R+V Versicherung AG

R+V Versicherung AG

R+V Versicherung AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60<br />

Consolidated financial statements / Fees of the auditor<br />

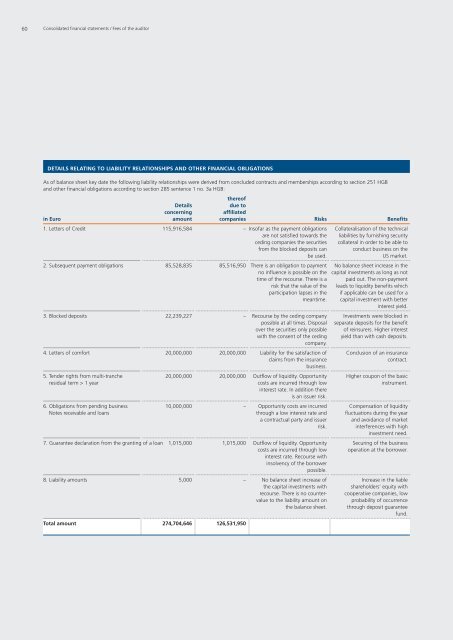

DETAILS RELATING TO LIABILITY RELATIONSHIPS AND OTHER FINANCIAL OBLIGATIONS<br />

As of balance sheet key date the following liability relationships were derived from concluded contracts and memberships according to section 251 HGB<br />

and other financial obligations according to section 285 sentence 1 no. 3a HGB:<br />

thereof<br />

Details due to<br />

concerning affiliated<br />

in Euro amount companies Risks Benefits<br />

1. Letters of Credit 115,916,584 – Insofar as the payment obligations Collateralisation of the technical<br />

are not satisfied towards the liabilities by furnishing security<br />

ceding companies the securities collateral in order to be able to<br />

from the blocked deposits can conduct business on the<br />

be used. US market.<br />

2. Subsequent payment obligations 85,528,835 85,516,950 There is an obligation to payment No balance sheet increase in the<br />

no influence is possible on the capital investments as long as not<br />

time of the recourse. There is a paid out. The non-payment<br />

risk that the value of the leads to liquidity benefits which<br />

participation lapses in the if applicable can be used for a<br />

meantime. capital investment with better<br />

interest yield.<br />

3. Blocked deposits 22,239,227 – Recourse by the ceding company Investments were blocked in<br />

possible at all times. Disposal separate deposits for the benefit<br />

over the securities only possible of reinsurers. Higher interest<br />

with the consent of the ceding<br />

company.<br />

yield than with cash deposits.<br />

4. Letters of comfort 20,000,000 20,000,000 Liability for the satisfaction of Conclusion of an insurance<br />

claims from the insurance<br />

business.<br />

contract.<br />

5. Tender rights from multi-tranche 20,000,000 20,000,000 Outflow of liquidity. Opportunity Higher coupon of the basic<br />

residual term > 1 year costs are incurred through low<br />

interest rate. In addition there<br />

is an issuer risk.<br />

instrument.<br />

6. Obligations from pending business 10,000,000 – Opportunity costs are incurred Compensation of liquidity<br />

Notes receivable and loans through a low interest rate and fluctuations during the year<br />

a contractual party and issuer and avoidance of market<br />

risk. interferences with high<br />

investment need.<br />

7. Guarantee declaration from the granting of a loan 1,015,000 1,015,000 Outflow of liquidity. Opportunity Securing of the business<br />

costs are incurred through low<br />

interest rate. Recourse with<br />

insolvency of the borrower<br />

possible.<br />

operation at the borrower.<br />

8. Liability amounts 5,000 – No balance sheet increase of Increase in the liable<br />

the capital investments with shareholders’ equity with<br />

recourse. There is no counter- cooperative companies, low<br />

value to the liability amount on probability of occurrence<br />

the balance sheet. through deposit guarantee<br />

fund.<br />

Total amount 274,704,646 126,531,950