JPS & Partners 2017 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Treasurer’s <strong>Report</strong> Continued<br />

26.04% was spent on financial expenses,<br />

26.03% for administration expenses, 6.35% for<br />

representation cost, 1.04% for loan loss<br />

provision, with 9.13% remaining as surplus.<br />

BALANCE SHEET<br />

Total Assets for <strong>2017</strong> increased to $4.22 Billion,<br />

which represent an increase of $113.25M when<br />

compared to 2016.<br />

Loans to members increased by $210.22M or<br />

8.6% over 2016. The portfolio balance stood at<br />

$2.66B at the end of <strong>2017</strong>. Loan promotions<br />

introduced throughout the year yielded positive<br />

results despite the competitive and declining<br />

interest rate environment within which we<br />

operated.<br />

investment in higher income earning products<br />

such as stocks and shares.<br />

Loan delinquency as at year end stood at 2.29%<br />

of the loans portfolio. This is a marginal increase<br />

of 0.22% when compared to 2016 delinquency<br />

ratio of 2.07%. Our loan delinquency ratio<br />

remains well within the international Credit Union<br />

benchmark of 5%.<br />

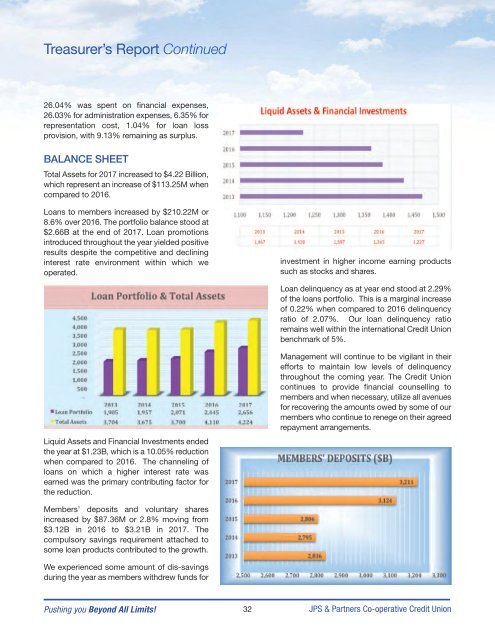

Liquid Assets and Financial Investments ended<br />

the year at $1.23B, which is a 10.05% reduction<br />

when compared to 2016. The channeling of<br />

loans on which a higher interest rate was<br />

earned was the primary contributing factor for<br />

the reduction.<br />

Management will continue to be vigilant in their<br />

efforts to maintain low levels of delinquency<br />

throughout the coming year. The Credit Union<br />

continues to provide financial counselling to<br />

members and when necessary, utilize all avenues<br />

for recovering the amounts owed by some of our<br />

members who continue to renege on their agreed<br />

repayment arrangements.<br />

Members’ deposits and voluntary shares<br />

increased by $87.36M or 2.8% moving from<br />

$3.12B in 2016 to $3.21B in <strong>2017</strong>. The<br />

compulsory savings requirement attached to<br />

some loan products contributed to the growth.<br />

We experienced some amount of dis-savings<br />

during the year as members withdrew funds for<br />

Pushing you Beyond All Limits!<br />

32<br />

<strong>JPS</strong> & <strong>Partners</strong> Co-operative Credit Union