R+V Versicherung AG

R+V Versicherung AG

R+V Versicherung AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

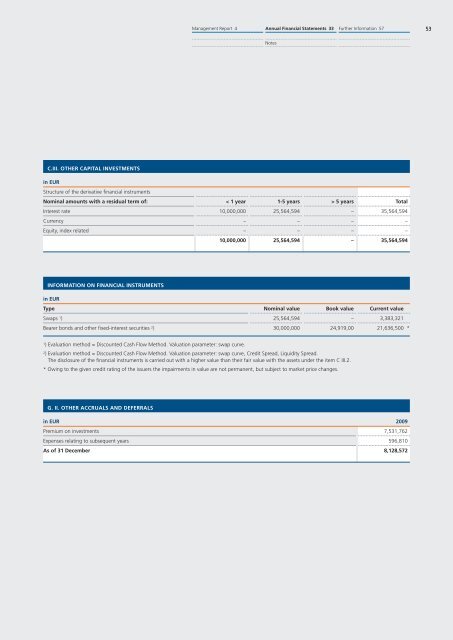

C.III. OTHER CAPITAL INVESTMENTS<br />

in EUR<br />

Structure of the derivative financial instruments<br />

Management Report 4 Annual Financial Statements 33<br />

Notes<br />

Further Information 57 53<br />

Nominal amounts with a residual term of: < 1 year 1-5 years > 5 years Total<br />

Interest rate 10,000,000 25,564,594 – 35,564,594<br />

Currency – – – –<br />

Equity, index related – – – –<br />

10,000,000 25,564,594 – 35,564,594<br />

INFORMATION ON FINANCIAL INSTRUMENTS<br />

in EUR<br />

Type Nominal value Book value Current value<br />

Swaps 1 ) 25,564,594 – 3,383,321<br />

Bearer bonds and other fixed-interest securities 2 ) 30,000,000 24,919,00 21,636,500 *<br />

1 ) Evaluation method = Discounted Cash Flow Method. Valuation parameter: swap curve.<br />

2 ) Evaluation method = Discounted Cash Flow Method. Valuation parameter: swap curve, Credit Spread, Liquidity Spread.<br />

The disclosure of the financial instruments is carried out with a higher value than their fair value with the assets under the item C III.2.<br />

* Owing to the given credit rating of the issuers the impairments in value are not permanent, but subject to market price changes.<br />

G. II. OTHER ACCRUALS AND DEFERRALS<br />

in EUR 2009<br />

Premium on investments 7,531,762<br />

Expenses relating to subsequent years 596,810<br />

As of 31 December 8,128,572