Automotive Exports March 2021

Automotive Exports March 2021

Automotive Exports March 2021

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.automotive-exports.com <strong>March</strong> <strong>2021</strong>

Monthly automotive aftermarket magazine<br />

GROUP CHAIRMAN<br />

H. FERRUH ISIK<br />

PUBLISHER:<br />

İstmag Magazin Gazetecilik<br />

İç ve Dış Ticaret Ltd. Şti.<br />

Managing Editor (Responsible)<br />

Mehmet Söztutan<br />

mehmet.soztutan@img.com.tr<br />

Editor<br />

Ali Erdem<br />

ali.erdem@img.com.tr<br />

Mehmet Soztutan, Editor-in-Chief<br />

mehmet.soztutan@img.com.tr<br />

Advertising Managers<br />

Adem Saçın<br />

+90 505 577 36 42<br />

adem.sacin@img.com.tr<br />

Enes Karadayı<br />

enes.karadayi@img.com.tr<br />

Full steam ahead…<br />

Following a mandatory yet brief break due to the coronavirus outbreak, Turkish<br />

factories in western Kocaeli, Bursa and Sakarya provinces – leading industrial cities of<br />

the country, started operating, with new investments on the way thanks to increasing<br />

orders.<br />

As known, the Turkish auto parts industry has recorded a dynamic growth in line with<br />

the automotive industry. From simple components in the mid-1960s, the sector has<br />

ascended to produce high-tech components.<br />

The industry with its large capacity, wide variety of production and high standards,<br />

supports automotive industry production and the vehicles in Turkey and also has<br />

ample potential for additional exports.<br />

The leading foreign automotive parts manufacturers have established their presence<br />

in the country through joint-ventures. There has also been substantial locally-owned<br />

investments by spare parts manufacturers.<br />

The major effects are that:<br />

- Quality of production improved dramatically, especially through the establishment<br />

of quality management systems.<br />

- The industry has adapted to the EU regulations and has established an efficient<br />

and exemplary cooperation with public institutions in the transformation of the EU<br />

regulations to national regulations.<br />

- <strong>Exports</strong> have risen sharply, and Turkish production has been integrated into<br />

manufacturers’ global planning.<br />

-The export potential of the automotive parts sector, coupled with the presence of<br />

major international automotive manufacturers, has attracted an increasing number<br />

of foreign investors.<br />

Key factors which attract foreign capital inflows to Turkey mainly include the market<br />

size, consumer composition, friendly investment legislation and banking system<br />

together with other attractiveness arising from highly skilled human resources in<br />

production and management, the unsaturated domestic market with high potential,<br />

easy access to neighboring (regional) emerging markets, and low labor cost.<br />

We wish them lucrative trade for the business people operating in the automotive<br />

