under appropriate head in accordance with rule* for transfer credit.<br />

(17) Cheques drawn in favour of corporate bodies, firms, contractors <strong>and</strong> private persons shall be<br />

crossed by opting the words "Account Payees only - not negotiable”.<br />

(18) In case of a cheque issued against the Local Fund Account maintained with the Treasury, it<br />

shall remain valid for three months after the month of issue, but no cheque shall be payable after 30 days of the<br />

date of its enfacement by the Treasury Officer.<br />

(19) The Drawing Officer shall periodically verify from the Pass Book of the Treasury or Bank to<br />

ascertain whether the cheques issued have been encashed. If a cheque is not encashed within three<br />

months after issue, the Drawing Officer shall require the payee to explain sufficient reason for nonencashment<br />

of the cheque. On receipt of his reply or if no reply is received, he shall take appropriate actions<br />

in terms of rule 27.<br />

(20) If a cheque is issued by the <strong>Zilla</strong> <strong>Parishad</strong> or the <strong>Panchayat</strong> <strong>Samiti</strong> in payment of any sum due<br />

from the <strong>Zilla</strong> <strong>Parishad</strong> or the <strong>Panchayat</strong> <strong>Samiti</strong> concerned <strong>and</strong> that cheque is honoured on presentation to the<br />

payee's Banker, payment shall be deemed to have been made on the date it is h<strong>and</strong>ed over to the payee or his<br />

authorized agent, or on the date on which it is posted, if the cheque is posted to the payee in pursuance of a<br />

request for payment by post.<br />

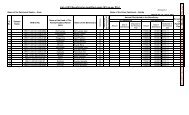

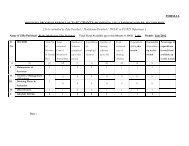

(21) As soon as any amount is received by the <strong>Zilla</strong> <strong>Parishad</strong> or the <strong>Panchayat</strong> <strong>Samiti</strong> through a<br />

cheque, its particulars shall be recorded in the Register of Cheques Received in Form 10 <strong>and</strong> the amount<br />

shall be entered in cheque book on the same day. The receipt of such cheque shall be duly acknowledged<br />

by giving a receipt in Form 2 <strong>and</strong> the serial number of the receipt shall be entered in the Register in Form 10.<br />

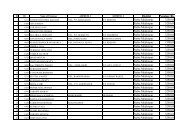

(22) As soon as a cheque is issued by the <strong>Zilla</strong> <strong>Parishad</strong> or the <strong>Panchayat</strong> <strong>Samiti</strong>, the particulars of the<br />

cheque issued shall be recorded in the Register of Cheques Issued in Form 10A <strong>and</strong> the amount shall likewise<br />

be entered in the cheque book.