BusinessDay 07 Jan 2019

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

18 BUSINESS DAY www.businessday.ng www.facebook.com/businessdayng @businessDayNG @Businessdayng Monday <strong>07</strong> <strong>Jan</strong>uary <strong>2019</strong><br />

Live @ The Exchanges<br />

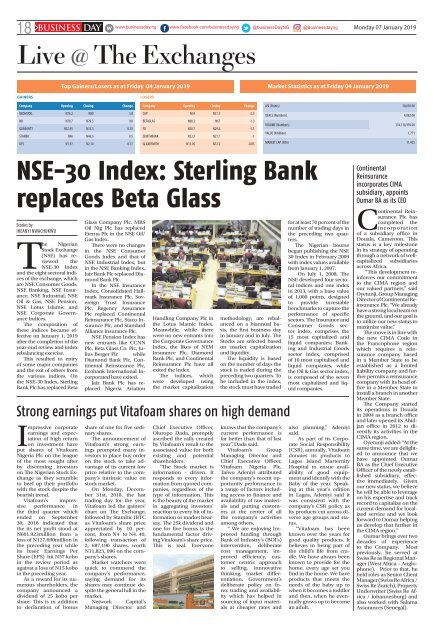

Top Gainers/Losers as at Friday 04 <strong>Jan</strong>uary <strong>2019</strong> Market Statistics as at Friday 04 <strong>Jan</strong>uary <strong>2019</strong><br />