business.<br />

International Marketing Coordinator<br />

Ayca Sarioglu<br />

ayca.sarioglu@img.com.tr<br />

Correspondent<br />

İsmail Çakır<br />

ismail.cakir@img.com.tr<br />

Finance Manager<br />

Cuma Karaman<br />

cuma.karaman@img.com.tr<br />

Accountant<br />

Yusuf Demirkazık<br />

yusuf.demirkazik@img.com.tr<br />

Digital Assets Manager<br />

Emre Yener<br />

emre.yener@img.com.tr<br />

Web Designer<br />

Amine Nur Yılmaz<br />

amine.yilmaz@img.com.tr<br />

Technical Manager<br />

Tayfun Aydın<br />

tayfun.aydin@img.com.tr<br />

Design & Graphics<br />

Sami aktaş<br />

sami.aktas@img.com.tr<br />

Subsciption<br />

İsmail Özçelik<br />

ismail.ozcelik@img.com.tr<br />

HEAD OFFICE:<br />

ISTANBUL MAGAZINE GROUP<br />

Ihlas Media Center<br />

Merkez Mah. 29 Ekim Caddesi No: 11B/21<br />

Yenibosna Bahcelievler, Istanbul / TURKEY<br />

Tel: +90 212 454 22 22<br />

www.img.com.tr sales@img.com.tr<br />

KONYA:<br />

Metin Demir<br />

Hazım Uluşahin İş Merkezi C Blok<br />

Kat: 6 No: 603-604-605 KONYA<br />

Tel: (90.332)238 10 71 Fax: (90.332)238 01 74<br />

PRINTED BY:<br />

İHLAS GAZETECİLİK A.Ş.<br />

Merkez Mahallesi 29 Ekim Caddesi İhlas Plaza<br />

No:11 A/41 Yenibosna–Bahçelievler/ İSTANBUL<br />

Tel: 0212 454 30 00<br />

www.ihlasmatbaacilik.com<br />

automotiveexport<br />

<strong>2021</strong><br />

automotiveexports

TOGG<br />

cooperates<br />

with Farasis for<br />

li-ion battery<br />

production<br />

Turkey’s Automobile Joint Venture Group<br />

(TOGG), which is producing the country’s<br />

first fully indigenous electric car, signed<br />

a letter of intent with leading lithiumion<br />

(li-ion) battery producing company<br />

Farasis Energy for the production and use<br />

of battery cells in the full range of TOGG<br />

products, the company said in a press<br />

release.<br />

According to the agreement, battery<br />

cells will be provided by Farasis and the<br />

battery modules and packs will be jointly<br />

developed and produced in Turkey.<br />

The agreement was signed between the<br />

board chairpersons of both companies in<br />

Bilişim Vadisi (Informatics Valley) in the<br />

northwestern Kocaeli province of Turkey.<br />

TOGG CEO Gürcan Karakaş, commenting on<br />

the cooperation, said that the agreement<br />

was signed as a result of a large-scale<br />

evaluation process initiated in 2018<br />

during which more than 30 global battery<br />

suppliers have been evaluated, within the<br />

framework of confidentiality agreements<br />

(NDAs), including possible domestic<br />

collaborations.<br />

“Among them, the company that best met<br />

our technical, commercial and strategic<br />

criteria and one of the world’s leading li-Ion<br />

battery manufacturers, Farasis, has been<br />

chosen as our business partner,” he said.<br />

Karakaş noted that it is important<br />

to produce this technology, which is<br />

considered one of the most important<br />

and fundamental technologies for electric<br />

vehicles today, within the country with an<br />

important player in the sector.<br />

“TOGG’s mobility ecosystem will become<br />

an important regional player that develops<br />

technology and produces serious economic<br />

value,” he added.<br />

Li-ion batteries are a fundamental<br />

component of an electric car.<br />

In addition to supplying batteries, the<br />

two companies will also expand their<br />

cooperation through a joint venture<br />

company, which is set to combine Farasis<br />

technology with the country’s automotive<br />

industry leaders, to provide battery energy<br />

storage solutions for Turkey and the<br />

surrounding region.<br />

Rifat Hisarcıklıoğlu, chairperson of the<br />

Union of Chambers and Commodity<br />

Exchanges of Turkey (TOBB) – the umbrella<br />

organization for the TOGG, said in a<br />

statement following the signing ceremony<br />

that the joint venture established with<br />

Farasis “will be an initiative to increase<br />

the efficiency of our country’s energy<br />

system, reduce our country’s dependence<br />

on foreign energy, and accelerate our<br />

development of a clean and efficient<br />

energy system.”<br />

“This cooperation will go beyond producing<br />

electric vehicle batteries in Turkey and also<br />

improve battery R&D competencies in our<br />

country, trigger automotive manufacturers<br />

to bring their electric vehicle projects<br />

to our country and enhance the energy<br />

storage business with nonautomotive<br />

energy storage products in Farasis’ product<br />

<strong>March</strong> <strong>2021</strong> 8

portfolio,” the TOGG chairperson also said.<br />

He pointed out that the joint venture will<br />

form a basis of very important economic<br />

value as a representative of the energy<br />

company in the region, adding that the<br />

TOGG alone will lead the technological<br />

transformation in Turkey while contributing<br />

to the country’s zero-emission future.<br />

’TOGG pioneering initiative’<br />

Farasis co-founder and CEO Yu Wang, who<br />

attended the signing ceremony online due<br />

to the COVID-19 pandemic, said Turkey<br />

is one of the most important automotive<br />

markets in the region.<br />

“Partnering with the TOGG as they prepare<br />

to manufacture electric vehicles, building on<br />

the advanced and accumulated automotive<br />

know-how in Turkey, is a natural step we<br />

have taken in line with our basic strategies,”<br />

he said, noting that they “value Turkey as<br />

the next big market for electrification and<br />

thus an ideal location along with the TOGG<br />

as a greatly innovative partner doing the<br />

right work, at the right time, in the right<br />

place, to support the ambitious growth<br />

plans of our company.”<br />

“We have signed this letter of intent to<br />

meet the demands both in Turkey and in the<br />

region. We are excited that this cooperation,<br />

which started with the supply of batteries,<br />

will turn into a long-term partnership,”<br />

Wang added.<br />

The energy company’s head of European<br />

organization and business, Sebastian Wolf,<br />

who had personally taken part in the<br />

signing ceremony, noted that from the very<br />

beginning of the cooperation talks with the<br />

TOGG, they felt that both companies share<br />

the same goal of electrifying the future of<br />

individual mobility.<br />

“We expect the Turkish automotive and<br />

nonautomotive market to face substantial<br />

growth in demand for li-ion batteries,” he<br />

said, expressing excitement over partnering<br />

with the Turkish automotive joint venture.<br />

The agreement foresees a comprehensive<br />

business plan for cooperation between the<br />

two countries by 2020 end, while the official<br />

establishment of the joint venture company<br />

is set for the beginning of <strong>2021</strong>.<br />

In June 2018, five industrial giants – Anadolu<br />

Group, BMC, Kök Group, Turkcell and Zorlu<br />

Holding – joined hands with the umbrella<br />

organization TOBB to produce the TOGG to<br />

realize Turkey’s long-term aim of producing<br />

a fully Turkish-made automobile, unveiling<br />

prototypes on Dec. 27.<br />

The TOGG will produce five different models<br />

– an SUV, sedan, C-hatchback, B-SUV and<br />

B-MPV – by 2030 and own the intellectual<br />

and industrial property rights to each. Mass<br />

production of the SUV will begin in 2022,<br />

with the sedan to follow.<br />

Farasis Energy Inc., the predecessor<br />

of Farasis Energy Ltd. based in China’s<br />

Ganzhou, was founded in the U.S. in 2002,<br />

gradually extending its business across<br />

China and Europe. The company has a broad<br />

portfolio of battery solutions and global<br />

customers in different markets.<br />

Farasis is currently one of the largest<br />

manufacturers of pouch cells for the BEV<br />

market, with multiple global R&D centers<br />

and over 4,000 employees. The company<br />

has previously started programs with BAIC,<br />

