R+V Versicherung AG

R+V Versicherung AG

R+V Versicherung AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report 4<br />

Overview of Business Development<br />

of <strong>R+V</strong> <strong>Versicherung</strong> <strong>AG</strong><br />

Whereas the claims expenditure of the previous year was<br />

marked by expenses from the settlement result of the loss provisions<br />

this improved substantially in 2009 so that the reported<br />

gross loss ratio fell to 62.6 % (2008: 77.7 %). Due to the less<br />

than average increase in the expenses for the insurance operation<br />

the gross expenses ratio fell to 34.9 % (2008: 35.5 %). The<br />

gross Combined Ratio improved by 15.7 % points to 97.5 %.<br />

Altogether the class closed with a net profit before equalisation<br />

and similar provision of EUR 1.3 million (2008: EUR<br />

- 5.0 million). After taking into consideration a transfer to the<br />

equalisation provision in the amount of EUR 7.9 million (2008:<br />

EUR 0.1 million) this resulted in technical results of EUR - 6.6<br />

million (2008: EUR - 5.1 million).<br />

Motor<br />

Good premium development and fall in losses<br />

The motor insurance, the business of which is underwritten<br />

worldwide, is among one of the classes of <strong>R+V</strong> <strong>Versicherung</strong> <strong>AG</strong><br />

with the highest premiums. In the period under review it represented<br />

a share of 26.5 % of the gross premiums written.<br />

Owing to their strong position on the domestic market the<br />

companies of <strong>R+V</strong> contribute a share of 64.3 % to the premium<br />

volume. Despite the strong competition in the industry this<br />

class generated a growth in premiums of a total of 14.6 % to<br />

EUR 304.1 million (2008: EUR 265.5 million). The growth<br />

amounted to 11.0 % on the domestic market.<br />

In particular the motor own damage insurance classes were<br />

also encumbered in the period under review by storm and hail<br />

damages in connection with the low-pressure system “Felix”<br />

and the low-pressure area “Wolfgang”. However, these did not<br />

reach the high level from the thunderstorm damages of the<br />

previous year so that the fiscal year loss ratio fell by 4.2 %<br />

points to 90.0 % compared with the previous year. Owing to an<br />

also increased settlement result of the loss provisions taken<br />

over from the previous year the reported gross loss ratio fell to<br />

86.8 % (2008: 91.3 %).<br />

Annual Financial Statements 33 Further Information 57 15<br />

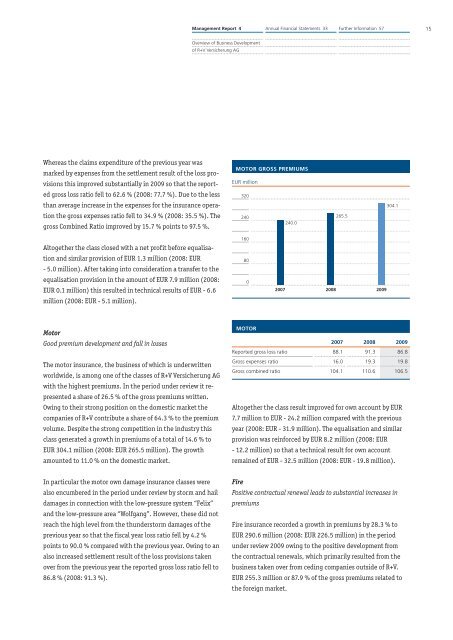

MOTOR GROSS PREMIUMS<br />

EUR million<br />

320<br />

240<br />

160<br />

80<br />

0<br />

MOTOR<br />

2007<br />

240.0<br />

2008<br />

265.5<br />

2009<br />

304.1<br />

2007 2008 2009<br />

Reported gross loss ratio 88.1 91.3 86.8<br />

Gross expenses ratio 16.0 19.3 19.8<br />

Gross combined ratio 104.1 110.6 106.5<br />

Altogether the class result improved for own account by EUR<br />

7.7 million to EUR - 24.2 million compared with the previous<br />

year (2008: EUR - 31.9 million). The equalisation and similar<br />

provision was reinforced by EUR 8.2 million (2008: EUR<br />

- 12.2 million) so that a technical result for own account<br />

remained of EUR - 32.5 million (2008: EUR - 19.8 million).<br />

Fire<br />

Positive contractual renewal leads to substantial increases in<br />

premiums<br />

Fire insurance recorded a growth in premiums by 28.3 % to<br />

EUR 290.6 million (2008: EUR 226.5 million) in the period<br />

under review 2009 owing to the positive development from<br />

the contractual renewals, which primarily resulted from the<br />

business taken over from ceding companies outside of <strong>R+V</strong>.<br />

EUR 255.3 million or 87.9 % of the gross premiums related to<br />

the foreign market.