GAINERS<br />

Company Opening Closing Change<br />

OKOMUOIL N76.2 N80 3.8<br />

NB N78.7 N79.5 0.8<br />

GUARANTY N32.95 N33.5 0.55<br />

STANBIC N46 N46.5 0.5<br />

UPL N1.97 N2.14 0.17<br />

LOSERS<br />

Company Opening Closing Change<br />

CAP N34 N31.5 -2.5<br />

BETAGLAS N68.3 N67 -1.3<br />

FO N30.7 N29.6 -1.1<br />

ZENITHBANK N22.7 N21.7 -1<br />

GLAXOSMITH N13.05 N12.2 -0.85<br />

ASI (Points) 30,638.90<br />

DEALS (Numbers) 4,082.00<br />

VOLUME (Numbers) 334,316,959.00<br />

VALUE (N billion) 1.771<br />

MARKET CAP (N Trn 11.425<br />

NSE-30 Index: Sterling Bank<br />

replaces Beta Glass<br />

Stories by<br />

Iheanyi Nwachukwu<br />

The Nigerian<br />

Stock Exchange<br />

(NSE) has reviewed<br />

the<br />

NSE-30 Index<br />

and the eight sectoral indices<br />

of the exchange, which<br />

are NSE Consumer Goods,<br />

NSE Banking, NSE Insurance,<br />

NSE Industrial, NSE<br />

Oil & Gas, NSE Pension,<br />

NSE Lotus Islamic and<br />

NSE Corporate Governance<br />

Indices.<br />

The composition of<br />

these indices became effective<br />

on <strong>Jan</strong>uary 1, <strong>2019</strong><br />

after the completion of the<br />

year-end review and index<br />

rebalancing exercise.<br />

This resulted to entry<br />

of some major companies<br />

and the exit of others from<br />

the various indices. On<br />

the NSE-30 Index, Sterling<br />

Bank Plc has replaced Beta<br />

Glass Company Plc. MRS<br />

Oil Nig Plc has replaced<br />

Eterna Plc in the NSE Oil/<br />

Gas Index.<br />

There were no changes<br />

in the NSE Consumer<br />

Goods Index and that of<br />

NSE Industrial Index, but<br />

in the NSE Banking Index,<br />

Jaiz Bank Plc replaced Diamond<br />

Bank Plc.<br />

In the NSE Insurance<br />

Index, Consolidated Hallmark<br />

Insurance Plc, Sovereign<br />

Trust Insurance<br />

Plc, Regency Assurance<br />

Plc replaced Continental<br />

Reinsurance Plc, Staco Insurance<br />

Plc, and Standard<br />

Alliance Insurance Plc.<br />

NSE Pension Index has<br />

new entrants like CCNN<br />

Plc, Beta Glass Co. Plc, Julius<br />

Berger Plc while<br />

Diamond Bank Plc, Continental<br />

Reinsurance Plc,<br />

Ecobank International Incorporated<br />

have exited.<br />

Jaiz Bank Plc has replaced<br />

Nigeria Aviation<br />

Handling Company Plc in<br />

the Lotus Islamic Index.<br />

Meanwhile, while there<br />

were no new entrants into<br />

the Corporate Governance<br />

Index, the likes of NEM<br />

Insurance Plc, Diamond<br />

Bank Plc, and Continental<br />

Reinsurance Plc have all<br />

exited the Index.<br />

The indices, which<br />

were developed using<br />

the market capitalization<br />

methodology, are rebalanced<br />

on a biannual basis,<br />

the first business day<br />

in <strong>Jan</strong>uary and in July. The<br />

Stocks are selected based<br />

on market capitalization<br />

and liquidity.<br />

The liquidity is based<br />

on the number of days the<br />

stock is traded during the<br />

preceding two quarters. To<br />

be included in the index,<br />

the stock must have traded<br />

Strong earnings put Vitafoam shares on high demand<br />

Impressive corporate<br />

earnings and expectation<br />

of high return<br />

on investment have<br />

put shares of Vitafoam<br />

Nigeria Plc on the league<br />

of the most sought after<br />

by discerning investors<br />

on The Nigerian Stock Exchange<br />

as they scramble<br />

to beef up their portfolio<br />

with the stock despite the<br />

bearish trend.<br />

Vitafoam’s impressive<br />

performance in<br />

the third quarter which<br />

ended on September<br />

30, 2018 indicated that<br />

the its net profit stood at<br />

N601.923million from a<br />

loss of N127.690million in<br />

the preceding year while<br />

its basic Earnings Per<br />

Share (EPS) hit N57 kobo<br />

in the review period as<br />

against a loss of N15 kobo<br />

in the preceding year.<br />

As a reward for its numerous<br />

shareholders, the<br />

company announced a<br />

dividend of 25 kobo per<br />

share. This is in addition<br />

to declaration of bonus<br />

share of one for five ordinary<br />

shares.<br />

The announcement of<br />

Vitafoam’s strong earnings<br />

prompted many investors<br />

to place buy order<br />

on the stock to take advantage<br />

of its current low<br />

price relative to the company’s<br />

intrinsic value on<br />

stock market.<br />

On Monday, December<br />

31st, 2018, the last<br />

trading day for the year,<br />

Vitafoam led the gainers’<br />

chart on The Exchange,<br />

followed by Stambic IBTC<br />

as Vitafoam’s share price<br />

appreciated by 10 percent,<br />

from N4 to N4. 40,<br />

following transaction of<br />

2, 687,190 shares, worth<br />

N11,823, 096 on the company’s<br />

shares.<br />

Market watchers were<br />

quick to commend the<br />

company’s performance,<br />

saying demand for its<br />

shares may continue despite<br />

the general lull in the<br />

market.<br />

Network Capital’s<br />

Managing Director and<br />

Chief Executive Officer,<br />

Oluropo Dada, promptly<br />

ascribed the rally created<br />

by Vitafoam’s result to the<br />

associated value for both<br />

existing and potential<br />

shareholders:<br />

“The Stock market is<br />

information - driven. It<br />

responds to every information<br />

from quoted companies,<br />

regardless of the<br />

type of information. This<br />