one of the leading original equipment<br />

manufacturers (OEMs) of China and Daimler<br />

(Mercedes-Benz) on a range of electric<br />

vehicle battery solutions.<br />

<strong>March</strong> <strong>2021</strong><br />

10

Automechanika Frankfurt: Leading aftermarket<br />

trade fair to take place as physical event with a<br />

new online program<br />

Frankfurt am Main – This year’s<br />

Automechanika Frankfurt is taking place<br />

as a hybrid event for the first time. The<br />

primary focus will be on the physical<br />

event and all the advantages it offers.<br />

Automechanika will be supplementing<br />

these by providing all exhibitors with new<br />

opportunities to network digitally with<br />

those members of the international B2B<br />

audience who cannot travel to Frankfurt<br />

due to the pandemic. Digital features that<br />

are made available to all exhibitors free of<br />

charge maximise their reach while opening<br />

up entirely new possibilities for product<br />

presentations and communication with<br />

customers.<br />

Detlef Braun, Member of the Executive<br />

Board of Messe Frankfurt GmbH, is positive<br />

about the future: Starting in June, the<br />

Frankfurt exhibition grounds will be hosting<br />

trade fairs once again. First up is Indoor-Air,<br />

a trade fair for ventilation and air quality,<br />

and work on the content and organisation<br />

of this September’s Automechanika, our<br />

leading trade fair brand, is also in full<br />

swing. Thanks to our hygiene and safety<br />

concept, everything is in place to ensure<br />

safe events for everyone involved.<br />

The primary focus is on face-to-face<br />

business encounters. And to ensure that<br />

customers who are still unable to travel<br />

to their normal extent in September will<br />

be able to take part, the organisers are<br />

planning a hybrid format.<br />

Michael Johannes, Brand Manager<br />

of Automechanika: We want to bring<br />

industry players from different countries<br />

and continents together be it live in<br />

Frankfurt or virtually from afar to satisfy<br />

their need to network. Based on the good<br />

experience we’ve had over the past six<br />

months providing digital services for our<br />

customers not only in German-speaking<br />

countries, but also in Russia, Dubai,<br />

Shanghai and beyond, we have decided<br />

to hold Automechanika Frankfurt as a<br />

hybrid event. ACMA Automechanika New<br />

Delhi, one of 15 Automechanika trade fairs<br />

worldwide, has also opted for the hybrid<br />

format when it takes place next month.<br />

Johannes: Our entire international brand<br />

family works together closely, and we have<br />

gained valuable experience and expertise<br />

from each of our trade fair teams activities<br />

in their home countries.<br />

New digital features<br />

Automechanika Frankfurt is taking place as<br />

a physical event on the Frankfurt exhibition<br />

grounds in accordance with all applicable<br />

hygiene and protection measures. To<br />

ensure that networking will also be<br />

possible for those international visitors<br />

who are not able to travel to Frankfurt,<br />

exhibitors can take advantage of new<br />

digital features.<br />

Olaf Mußhoff, Director of Automechanika<br />

Frankfurt: Thanks to a digital matchmaking<br />

and scheduling tool and facilities for live<br />

chats and 1:1 video calls, exhibitors will be<br />

able to communicate directly with their<br />

customers and generate new leads. We<br />

are making these services available free<br />

of charge this year to the approx. 2,000<br />

exhibitors who have already confirmed that<br />

they are taking part. Exhibitors product<br />

information and company profiles will also<br />

remain online even after the event has<br />

finished. This lets us give all participating<br />

companies greater reach.<br />

Exhibitors can also present their product<br />

innovations via live stream.<br />

Michael Johannes explained: We have used<br />

these months to invest in our employees’<br />

technical skills and establish our own<br />

web studio for our customers here on the<br />

Frankfurt exhibition grounds. I am already<br />

looking forward to the videos and live<br />

streams that our exhibitors will be creating<br />

to supplement the supporting program.<br />

Events: in person in Frankfurt and as live<br />

streams online<br />

For everyone who is unable to travel<br />

to Frankfurt due to the coronavirus,<br />

Automechanika Frankfurt will be offering<br />

some of the supporting program digitally<br />

as well. This means that people can<br />

take part in a select online program that<br />

includes Collision talk, the Automechanika<br />

Innovation Awards, Automechanika<br />

Academy an event focusing on themes<br />

that are important to the future and a<br />

special program for workshops. Most of the<br />

content will also be available online in the<br />

media centre afterwards.<br />

<strong>March</strong> <strong>2021</strong> 12

Volvo phases out all cars but electric by 2030<br />

Swedish automaker Volvo said that it will<br />

make only electric vehicles by 2030, but<br />

the customers will have to purchase the<br />

cars online.<br />

The company said that it is phasing out<br />

the production of all cars with internal<br />

combustion engines – including hybrids.<br />

“There is no long-term future for cars with<br />

an internal combustion engine,” said Henrik<br />

Green, Volvo’s chief technology officer<br />

(CTO).<br />

Volvo’s announcement follows General<br />

Motors’ pledge earlier this year to make<br />

only battery-powered vehicles by 2035.<br />

Volvo also said that, while its all-electric<br />

vehicles will be sold exclusively online,<br />

dealerships will “remain a crucial part of<br />

the customer experience and will continue<br />

to be responsible for a variety of important<br />

services such as selling, preparing,<br />

delivering and servicing cars.”<br />

As part of the announcement , the Swedish<br />

automaker will unveil its second fully<br />

electric car, a follow-up to last year’s XC40<br />

Recharge, a compact SUV.<br />

Volvo said its goal is to have half of its<br />

global sales be fully electric cars by 2025,<br />

with the remaining half made up of<br />

hybrids.<br />

Automakers around the world are ramping<br />

up the production of electric vehicles<br />

as charging technology improves and<br />

governments impose stricter pollution<br />

regulations.<br />

“We are firmly committed to becoming an<br />

electric-only car maker,” Green said. “It will<br />

allow us to meet the expectations of our<br />

customers and be a part of the solution<br />

when it comes to fighting climate change.”<br />

Despite the rising number of EVs available<br />

in the U.S., fully electric vehicles accounted<br />

for less than 2% of new vehicle sales last<br />

year. Americans continue to spend record<br />

amounts on gas-powered trucks and SUVs.<br />

About 2.5 million electric vehicles were<br />

sold worldwide last year and industry<br />

analyst IHS Markit forecasts that sales will<br />

increase by 70% in <strong>2021</strong>.<br />

Volvo says it sold 661,713 cars in about 100<br />

countries worldwide in 2020. According to<br />

Autodata Corp., 107,626 of those vehicles<br />

were sold in the U.S.<br />

Founded in 1927, Volvo Cars has been<br />

owned by China’s Zhejiang Geely Holding<br />

Group since 2010.<br />

<strong>March</strong> <strong>2021</strong> 14

Japan automakers post 4.5%<br />

output slump over chip shortages<br />

The widespread chip shortages force<br />

global auto industry to cut production.<br />

Accordingly, the production at Japanese<br />

automakers including Honda Motor Co<br />

slipped 4.51% in January from last year.<br />

The country’s seven major automakers,<br />

including Toyota Motor Corp and Nissan<br />

Motor Co’s, produced a combined 2.12<br />

million vehicles last month, according to<br />

