JPS & Partners 2017 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Board of Directors <strong>Report</strong> (Continued)<br />

institutions that charges minimal fees on its products<br />

and services.<br />

During the year a number of objectives were pursued, to<br />

ensure the continued growth and viability of the Credit<br />

Union. Some of the objectives pursued included but<br />

were not limited to:<br />

• Growth in the Loans portfolio<br />

• Formation of Strategic alliances to grow<br />

membership<br />

• Product promotional days<br />

• Ongoing Interest rate reviews<br />

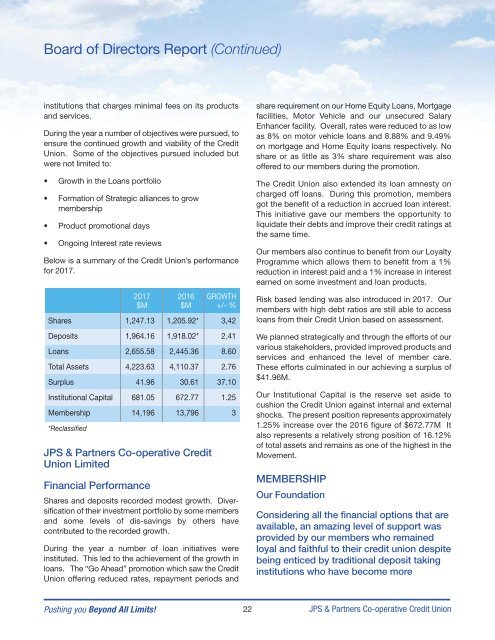

Below is a summary of the Credit Union’s performance<br />

for <strong>2017</strong>.<br />

<strong>JPS</strong> & <strong>Partners</strong> Co-operative Credit<br />

Union Limited<br />

Financial Performance<br />

<strong>2017</strong> 2016 GROWTH<br />

$M $M +/- %<br />

Shares 1,247.13 1,205.92* 3,42<br />

Deposits 1,964.16 1,918.02* 2.41<br />

Loans 2,655.58 2,445.36 8.60<br />

Total Assets 4,223.63 4,110.37 2.76<br />

Surplus 41.96 30.61 37.10<br />

Institutional Capital 681.05 672.77 1.25<br />

Membership 14,196 13,796 3<br />

*Reclassified<br />

Shares and deposits recorded modest growth. Diversification<br />

of their investment portfolio by some members<br />

and some levels of dis-savings by others have<br />

contributed to the recorded growth.<br />

During the year a number of loan initiatives were<br />

instituted. This led to the achievement of the growth in<br />

loans. The “Go Ahead” promotion which saw the Credit<br />

Union offering reduced rates, repayment periods and<br />

share requirement on our Home Equity Loans, Mortgage<br />

facilities, Motor Vehicle and our unsecured Salary<br />

Enhancer facility. Overall, rates were reduced to as low<br />

as 8% on motor vehicle loans and 8.88% and 9.49%<br />

on mortgage and Home Equity loans respectively. No<br />

share or as little as 3% share requirement was also<br />

offered to our members during the promotion.<br />

The Credit Union also extended its loan amnesty on<br />

charged off loans. During this promotion, members<br />

got the benefit of a reduction in accrued loan interest.<br />

This initiative gave our members the opportunity to<br />

liquidate their debts and improve their credit ratings at<br />

the same time.<br />

Our members also continue to benefit from our Loyalty<br />

Programme which allows them to benefit from a 1%<br />

reduction in interest paid and a 1% increase in interest<br />

earned on some investment and loan products.<br />

Risk based lending was also introduced in <strong>2017</strong>. Our<br />

members with high debt ratios are still able to access<br />

loans from their Credit Union based on assessment.<br />

We planned strategically and through the efforts of our<br />

various stakeholders, provided improved products and<br />

services and enhanced the level of member care.<br />

These efforts culminated in our achieving a surplus of<br />

$41.96M.<br />

Our Institutional Capital is the reserve set aside to<br />

cushion the Credit Union against internal and external<br />

shocks. The present position represents approximately<br />

1.25% increase over the 2016 figure of $672.77M It<br />

also represents a relatively strong position of 16.12%<br />

of total assets and remains as one of the highest in the<br />

Movement.<br />

MEMBERSHIP<br />

Our Foundation<br />

Considering all the financial options that are<br />

available, an amazing level of support was<br />

provided by our members who remained<br />

loyal and faithful to their credit union despite<br />

being enticed by traditional deposit taking<br />

institutions who have become more<br />

Pushing you Beyond All Limits!<br />

22<br />

<strong>JPS</strong> & <strong>Partners</strong> Co-operative Credit Union