Paris School of Economics - L'Agence Française de Développement

Paris School of Economics - L'Agence Française de Développement

Paris School of Economics - L'Agence Française de Développement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

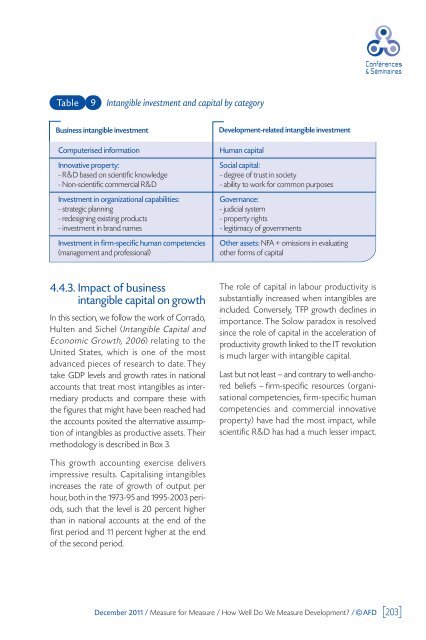

Table<br />

9<br />

Intangible investment and capital by category<br />

Business intangible investment Development-related intangible investment<br />

Computerised information Human capital<br />

Innovative property: Social capital:<br />

- R&D based on scientific knowledge - <strong>de</strong>gree <strong>of</strong> trust in society<br />

- Non-scientific commercial R&D - ability to work for common purposes<br />

Investment in organizational capabilities: Governance:<br />

- strategic planning - judicial system<br />

- re<strong>de</strong>signing existing products - property rights<br />

- investment in brand names - legitimacy <strong>of</strong> governments<br />

Investment in firm-specific human competencies Other assets: NFA + omissions in evaluating<br />

(management and pr<strong>of</strong>essional) other forms <strong>of</strong> capital<br />

4.4.3. Impact <strong>of</strong> business<br />

intangible capital on growth<br />

In this section, we follow the work <strong>of</strong> Corrado,<br />

Hulten and Sichel (Intangible Capital and<br />

Economic Growth, 2006) relating to the<br />

United States, which is one <strong>of</strong> the most<br />

advanced pieces <strong>of</strong> research to date. They<br />

take GDP levels and growth rates in national<br />

accounts that treat most intangibles as intermediary<br />

products and compare these with<br />

the figures that might have been reached had<br />

the accounts posited the alternative assumption<br />

<strong>of</strong> intangibles as productive assets. Their<br />

methodology is <strong>de</strong>scribed in Box 3.<br />

This growth accounting exercise <strong>de</strong>livers<br />

impressive results. Capitalising intangibles<br />

increases the rate <strong>of</strong> growth <strong>of</strong> output per<br />

hour, both in the 1973-95 and 1995-2003 periods,<br />

such that the level is 20 percent higher<br />

than in national accounts at the end <strong>of</strong> the<br />

first period and 11 percent higher at the end<br />

<strong>of</strong> the second period.<br />

The role <strong>of</strong> capital in labour productivity is<br />

substantially increased when intangibles are<br />

inclu<strong>de</strong>d. Conversely, TFP growth <strong>de</strong>clines in<br />

importance. The Solow paradox is resolved<br />

since the role <strong>of</strong> capital in the acceleration <strong>of</strong><br />

productivity growth linked to the IT revolution<br />

is much larger with intangible capital.<br />

Last but not least — and contrary to well-anchored<br />

beliefs — firm-specific resources (organisational<br />

competencies, firm-specific human<br />

competencies and commercial innovative<br />

property) have had the most impact, while<br />

scientific R&D has had a much lesser impact.<br />

December 2011 / Measure for Measure / How Well Do We Measure Development? / © AFD [ 203]