Reuters calculations based on output data<br />

released by the companies .<br />

That compared with a 24% production<br />

jump in December. The global automobile<br />

industry has been grappling with a chip<br />

shortage since the end of last year, with<br />

the former U.S. administration’s sanctions<br />

on Chinese chip factories adding to the<br />

problem. Last month, global vehicle<br />

production at Honda and Subaru fell 8.8%<br />

and 29.2%, respectively, mostly due to the<br />

semiconductor shortage.<br />

Nissan Motor Co’s global production, on<br />

the other hand, rose 2.4% in January from<br />

a year before.<br />

Honda and Nissan, Japan’s second and<br />

third-largest automakers have said this<br />

month they will sell a combined 250,000<br />

fewer cars in the current financial year.<br />

Elsewhere, automakers Suzuki<br />

Motor Corp, Mazda Motor Corp and<br />

Mitsubishi Motors Corp saw their global<br />

production drop in January. But the<br />

three automakers have said they have<br />

seen no impact of the chip shortage on<br />

production.<br />

Toyota Motor, which said earlier this<br />

month it had up to a four-month chip<br />

inventory, notched a 1.9% rise in global<br />

output, their fifth consecutive month<br />

of gain. Total global vehicle sales at<br />

Japan’s seven major automakers inched<br />

down 0.98% year-on-year to 2.06 million<br />

vehicles last month.<br />

<strong>March</strong> <strong>2021</strong> 18

Ford to spend<br />

$1B to convert<br />

German factory<br />

to make electric<br />

Ford said it would make a new electric car<br />

in Europe using Volkswagen’s mechanical<br />

framework for battery-powered vehicles<br />

and spend $1 billion to revamp a factory in<br />

Germany to make the zero-emission cars.<br />

Ford of Europe President Stewart Rowley<br />

said during an online news conference that<br />

the factory in Cologne will build an electric<br />

passenger vehicle to reach the market in<br />

mid-2023, and it may build a second one<br />

there in the future.<br />

He said it was part of Ford’s push to<br />

offer fully electric or plug-in, gas-electric<br />

versions of all passenger vehicles in Europe<br />

by 2024, with all European vehicles going<br />

full electric by 2030. The company also<br />

predicted that two-thirds of its European<br />

commercial vehicle sales will be electric or<br />

plug-in hybrids by 2030.<br />

“We are going all in on electric vehicles,”<br />

Rowley said.<br />

The agreement with Volkswagen enabling<br />

the use of the German company’s<br />

mechanical framework for electric cars<br />

– known by its German acronym MEB,<br />

or modular electric toolkit – lets Ford<br />

take advantage of Volkswagen’s massive<br />

investment in electric cars as the industry<br />

shifts toward zero-local emissions vehicles.<br />

The Volkswagen framework uses standard<br />

mechanical underpinnings such as the<br />

battery, wheels and axles that can be<br />

adjusted to manufacture different vehicle<br />

models.<br />

Carmakers in Europe must sell more<br />

electrics to meet new, lower limits on<br />

emissions of carbon dioxide, the main<br />

greenhouse gas blamed for global warming.<br />

If manufacturers don’t hold fleet average<br />

emissions below the limit, they face heavy<br />

fines. Rowley said Ford was in a position to<br />

avoid the fines going forward.<br />

Ford lost $1.28 billion last year as it dealt<br />

with a huge restructuring, a costly recall<br />

and a decline in the value of its pension<br />

fund. Meanwhile, the company said<br />

commercial vehicles are the key to growth<br />

and profitability in Europe, with new<br />

products and services through its alliance<br />

with Volkswagen and Ford’s Otosan joint<br />

venture in Turkey.<br />

The joint venture recently announced a<br />

new-generation commercial vehicle and<br />

battery assembly factory investment in<br />

Turkey’s industrial Kocaeli province.<br />

To be made through a fixed investment<br />

worth around TL 20.5 billion ($2.92), the<br />

investment will span six years.<br />

Once completed, Ford is expected<br />

to produce 210,000 new-generation<br />

commercial vehicles and 130,000 batteries<br />

per year. The Kocaeli facility, located in the<br />

Gölcük district, is the largest commercial<br />

vehicle production hub for Ford in Europe.<br />

Previously, the firm produced Turkey’s<br />

first plug-in hybrid commercial vehicle<br />

– Transit Custom Plug-In Hybrid – and<br />

was recently assigned responsibility<br />

to manufacture E-Transit, Ford’s first<br />

all-electric commercial van. The latest<br />

investment, to be made through 2025, is<br />

among the most significant Ford has made<br />

in more than a generation and “underlines<br />

our commitment to Europe and a modern<br />

future,” Rowley said in the statement.<br />

Ford said the investment in the Cologne<br />

plant, which employs just over 4,000<br />

workers, comes after its European<br />

operations returned to a profit in the<br />

fourth quarter of 2020.<br />

The investment is part of Ford’s goal of<br />

spending at least $22 billion on electric<br />

vehicles from 2016-2025.<br />

<strong>March</strong> <strong>2021</strong> 20

EU new car sales<br />

down 24% to<br />

record-low in<br />

January<br />

The January new car sales across Europe<br />

plunged by 24% year-on-year to a record<br />

low as the COVID-19 pandemic kept the<br />

market under pressure, an industry survey<br />

showed .<br />

In 2020, marked by strict lockdowns<br />

and economic upheaval, car sales in the<br />

27-member European Union slumped<br />

by some 3.0 million to under 10 million,<br />

according to the European Automobile<br />

Manufacturers’ Association (ACEA).<br />

“In January <strong>2021</strong>, the EU passenger car<br />

market posted an accelerated decline, as<br />

COVID-related restrictions continued to<br />

weigh heavily on sales across the European<br />

Union,” the ACEA said in a statement.<br />

It said 726,491 vehicles were sold in the<br />

month, down from 956,447 in January<br />

2020.<br />

Spain was the worst hit, with a fall of<br />

51.5%, followed by Germany down 31.1%<br />

and Belgium 27.2%.<br />

France fared comparatively better, with a<br />

drop of 5.8% while Italy was down 14%.<br />

Sweden managed an increase of 22.5%.<br />

Outside the EU, sales in the UK plummeted<br />

39.5%, the worst performance since 1970,<br />

the ACEA noted.<br />

By maker, Volkswagen group sales tumbled<br />

26.8% in January, with Stellantis – formerly<br />

Fiat-Peugeot – down 26.1% as Renault lost<br />

21.6%. German giant Volkswagen, once<br />

the best global auto seller, has already<br />

lost its top place to Japanese Toyota with<br />

the effect of declining sales in 2020. The<br />

pandemic year, meanwhile, saw Turkey<br />

jumping in overall auto sales rank in<br />

Europe as the only country with sales in<br />

positive territory. Turkey saw the sales<br />

jumping 57.5% year-on-year to 610,109<br />

units in 2020, the data by the <strong>Automotive</strong><br />

Manufacturers Association (OSD) showed<br />

earlier in January<br />

<strong>March</strong> <strong>2021</strong> 22

managed to conclude innovation process<br />

of LPG kits whose R&D studies lasted 3<br />

years and that they minimized the petrol<br />

consumption on cars equipped with LPG<br />

systems down to %2. “New generation<br />

ECU (Electronic Control Unit) that we’ve<br />

developed is manufactured to function<br />

in coherence with the automobile’s own<br />

software. The software on our kit runs<br />

like automobile’s authentic software, not<br />

like an outside interference. Additionally,<br />

128 different electronic control systems<br />

monitor the overall operation. As for the<br />

petrol consumption, it’s down to max<br />

%2 which is ideal and probably a record<br />

low consumption. Master Direct also<br />

operates efficiently on automobiles that<br />

