R+V Versicherung AG

R+V Versicherung AG

R+V Versicherung AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report 4<br />

Overview of Business Development<br />

of <strong>R+V</strong> <strong>Versicherung</strong> <strong>AG</strong> /<br />

Profitability / Financial position<br />

Other earnings and expenses<br />

The other earnings amounted to EUR 27.2 million in the period<br />

under review (2008: EUR 33.6 million). They essentially included<br />

earnings from services rendered and interest income.<br />

Exchange rate profits to the amount of EUR 1.6 million (2008:<br />

EUR 10.5 million) resulted from conversions of foreign currencies.<br />

The other expenses of EUR 44.9 million (2008: EUR 27.7 million)<br />

included in addition to the expenses for services rendered<br />

and interest in particular one-off effects from the outsourcing<br />

of pension provisions in the amount of EUR 6.2 million,<br />

increased personnel expenses above all in the field of retirement<br />

benefit of EUR 1.7 million and expenses from the conversion<br />

of foreign currencies of EUR 10.9 million.<br />

Overall result<br />

The results of the normal business activities fell in total by<br />

1.3 % to EUR 173.9 million (2008: EUR 176.2 million). By taking<br />

into account taxation of EUR 43.0 million (2008: EUR 56.3<br />

million) net income for the year remained to the amount of<br />

EUR 130.9 million (2008: EUR 119.9 million).<br />

From the net income for the year 2009 EUR 46.3 million were<br />

transferred to the retained earnings in advance and EUR 84.6<br />

million disclosed as net retained profits.<br />

The Annual General Meeting will propose to use these net retained<br />

profits for the payment of a dividend of EUR 6.90 per individual<br />

share certificate.<br />

Annual Financial Statements 33 Further Information 57 19<br />

Financial position<br />

Capital structure<br />

As of balance sheet key date the shareholders’ equity of<br />

<strong>R+V</strong> <strong>Versicherung</strong> <strong>AG</strong> amounted to EUR 1,744.0 million (2008:<br />

EUR 1,697.4 million).<br />

With the aim to reinforce the financial group on the whole and<br />

to signalise to the joint customers that <strong>R+V</strong> is a reliable and<br />

efficient all finance service provider a capital increase was<br />

carried out within the framework of a distribute-get-back procedure<br />

through a resolution of the Annual General Meeting<br />

2009. This way both the statutory requirements from the<br />

provision of shareholders’ equity as well as the good ratings<br />

and a sufficient coverage of the technical obligations of the<br />

company are guaranteed.<br />

By issuing 1,022,000 new individual share certificates in<br />

the bearer’s name and subject to transfer restrictions the subscribed<br />

capital was increased by EUR 26.5 million to EUR 318.5<br />

million within the framework of this measure.<br />

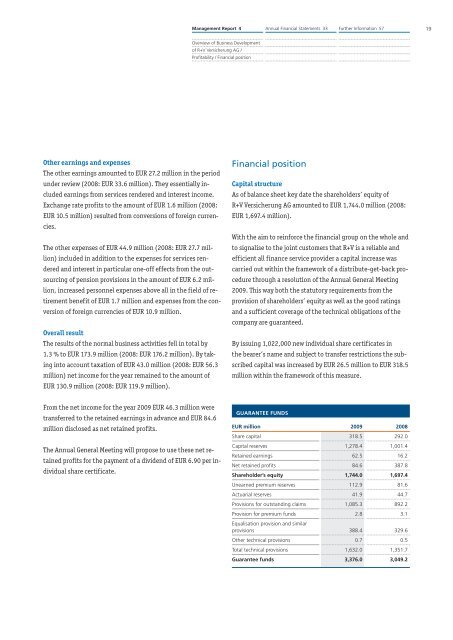

GUARANTEE FUNDS<br />

EUR million 2009 2008<br />

Share capital 318.5 292.0<br />

Capital reserves 1,278.4 1,001.4<br />

Retained earnings 62.5 16.2<br />

Net retained profits 84.6 387.8<br />

Shareholder’s equity 1,744.0 1,697.4<br />

Unearned premium reserves 112.9 81.6<br />

Actuarial reserves 41.9 44.7<br />

Provisions for outstanding claims 1,085.3 892.2<br />

Provision for premium funds<br />

Equalisation provision and similar<br />

2.8 3.1<br />

provisions 388.4 329.6<br />

Other technical provisions 0.7 0.5<br />

Total technical provisions 1,632.0 1,351.7<br />

Guarantee funds 3,376.0 3,049.2