R+V Versicherung AG

R+V Versicherung AG

R+V Versicherung AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

52<br />

Notes to the balance sheet<br />

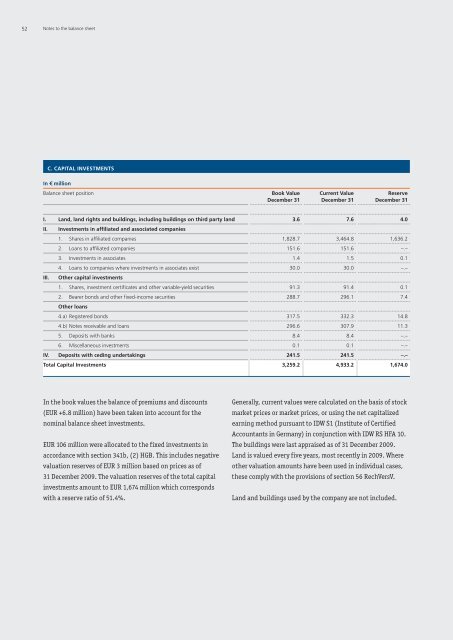

C. CAPITAL INVESTMENTS<br />

In € million<br />

Balance sheet position Book Value Current Value Reserve<br />

December 31 December 31 December 31<br />

I. Land, land rights and buildings, including buildings on third party land 3.6 7.6 4.0<br />

II. Investments in affiliated and associated companies<br />

1. Shares in affiliated companies 1,828.7 3,464.8 1,636.2<br />

2. Loans to affiliated companies 151.6 151.6 –.–<br />

3. Investments in associates 1.4 1.5 0.1<br />

4. Loans to companies where investments in associates exist 30.0 30.0 –.–<br />

III. Other capital investments<br />

1. Shares, investment certificates and other variable-yield securities 91.3 91.4 0.1<br />

2. Bearer bonds and other fixed-income securities 288.7 296.1 7.4<br />

Other loans<br />

4.a) Registered bonds 317.5 332.3 14.8<br />

4.b) Notes receivable and loans 296.6 307.9 11.3<br />

5. Deposits with banks 8.4 8.4 –.–<br />

6. Miscellaneous investments 0.1 0.1 –.–<br />

IV. Deposits with ceding undertakings 241.5 241.5 –.–<br />

Total Capital Investments 3,259.2 4,933.2 1,674.0<br />

In the book values the balance of premiums and discounts<br />

(EUR +6.8 million) have been taken into account for the<br />

nominal balance sheet investments.<br />

EUR 106 million were allocated to the fixed investments in<br />

accordance with section 341b, (2) HGB. This includes negative<br />

valuation reserves of EUR 3 million based on prices as of<br />

31 December 2009. The valuation reserves of the total capital<br />

investments amount to EUR 1,674 million which corresponds<br />

with a reserve ratio of 51.4%.<br />

Generally, current values were calculated on the basis of stock<br />

market prices or market prices, or using the net capitalized<br />

earning method pursuant to IDW S1 (Institute of Certified<br />

Accountants in Germany) in conjunction with IDW RS HFA 10.<br />

The buildings were last appraised as of 31 December 2009.<br />

Land is valued every five years, most recently in 2009. Where<br />

other valuation amounts have been used in individual cases,<br />

these comply with the provisions of section 56 RechVersV.<br />

Land and buildings used by the company are not included.