are powered with tuning systems. I’d like<br />

to acknowledge Cangas R&D team for their<br />

outstanding endeavors and our managerial<br />

team for their vision and endless<br />

contribution. I sincerely wish it brings good<br />

luck and contributes to whoever is involved<br />

in our sector.”<br />

Okan NIGDELI<br />

Cangas R&D Tech. Manager<br />

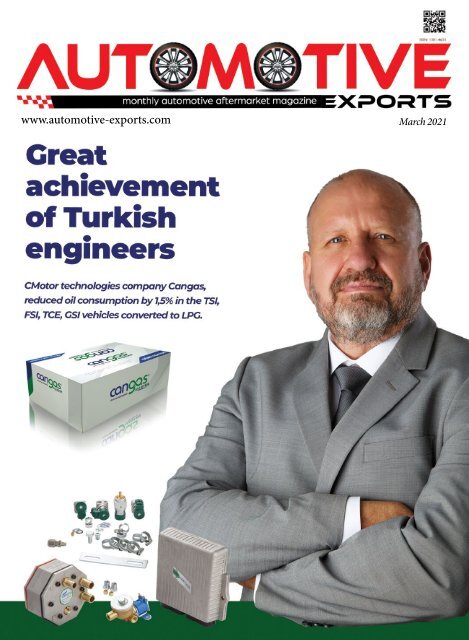

Striking accomplishment by<br />

Turkish engineers<br />

Cangas, an engine tech company has minimized petrol consumption on<br />

TSI, FSI, TCE, GSI engine cars -equipped with LPG conversion - around<br />

%2. Delivered to be on the dealers inventory with the registered label,<br />

‘Master Direct’, the kit offers pioneering production and software<br />

specifications.<br />

Drawbacks are History!<br />

Developed as a result of a two-year R&D<br />

effort, Cangas Master Direct Kit shines<br />

with unequalled software. The LPG ECU is<br />

checking 128 functions and operates with<br />

the automobile’s own system as one.<br />

This very system is not all about software<br />

adaptation; it offers various other<br />

remarkable advantages which contribute so<br />

much to users’ budget.<br />

The data collected out of performance tests<br />

displays that average petrol consumption<br />

of cars, equipped with Master Direct<br />

does not exceed %2, which we believe is<br />

legendary among other LPG kits selling at<br />

the market!<br />

The performance results are amazing.<br />

It operates quite satisfactorily up to an<br />

Headquartered in İzmir and specialized<br />

to manufacture sequential LPG systems<br />

and spare parts, Cangas LPG Technologies<br />

jump-started <strong>2021</strong> with their new, cuttingedge<br />

tech product, ‘Master Direct’.<br />

Excitingly welcomed by the relevant sector,<br />

Master Direct, applicable to TSI, FSI, TCE,<br />

GSI engined cars, manufactured in 2015<br />

and later is successfully continuing. There’s<br />

a growing demand to the kit both from<br />

domestic and international markets as it<br />

lowers the petrol consumption around<br />

%2. Info rming us of the new product,<br />

registered as ‘Master Direct’, Okan<br />

Niğdeli, the R&D manager at Cangas<br />

Technologies said they successfully<br />

<strong>March</strong> <strong>2021</strong> 24

average of 6500 rpm without cutting off gas<br />

usage. One doesn’t have to worry about<br />

challenging roads where one needs power<br />

and performance.<br />

Master Direct, whose parts have gone<br />

through countless numbers of tests clearly<br />

eliminates problems like engine knocking<br />

or flood. It stands out by a landslide with its<br />

perfect functioning in combustion chamber.<br />

Master Direct Kit will be supplied to the<br />

Dealers Before the Year is Out!<br />

More than 100.000 km test drives with<br />

over 30 automobiles prove that Master<br />

Direct is ready to do its role at the market<br />

as the flagship of Cangas.<br />

The mass-production of Master Direct,<br />

appraised highly according to the tests, will<br />

be on the shelves at the Cangas dealers<br />

before the year is out.<br />

This is not the first high-caliber<br />

success of Cangas!<br />

Cangas has already realized<br />

yet another pioneering<br />

accomplishment in the world.<br />

They’ve developed an electronic<br />

smart kit that enables both single<br />

injection cars and those with<br />

carburetor to operate with top<br />

performance possible .It means<br />

its a unique system that converts<br />

carburator cars to sequential<br />

System.<br />

Accomplishment as such by Turkish<br />

engineers is a clear indication that there<br />

will be way more innovative contributions<br />

to the sector in the days to come.<br />

Informing us of their recently launched<br />

products, registered as ‘MIC 24’ and MIC<br />

28, Okan Niğdeli, the R&D manager at<br />

Cangas Technologies said they had worked<br />

roughly about 3 years on 4 4 cylinder<br />

engine applications with MIC 24 and on 6-8<br />

cc ones with MIC 28. “Last year, we applied<br />

preliminary installations to test the new<br />

products, which ended up in %98 success.<br />

That we obtained such a good result<br />

excited and made us proud so much. Upon<br />

heavy demand from customers through<br />

our 250 dealers and installation teams<br />

nationwide, we escalated the production<br />

which is %100 domestic for the year 2020.<br />

We are proud and happy to have launched<br />

such kits developed by our own R&D team,<br />

for which we see there is a great demand<br />

from the relevant market. Apparently,<br />

we reap the fruits of our constant R&D<br />

investments.”<br />

Specifications of MIC 24<br />

MIC 24 kit of Cangas features pioneering<br />

specs. It contains its own electronic control<br />

units (ECU). Being the achivement of Turkish<br />

engineers, the innovation is now a hope for<br />

single injection automobiles, mechanical<br />

injection automobiles and those with<br />

carburetor.<br />

The kit features following advantageous<br />

specifications: It maintains the emission<br />

level regardless of how much the air filter<br />

gets contaminated. It eliminates repulsion<br />

on mechanical and mono point injection<br />

cars. It complies with gasolina standards in<br />

terms of engine performance with the ability<br />

to get stabilized at high revs. Additionally,<br />

compared to mixer systems, it provides more<br />

than %10 less gas consumption. Injection<br />

of LPG into the engine is supplied by engine<br />

compression itself. Excessive accumulation<br />

of LPG, in the meantime, is prevented,<br />

thanks to the technical specs of MIC 24.<br />

Road analyses, engine performances, gas<br />

savings and satisfaction surveys carried<br />

out through test drives with over 2000<br />

automobiles powered by MIC 24 sequential<br />

LPG system proved the realization of 40%<br />

to 45% less gas consumption compared to<br />

petrol consumption.<br />

25<br />

<strong>March</strong> <strong>2021</strong>

<strong>Exports</strong> at<br />

$169.5B for<br />

pandemic-hit<br />

2020<br />

In 2020, when the COVID-19 outbreak<br />

ravaged world economies and battered<br />

supply chains, particularly in Turkey’s main<br />

export destination, Europe, the country’s<br />

foreign sales slipped around 6.3% on an<br />

annual basis to $169.48 billion (TL 1.24<br />

trillion), according to official data released.<br />

Turkey’s imports last year rose 4.3% to<br />

$219.4 billion, bringing the foreign trade<br />

deficit to $49.9 billion, an increase of<br />

69.1%, the country’s statistical authority,<br />

the Turkish Statistical Institute (TurkStat)<br />

said.<br />

The export-import coverage ratio was<br />

77.2% in 2020, down from 86% the<br />

previous year. Among sectors, the<br />

manufacturing sector was the best<br />

performer with a share of 94.3% in overall<br />

exports in 2020.<br />

Meanwhile, the ratio of intermediate goods<br />

in the year was 74.3%.<br />

In 2020, Germany was Turkey’s main<br />

partner in foreign trade, with $15.97 billion<br />

in exports and $21.7 billion in imports.<br />

Country-to-country trade balances showed<br />

that Turkey had its largest deficit with<br />

China – nearly $20.15 billion. Turkey’s<br />

exports to European Union countries last<br />

year were $69.96 billion, down 8.8%, while<br />

imports were $73.27 billion, up 7.9%.<br />

The share of high-tech products was 3.4%<br />

of the country’s manufacturing exports for<br />

the year, down from 3.5% on a yearly basis.<br />

Foreign trade statistics are calculated using<br />

two different methods: the special and the<br />

general trade systems.<br />

The general trade system is a wider<br />

concept, including customs warehouses, all<br />

types of free zones, free circulation areas<br />

and premises for inward processing.<br />

According to the special trade system,<br />

exports were $160.5 billion in the year and<br />

imports $209.4 billion.<br />

