Chapter 1

Chapter 1

Chapter 1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

agroindustries (10 percent). The program came up against ties to the private sector, either because of social concerns or<br />

several obstacles: (1) the limited size of the financial mar- because it is not convinced the private sector can do a better<br />

ket; (2) concems that a few groups, families, or foreigners job, then private and foreign investors will not be convinced<br />

would dominate too much of the economy; and (3) most that the time and conditions are right for investment. Two<br />

important of all, resistance from well-organized unions and recent Bank studies of cross-country experience, Galal and<br />

from management and govemment bureaucrats that bene- others 1994 and Galal and Shirley 1995, assess the political<br />

fit from sitting on the boards of public enterprises. and social complexities of divestiture and measure the<br />

Slowing down the pace of privatization may help to main- impact of PE ownership on an economy's per capita income,<br />

tain stability, but at a cost, because it also slows down the savings, and growth prospects. The findings support the view<br />

pace of new job creation through the establishment of new that there are substantial advantages in terms of efficiency,<br />

and more efficient private investments, and it prolongs the enhanced intemational competitiveness, and long-term<br />

inefficiencies and misuse of scarce resources in the economy. growth of selling public enterprises and supporting divesti-<br />

Most studies, including the Sader privatization study (table ture measures with appropriate competition policies.<br />

2.2), find that weak privatization programs slow down the Since 1991/92, the Government has been preparing secadjustment<br />

process and discourage foreign and local private toral studies, evaluating divestiture options, and identifying<br />

investors. Without clear signals that the system has changed, constraints and opportunities. It has also focused on creatthe<br />

reform process becomes much more tenuous and subject ing the necessary legal environment to regulate the stock<br />

to costly political, social, and economic setbacks. After all, if exchange which will permit them to move forward in a pruthe<br />

goverrment is not ready to relinquish productive activi- dent way for a stronger privatization effort in 1995/96.<br />

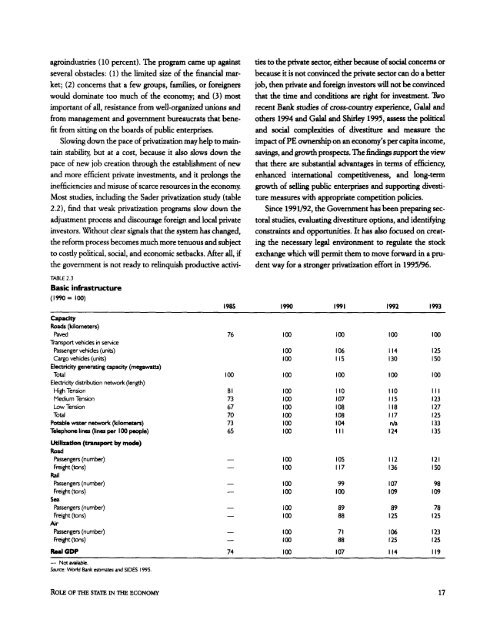

TABLE 2.3<br />

Basic infrastructure<br />

(1990 = o00)<br />

1985 1990 1991 1992 1993<br />

Capacity<br />

Roads (kilometers)<br />

Paved<br />

Transport vehicles in service<br />

76 100 100 100 100<br />

Passenger vehicles (units) 100 106 114 125<br />

Cargo vehicles (units)<br />

Electricity generating capacity (megawatts)<br />

100 115 130 ISO<br />

Total<br />

Electricity distribution network (length)<br />

100 100 100 100 100<br />

High Tension 8 1 100 110 110 III<br />

Medium Tension 73 100 107 115 123<br />

Low Tension 67 100 108 118 127<br />

Total 70 100 108 117 125<br />

Potable water network (kilometers) 73 100 104 r/a 133<br />

Telephone lines (lines per I 00 people) 65 100 III 124 135<br />

Utilization (transport by mode)<br />

Road<br />

Passengers (number)<br />

Freight (tons)<br />

Rail<br />

-<br />

-<br />

100<br />

100<br />

105<br />

117<br />

112<br />

136<br />

121<br />

ISO<br />

Passengers (number) - 100 99 107 98<br />

Freight (tons)<br />

Sea<br />

- 100 100 109 109<br />

Passengers (number) _100 89 89 78<br />

Freight (tons)<br />

Air<br />

- 100 88 125 125<br />

Passengers (number) - 100 71 106 123<br />

Freight (tons) - 100 88 125 125<br />

Real GDP 74 100 107 114 119<br />

- Not avlable.<br />

Source: VMdd Bank estmates and SIDES 1995.<br />

RoLE OP THE STATE IN THE ECONOMY 17