LSB September 2019_Web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

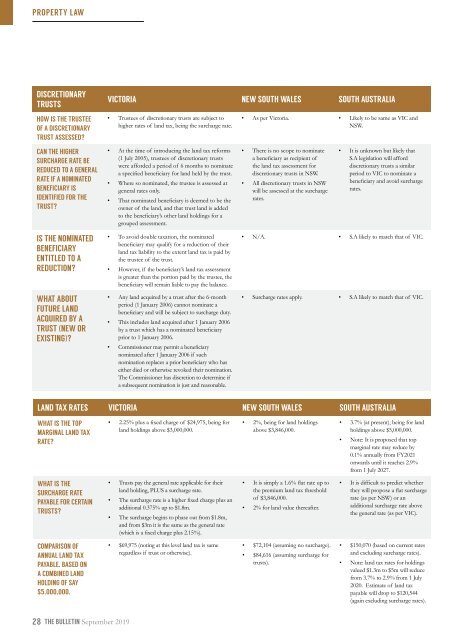

PROPERTY LAW<br />

DISCRETIONARY<br />

TRUSTS<br />

VICTORIA NEW SOUTH WALES SOUTH AUSTRALIA<br />

HOW IS THE TRUSTEE<br />

OF A DISCRETIONARY<br />

TRUST ASSESSED?<br />

• Trustees of discretionary trusts are subject to<br />

higher rates of land tax, being the surcharge rate.<br />

• As per Victoria. • Likely to be same as VIC and<br />

NSW.<br />

CAN THE HIGHER<br />

SURCHARGE RATE BE<br />

REDUCED TO A GENERAL<br />

RATE IF A NOMINATED<br />

BENEFICIARY IS<br />

IDENTIFIED FOR THE<br />

TRUST?<br />

• At the time of introducing the land tax reforms<br />

(1 July 2005), trustees of discretionary trusts<br />

were afforded a period of 6 months to nominate<br />

a specified beneficiary for land held by the trust.<br />

• Where so nominated, the trustee is assessed at<br />

general rates only.<br />

• That nominated beneficiary is deemed to be the<br />

owner of the land, and that trust land is added<br />

to the beneficiary’s other land holdings for a<br />

grouped assessment.<br />

• There is no scope to nominate<br />

a beneficiary as recipient of<br />

the land tax assessment for<br />

discretionary trusts in NSW.<br />

• All discretionary trusts in NSW<br />

will be assessed at the surcharge<br />

rates.<br />

• It is unknown but likely that<br />

S.A legislation will afford<br />

discretionary trusts a similar<br />

period to VIC to nominate a<br />

beneficiary and avoid surcharge<br />

rates.<br />

IS THE NOMINATED<br />

BENEFICIARY<br />

ENTITLED TO A<br />

REDUCTION?<br />

WHAT ABOUT<br />

FUTURE LAND<br />

ACQUIRED BY A<br />

TRUST (NEW OR<br />

EXISTING)?<br />

• To avoid double taxation, the nominated<br />

beneficiary may qualify for a reduction of their<br />

land tax liability to the extent land tax is paid by<br />

the trustee of the trust.<br />

• However, if the beneficiary’s land tax assessment<br />

is greater than the portion paid by the trustee, the<br />

beneficiary will remain liable to pay the balance.<br />

• Any land acquired by a trust after the 6-month<br />

period (1 January 2006) cannot nominate a<br />

beneficiary and will be subject to surcharge duty.<br />

• This includes land acquired after 1 January 2006<br />

by a trust which has a nominated beneficiary<br />

prior to 1 January 2006.<br />

• Commissioner may permit a beneficiary<br />

nominated after 1 January 2006 if such<br />

nomination replaces a prior beneficiary who has<br />

either died or otherwise revoked their nomination.<br />

The Commissioner has discretion to determine if<br />

a subsequent nomination is just and reasonable.<br />

• N/A. • S.A likely to match that of VIC.<br />

• Surcharge rates apply. • S.A likely to match that of VIC.<br />

LAND TAX RATES VICTORIA NEW SOUTH WALES SOUTH AUSTRALIA<br />

WHAT IS THE TOP<br />

MARGINAL LAND TAX<br />

RATE?<br />

• 2.25% plus a fixed charge of $24,975, being for<br />

land holdings above $3,000,000.<br />

• 2%, being for land holdings<br />

above $3,846,000.<br />

• 3.7% (at present), being for land<br />

holdings above $5,000,000.<br />

• Note: It is proposed that top<br />

marginal rate may reduce by<br />

0.1% annually from FY2021<br />

onwards until it reaches 2.9%<br />

from 1 July 2027.<br />

WHAT IS THE<br />

SURCHARGE RATE<br />

PAYABLE FOR CERTAIN<br />

TRUSTS?<br />

• Trusts pay the general rate applicable for their<br />

land holding, PLUS a surcharge rate.<br />

• The surcharge rate is a higher fixed charge plus an<br />

additional 0.375% up to $1.8m.<br />

• The surcharge begins to phase out from $1.8m,<br />

and from $3m it is the same as the general rate<br />

(which is a fixed charge plus 2.15%).<br />

• It is simply a 1.6% flat rate up to<br />

the premium land tax threshold<br />

of $3,846,000.<br />

• 2% for land value thereafter.<br />

• It is difficult to predict whether<br />

they will propose a flat surcharge<br />

rate (as per NSW) or an<br />

additional surcharge rate above<br />

the general rate (as per VIC).<br />

COMPARISON OF<br />

ANNUAL LAND TAX<br />

PAYABLE, BASED ON<br />

A COMBINED LAND<br />

HOLDING OF SAY<br />

$5,000,000.<br />

• $69,975 (noting at this level land tax is same<br />

regardless if trust or otherwise).<br />

• $72,104 (assuming no surcharge).<br />

• $84,616 (assuming surcharge for<br />

trusts).<br />

• $150,070 (based on current rates<br />

and excluding surcharge rates).<br />

• Note: land tax rates for holdings<br />

valued $1.3m to $5m will reduce<br />

from 3.7% to 2.9% from 1 July<br />

2020. Estimate of land tax<br />

payable will drop to $120,544<br />

(again excluding surcharge rates).<br />

28 THE BULLETIN <strong>September</strong> <strong>2019</strong>