Meanwhile, Turkey’s exports hit an all-time<br />

monthly high of $17.84 billion in December.<br />

The foreign sales of the country in the<br />

month in question saw a 16% rise, while<br />

imports were up 11.6% at $22.38 billion.<br />

The deficit last month was $4.53 billion,<br />

with a 3% yearly increase.<br />

The headline figure, despite the severe<br />

economic contraction and shrinking in<br />

foreign demand in the country’s main<br />

export markets, especially the EU, is the<br />

exporters’ success, Trade Minister Ruhsar<br />

Pekcan said at the time, congratulating<br />

exporters for bearing a hard year.<br />

Before the pandemic hit, Turkish exports<br />

enjoyed their best January ever with a 13%<br />

increase earlier last year, maintaining the<br />

upward trend posted in 2019. <strong>Exports</strong> were<br />

up 6.1% on an annual basis to $14.8 billion<br />

in January 2020, according to the Turkish<br />

Exporters Assembly’s (TIM) statements.<br />

<strong>March</strong> <strong>2021</strong> 26

Turkey’s<br />

January auto<br />

sales up 60%<br />

Passenger and light commercial vehicle<br />

sales in Turkey continued to increase<br />

in the first month of the new year, just<br />

they did last year, despite the pandemic.<br />

Accordingly, the sales surged 60.3%<br />

annually in January, data released by an<br />

industry group said.<br />

A total of 43,728 vehicles were sold<br />

across Turkey last month, the <strong>Automotive</strong><br />

Distributors’ Association (ODD) said in a<br />

statement. Passenger cars accounted for<br />

80% or 35,358 of the sales, rising 60.6%<br />

during the same period.<br />

As many as 8,370 light commercial vehicles<br />

were sold this January, up 59.2% from the<br />

same month last year.<br />

The statement also reported that the<br />

automotive market last month rose 35.8%<br />

compared with the average 10-year<br />

January sales.<br />

Last year, when the coronavirus pandemic<br />

brought unprecedented obstacles to the<br />

sector, from restrictions to the supply gluts,<br />

the Turkish auto industry managed to end<br />

the year on a positive note in contrast to<br />

many European countries.<br />

Sales of passenger cars and light<br />

commercial vehicles jumped 61.3%<br />

year-on-year in 2020 to 772,788 vehicles,<br />

according to the ODD data published<br />

earlier in January.<br />

The industry worldwide was ravaged by<br />

the outbreak, with sales plummeting<br />

after governments worldwide imposed<br />

lockdowns to stem the spread of the<br />

virus, while the struggle for the European<br />

countries continued throughout the year. In<br />

Europe, sales were declining every month<br />

except in September.<br />

Turkey ranked sixth in Europe in auto sales,<br />

up from the ninth rank in 2019, according<br />

to the figures which were published before<br />

the European December sales data.<br />

According to the latest data by the<br />

European Automobile Manufacturers<br />

Association (ACEA), which included the<br />

December data, European car sales<br />

plunged by nearly a quarter last year. New<br />

car registrations sank by 23.7%, or 3 million<br />

vehicles, to 9.9 million units.<br />

All major markets recorded double-digit<br />

declines, down 32.3% in Spain, 28% in Italy<br />

and 25% in France. Germany suffered a<br />

more contained 19% drop.<br />

December sales were just 3.3% lower than<br />

the previous year, but performance varied<br />

drastically between markets. Italy and<br />

Spain both had double-digit dips. Germany<br />

gained 10% while Spain was flat.<br />

Special consumption tax up<br />

Turkey has raised the special consumption<br />

tax (ÖTV) level on electric motor vehicles<br />

only from between 3%-15% to 10%-<br />

60%, according to a presidential decision<br />

published in the country’s Official Gazette.<br />

It said that for vehicles with an engine<br />

power of up to 85 kilowatts (kW), the tax<br />

will be raised to 10% from 3%, for vehicles<br />

with a power of between 85-120 kW to<br />

25% from 7% and for vehicles with a power<br />

of over 120 kW to 60% from 15%.<br />

<strong>March</strong> <strong>2021</strong> 30

Volkswagen, Microsoft cement<br />

partnership on autonomous<br />

vehicles<br />

Cementing a 2018 partnership, German<br />

auto giant Volkswagen and U.S. tech major<br />

Microsoft said they were joining forces<br />

to develop autonomous vehicle driving<br />

systems.<br />

Volkswagen said it aims to speed up the<br />

development of such connected systems,<br />

which are increasingly becoming the norm<br />

in the auto industry as it transitions to<br />

electric vehicles. “This is the next step<br />

in our strategic partnership,” Microsoft<br />

director Scott Guthrie said.<br />

The companies gave no information about<br />

the financial or contractual details of the<br />

accord. Volkswagen and Microsoft have<br />

cooperated since 2018 on creating a Cloud<br />

platform for connected vehicles.<br />

The first trials of the planned system are<br />

due later this year, with rollout envisaged<br />

in 2022, a statement said.<br />

Volkswagen plans to invest some 27 billion<br />

euros ($32 billion) in this field by 2025.<br />

Volkswagen’s “Car.Software” unit set up<br />

last year will have some 11,000 people<br />

working on its “VW.OS” operating system<br />

which will connect cars over the Cloud.<br />

Other tech companies like Apple have<br />

already announced plans for autonomous<br />

vehicles, while the company is said to be<br />

testing its vehicles now.<br />

The German group, like its peers, is finding<br />

that the shift into electric cars is as much<br />

if not more of a computing challenge<br />

than one of manufacturing, leading to an<br />

increasing number of such tie-ups.<br />

General Motors has just signed a similar<br />

deal with Microsoft to speed up its<br />

introduction of autonomous vehicles while<br />

France’s Renault established a partnership<br />

with Google last year.<br />

<strong>March</strong> <strong>2021</strong> 32

Turkey’s exports<br />

hit all-time<br />

monthly high<br />

for 3rd straight<br />

month<br />

Turkish exports have hit an all-time<br />

monthly high for the third consecutive<br />

month in February, the country’s trade<br />

minister announced.<br />

Sales surged 9.6% year-on-year to over<br />

$16 billion (TL 117.23 billion) in the month,<br />

Ruhsar Pekcan told a meeting in the capital<br />

Ankara.<br />

Turkey made a flying start to <strong>2021</strong> thanks<br />

to its strong performance for the second<br />

month in a row, Pekcan said.<br />

Imports rose 9.8% to $19.4 billion, bringing<br />

the trade deficit to $3.4 billion, the data<br />

showed.The export-to-import coverage<br />

ratio was 82.7% this February, the minister<br />

noted.<br />

“In the first two months of this year the<br />

ratio rose to 82.9% from 79.5 a year ago,”<br />

she added. The data follows the highest<br />

monthly figures in January and December<br />

as sales surpassed $15 billion and $17.84<br />

billion, respectively.<br />

Also addressing the meeting, Turkish<br />

Exporters’ Assembly (TIM) Chairperson<br />

Ismail Gülle said now that the country has<br />

renewed records in the first two months<br />

of the year, they believe a year-end target<br />

of $184 billion could be achieved and even<br />

exceeded.<br />

Pekcan recalled that Turkey joined China to<br />

become the only two Group of 20 countries<br />

that managed to expand last year despite<br />

the coronavirus pandemic.<br />

The economy grew a less-than-expected<br />

but still strong 5.9% in the fourth quarter<br />

and 1.8% in 2020 as a whole, the official<br />

data showed.<br />

The outbreak led to a 6.26% drop in 2020<br />

exports as Turkey closed the year with<br />

$169.5 billion in foreign sales, exceeding<br />

the target of $165.9 billion in the mediumterm<br />

program.<br />

Imports were up 4.3% to reach $219.4<br />