is the beauty of the market<br />

in aggregating investors’<br />

reaction to every bit of information<br />

or market hearsay.<br />

The 25k dividend and<br />

one for five bonus is the<br />

fundamental factor driving<br />

Vitafoam’s share price.<br />

This is real. Everyone<br />

knows that the company’s<br />

current performance is<br />

far better than that of last<br />

year”, Dada said.<br />

Vitafoam’s Group<br />

Managing Director and<br />

Chief Executive Officer,<br />

Vitafoam Nigeria Plc,<br />

Taiwo Adeniyi attributed<br />

the company’s recent opportunity<br />

performance to<br />

a range of factors including<br />

access to finance and<br />

availability of raw materials<br />

and putting customers<br />

at the center of all<br />

the company’s activities<br />

among others.<br />

“ We are enjoying Improved<br />

funding through<br />

Bank of Industry’s (BOI’s)<br />

intervention, deliberate<br />

cost management, improved<br />

efficiency, customer<br />

centric approach<br />

to selling, innnovative<br />

thinking, market differentiation,<br />

Government’s<br />

deliberate policy on forex<br />

trading and availability<br />

which has helped in<br />

sourcing of input materials<br />

at cheaper rates and<br />

for at least 70 percent of the<br />

number of trading days in<br />

the preceding two quarters.<br />

The Nigerian bourse<br />

began publishing the NSE<br />

30 Index in February 2009<br />

with index values available<br />

from <strong>Jan</strong>uary 1, 20<strong>07</strong>.<br />

On July 1, 2008, The<br />

NSE developed four sectoral<br />

indices and one index<br />

in 2013, with a base value<br />

of 1,000 points, designed<br />

to provide investable<br />

benchmarks to capture the<br />

performance of specific<br />

sectors. The Insurance and<br />

Consumer Goods sector<br />

index, comprises the<br />

15 most capitalized and<br />

liquid companies; Banking<br />

and Industrial Goods<br />

sector index, comprised<br />

of 10 most capitalised and<br />

liquid companies, while<br />

the Oil & Gas sector index,<br />

is composed of the seven<br />

most capitalized and liquid<br />

companies.<br />

also planning”, Adeniyi<br />

said.<br />

As part of its Corporate<br />

Social Responsibility<br />

(CSR), annually, Vitafoam<br />

donates its products to<br />

Lagos Island Marternity<br />

Hospital to ensue availability<br />

of good equipment<br />

and identify with the<br />

Baby of the year. Speaking<br />

at this year’s edition<br />

in Lagos, Adeniyi said it<br />

was consistent with the<br />

company’s CSR policy as<br />

its products cut across diverse<br />

age groups and status.<br />

“Vitafoam has been<br />

known over the years for<br />

good quality products. It<br />

believes in being part of<br />

the child’s life from cradle.<br />

We have always been<br />

known to provide for the<br />

home, every age set you<br />

find in the home. We have<br />

products that meets the<br />

needs of the baby up to<br />

when it becomes a toddler<br />

and then, when he eventually<br />

grows up to become<br />

an adult.<br />

Continental<br />

Reinsurance<br />

incorporates CIMA<br />

subsidiary, appoints<br />

Oumar BA as its CEO<br />

Continental Reinsurance<br />

Plc has<br />

completed the<br />

incorporation<br />

of a subsidiary office in<br />

Douala, Cameroon. This<br />

status is a key milestone<br />

in its strategy of operating<br />

through a network of wellcapitalized<br />

subsidiaries<br />

across Africa.<br />

“This development reinforces<br />

our commitment<br />

to the CIMA region and<br />

our valued partners,” said<br />

Oyetunji, Group Managing<br />

Director of Continental Reinsurance<br />

Plc. “We already<br />

have a strong local team on<br />

the ground, and our goal is<br />

to utilize our new status to<br />

maximize value.”<br />

The move is in line with<br />

the new CIMA Code in<br />

the Francophone region<br />

which requires a reinsurance<br />

company based<br />

in a Member State to be<br />

established as a limited<br />

liability company and further<br />

permits a reinsurance<br />

company with its head office<br />

in a Member State to<br />

install a branch in another<br />

Member State.<br />

The Company started<br />

its operations in Douala<br />

in 2004 as a branch office<br />

and later opened its Abidjan<br />

office in 2012 to diversify<br />

its activities in the<br />

CIMA region.<br />

Oyetunji added: “At the<br />

same time, we are delighted<br />

to announce that we<br />

have appointed Oumar<br />

BA as the Chief Executive<br />

Officer of the newly established<br />

subsidiary, effective<br />

immediately. Given<br />

our new status, we believe<br />

he will be able to leverage<br />

on his expertise and track<br />

record to capitalize on the<br />

current demand for localized<br />

service and we look<br />

forward to Oumar helping<br />

us develop that further in<br />

the CIMA region.”<br />

Oumar brings over two<br />

decades of experience<br />

to the Company. Most<br />

previously, he served at<br />

Swiss Re as Regional Manager<br />

(West Africa – Anglophone).<br />

Prior to that, he<br />

held roles as Senior Client<br />

Manager (Swiss Re Africa /<br />

Swiss Re Zurich), Property<br />

Underwriter (Swiss Re Africa<br />

/ Johannesburg) and<br />

also worked with Salama<br />

Assurances (Senegal).