billion. The trade deficit widened by<br />

69.12% to $49.9 billion last year.<br />

Rising sales to EU<br />

The exports rebounded rapidly in the third<br />

and fourth quarters last year, Pekcan said,<br />

recalling that sales increased by 6.7% in the<br />

October-December period to $51.3 billion,<br />

exceeding the $50 billion threshold for the<br />

first time.<br />

The country took a 3.7% share in the<br />

<strong>March</strong> <strong>2021</strong> 36

European Union’s total imports in 2020,<br />

according to EU statistical body Eurostat.<br />

This, Pekcan said, enabled Turkey to<br />

outperform Norway, South Korea and<br />

Japan to rank sixth in the bloc’s overall<br />

imports.<br />

“Since 2015, Turkey has been the only<br />

country to increase its share in EU imports<br />

for five consecutive years,” the minister<br />

said.<br />

The government is closely monitoring all<br />

factors, including excessive increases in raw<br />

material prices caused by the pandemic,<br />

difficulties and imbalances observed in<br />

logistics and volatility in international<br />

financial markets, Pekcan said, stressing<br />

that steps would be taken in favor of<br />

producers and exporters within this<br />

framework.<br />

She said the steps to be soon taken within<br />

the scope of the government’s reform<br />

process would help strengthen investments<br />

and production, also boosting exports.<br />

“In the coming periods, we will work<br />

together with all our exporters to increase<br />

and deepen our share in all our target<br />

markets, especially the EU, with more<br />

domestic production and more valueadded<br />

exports,” Pekcan noted.<br />

TIM’s Gülle said they conduced 55 virtual<br />

trade delegations and 10 virtual fairs in 50<br />

countries since May last year, looking to<br />

continue with face-to-face delegations as of<br />

the summer months.<br />

Works on logistics centers near completion<br />

Works on the logistics centers to be<br />

established abroad to facilitate exporters’<br />

access to other markets is approaching<br />

completion, he noted.<br />

“We plan to establish these logistics<br />

centers in three cities in the United States<br />

and Africa’s Ghana. Bureaucratically, we<br />

have brought the documents to the final<br />

stage,” Gülle informed.<br />

“I believe that these logistics centers will<br />

double our exports to the regions where<br />

they are established and will support our<br />

exporters in distant markets.”<br />

Some 1,538 firms have made their first<br />

exports ever in February, Gülle said,<br />

carrying out around $70.48 million worth<br />

of sales. A total of 40,616 companies made<br />

exports in the month.<br />

Below are details of data on February<br />

exports:<br />

•Germany was Turkey’s top market in<br />

February as it received nearly $1.5 billion<br />

worth of goods<br />

•The U.K. and U.S. followed with $968<br />

million and $917 million, respectively<br />

•22 sectors increased their exports<br />

compared to a year earlier<br />

•The automotive industry again ranked first<br />

with around $2.54 billion worth of exports<br />

•Chemicals and ready-to-wear sectors<br />

followed with $1.68 billion and $1.52<br />

billion, respectively<br />

•The mining sector saw the highest<br />

increase in sales with 47% to $415 million<br />

•The defense and aviation sector followed<br />

with a 34% increase to $233.2 million<br />

•Sales to the U.S. were up $177 million in<br />

the month, said Gülle. Other noteworthy<br />

rises occurred in exports to the United Arab<br />

Emirates (UAE) and Germany with $175<br />

million and $159 million.<br />

<strong>Exports</strong> to the EU, the country’s largest<br />

market, surged by 11.8%, reaching a<br />

volume of $6.87 billion and holding a<br />

42.9% share, he noted.<br />

Among others, some $2.75 billion worth<br />

of exports were made to Middle East<br />

countries, while the African continent<br />

received $1.57 billion worth of Turkish<br />

goods. Around $1.3 billion worth of sales<br />

were made to Far East countries, while<br />

exports to North America amounted to<br />

$989 million, Gülle added.<br />

37<br />

<strong>March</strong> <strong>2021</strong>

Turkey sold<br />

buses to 99<br />

countries in<br />

2020<br />

Buses, minibuses and midibuses produced<br />

in Turkey were sold to 99 different<br />

countries across the world in 2020. The<br />

exports of the vehicles have generated<br />

over $1.5 billion (TL 11.12 billion).<br />

In 2020, the highest amount of exports<br />

was made to European countries in the<br />

bus, minibus and midibus group. France<br />

was the biggest market for Turkish-made<br />

buses with a nearly 18% share, worth over<br />

$286.7 million.<br />

Germany, which ranked second, imported<br />

over $264.7 million worth of vehicles,<br />

while Italy ranked third with $131.9<br />

million. The shares of the two countries<br />

were over 17% and 8%, respectively.<br />

<strong>Exports</strong> of $683.4 million to these three<br />

countries accounted for almost 44.91% of<br />

Turkey’s total bus, minibus and midibus<br />

sales last year. Morocco, meanwhile, was<br />

also among the countries that increased<br />

its imports of such vehicles from Turkey<br />

in 2020. <strong>Exports</strong> to the country, which<br />

ranked fourth, jumped by 66% year-onyear,<br />

from $45.3 million in 2019 to $75.2<br />

million. Georgia ranked fifth with an<br />

increase of 96%, hitting $51.9 million.<br />

Sweden, Saudi Arabia and Egypt also saw<br />

a noteworthy increase in bus, minibus and<br />

midibus imports from Turkey.<br />

<strong>Exports</strong> to Sweden also increased by<br />

292% compared to 2019, from $13 million<br />

to $37.9 million, while exports to Saudi<br />

Arabia also increased by 348% from $6.4<br />

million to $22.3 million.<br />

Sales to Egypt, in the meantime, hit $13.6<br />

million in 2020, a significant jump from<br />

2019’s $164,000.<br />

The Turkish automotive sector also sold<br />

such vehicles to Libya, Rwanda, Uruguay,<br />

Madagascar, Congo, Malaysia and Guinea<br />

for the first time in 2020.<br />

<strong>March</strong> <strong>2021</strong> 40

Car sales in<br />

pandemichit<br />

2020 help<br />

Turkey rank 6th<br />

in Europe<br />

The pandemic year of 2020 saw Turkey<br />

jumping in overall auto sales rank in Europe<br />

as the only country with sales in positive<br />

territory.<br />

Measures to restrict the coronavirus<br />

pandemic hit sales in most of the<br />

continent’s largest markets, bringing the<br />

biggest yearly drop in car demand since<br />

records began.<br />

Car sales in the European Union, Britain<br />

and the countries of the European Free<br />

Trade Association (EFTA) fell 24.35% yearon-year<br />

to 11.96 million in 2020, according<br />

to data from the market evaluation<br />

report by the Automobile Manufacturers’<br />

Association (ACEA).<br />

Some 15.8 million vehicles were sold over<br />

the course of 2019, according to the data.<br />

In contrast, Turkey saw the sales jumping<br />

57.5% year-on-year to 610,109 units, the<br />

data by the <strong>Automotive</strong> Manufacturers<br />

Association (OSD) showed.<br />

The figure also helped the country jump<br />

to rank sixth in Europe, up from its rank as<br />

ninth in 2019.<br />

Croatia posted the highest yearly drop with<br />

42.8%, followed by Bulgaria and Portugal<br />

with 36.8% and 35%, respectively.<br />

Spain posted the biggest drops among<br />

Europe’s largest markets with sales falling<br />

32.3%, while Germany reported a narrower<br />

fall of 19.1%.<br />

Sales in Europe’s other major markets such<br />

as France and the U.K. were down 25.5%<br />

and 29.7%, respectively.<br />

Italy fell by 27.9% year-on-year, while sales<br />

in the Netherlands and Belgium dropped by<br />

19.5% and 21.5%. Czech dropped by 18.8%<br />

and Poland was down by 22.9%.<br />

On a monthly basis, European sales in<br />

December declined for the third month in<br />

a row.<br />

New car registrations dropped by 3.7%<br />

year-on-year in the month to 1.215 million<br />

vehicles, the ACEA data showed. The same<br />

figure was 1.261 million in 2019.<br />

Sales in Europe’s five largest markets<br />

posted different results. Registrations in<br />

the United Kingdom, France and Italy fell<br />

by 10.9%, 11.8% and 14.9%, respectively,<br />

while Germany recorded a rise of 9.9% and<br />

sales in Spain remained unchanged yearon-year.<br />

Croatia again posted the highest drop with<br />

49.5%, followed by Slovenia and Bulgaria<br />

with 47.6% and 40.3%, respectively.<br />

Ireland saw a skyrocketing rise of 168.3%<br />

year-on-year in the month. Sales in Norway<br />

and Denmark were also up by 82.8% and<br />

46.8%, respectively.<br />

<strong>March</strong> <strong>2021</strong> 42

Turkish economy is expected to grow 6% in <strong>2021</strong><br />

Turkey’s economy is expected to grow<br />

by about 6% in <strong>2021</strong>, according to the<br />

International Monetary Fund-IMF. The<br />

6% gross domestic product (GDP) growth<br />

projection in the preliminary findings of the<br />

IMF’s annual review of Turkey’s economy<br />

compared with a previous <strong>2021</strong> growth<br />

projection of 5% for the country issued<br />

as part of the IMF’s last World Economic<br />

Outlook.<br />

The spread of COVID-19 vaccines will<br />

power a stronger global economic recovery<br />

in <strong>2021</strong>, it forecast. After sinking 3.5% in<br />

2020, the worst year since World War II,<br />

the global economy will grow 5.5% this<br />

year, the 190-country lending organization<br />

predicted. The new figure for <strong>2021</strong> is an<br />

upgrade from the 5.2% expansion the IMF<br />

forecast in October and would mark the<br />

fastest year of global growth since the 2010<br />

snapback from the financial crisis.<br />

The vaccines should contain the spread<br />

of the virus and allow governments<br />

around the world to ease lockdowns and<br />

encourage a return to normal economic<br />

activity.<br />

But the IMF also says economies worldwide<br />

will need support from their governments<br />

to offset the damage from the pandemic<br />

and warns that coronavirus mutations<br />

could cloud the outlook for global health<br />

and economic growth.<br />

The positive forecast supported the Turkish<br />

lira, which fared better than most of its<br />

peers in Europe, the Middle East and Africa<br />

(EMEA), trading 0.2% higher to the dollar.<br />

Turkey’s GDP soared to a more-thanexpected<br />

6.7% growth rate in the third<br />

quarter after contracting by 9.9% in the<br />

previous three months when lockdowns<br />

were imposed to curb the initial COVID-19<br />

wave.<br />

According to the new economic program,<br />

announced last September, Ankara projects<br />

2020 growth to come in at 0.3%. It expects<br />

a rebound of 5.8% in <strong>2021</strong>.<br />

The IMF said the more optimistic forecast<br />

is due to the rollout of a vaccine, recovery<br />

of trading partner growth and carryover of<br />

positive momentum at the end of 2020.<br />

Turkey received 6.5 million further doses of<br />

the COVID-19 vaccine developed by China’s<br />

Sinovac Biotech, allowing a nationwide<br />

rollout to continue.<br />

The new shipment added to an initial<br />

consignment of 3 million doses, which<br />

Turkey received nearly a month ago. It has<br />

so far vaccinated more than 1.3 million<br />

people, mostly health workers and elderly<br />

people, according to Health Ministry data.<br />

The latest shipment is part of a second<br />

consignment, which will total 10 million<br />

doses.<br />

About 600,000 people were vaccinated<br />

in just two days when the vaccine rollout<br />

began in mid-January, but the pace slowed<br />

as it moved beyond health care workers.<br />

Measures to combat the spread of the<br />

coronavirus in spring last year led to a<br />

<strong>March</strong> <strong>2021</strong> 44

sharp slowdown in Turkey’s economy in<br />

the second quarter, and the government<br />

has taken a series of measures to ease the<br />

burden and revive activity.<br />

Rising COVID-19 cases throughout the<br />

country prompted the government to<br />

reimpose measures as of November as<br />

it adopted lockdowns for weekends and<br />

nighttime curfews on weekdays.<br />

As part of the relief package announced in<br />

spring last year, the government provided<br />

financial support to cushion the economic<br />

fallout from the outbreak. It had slashed<br />

taxes for hard-hit sectors and unlocked<br />

funding for workers.<br />

President Recep Tayyip Erdoğan announced<br />

the grant and rental support for businesses<br />

and promised to continue discounts for<br />

value-added taxes.<br />

Although the outbreak caused a decline in<br />

economic activity and employment in the<br />

second quarter of 2020, the IMF said the<br />

initial policy response to the pandemic led to<br />

a sharp rebound in the GDP.<br />

“The early stimulus relied primarily on<br />

rapid monetary and credit expansion,<br />

including policy rate cuts, cheap and rapid<br />

lending growth by state-owned banks, and<br />

administrative and regulatory measures<br />

designed to boost credit,” the statement<br />

said. Turkey implemented direct fiscal<br />

measures of around 2.5% of GDP in 2020,<br />

mainly in the form of tax deferrals and<br />

employment support, but more “targeted<br />

and temporary” fiscal support was needed,<br />

the IMF said. The IMF emphasized that these<br />

measures helped the economic activity<br />

rebound strongly in the third quarter to<br />

above pre-pandemic levels in Turkey, which<br />

is among the few countries estimated to<br />

have posted positive overall growth in 2020.<br />

“Turkey has some fiscal space to expand<br />

support in <strong>2021</strong>, possibly in the order of<br />

1% of GDP. Additional social transfers to<br />

vulnerable households and informal workers<br />

would help support those most affected by<br />

the pandemic,” it noted.<br />

“Despite some fiscal space, direct fiscal<br />

measures amounted to just 2.5% of GDP,<br />

mainly in the form of tax deferrals, but also<br />

including employment support,” it added.<br />

“Employment is expected to continue to<br />

recover slowly as the pandemic subsides,”<br />

the IMF said.<br />

The country’s unemployment rate stood<br />

at 12.7% in October, according to official<br />

data. The IMF staff projected that Turkey’s<br />

inflation would fall modestly by the end of<br />

<strong>2021</strong> but would remain well above target.<br />

The annual inflation increased to 14.6% in<br />

November, according to the official data.<br />

Month-on-month, consumer prices rose<br />

1.25% in the month. The higher-thanexpected<br />

rise in consumer prices has kept<br />

the pressure on the central bank to maintain<br />

a tight monetary policy. The Central Bank<br />

of the Republic of Turkey (CBRT) has hiked<br />

interest rates to 17% from 10.25% since<br />

November and promised even tighter<br />

policy if needed as he vowed to decisively<br />

battle inflation. On the other hand, Turkey’s<br />

current account deficit is expected to fall to<br />

3.5% of GDP, in large part, reflecting lower<br />

gold imports and a modest recovery of<br />

tourism, according to the IMF.<br />

45 <strong>March</strong> <strong>2021</strong>

Turkey’s<br />

economy<br />

outperforms<br />

peers, grows by<br />

1.8% in 2020<br />

Turkey’s economy grew a less-thanexpected<br />

but still robust 5.9% in the fourth<br />

quarter of 2020 and 1.8% in the year as a<br />

whole, data showed, emerging as one of<br />

only a few globally to skirt a contraction<br />

amid the coronavirus pandemic.<br />

Propelled by a burst of credit in mid-2020,<br />

the fourth-quarter gross domestic product<br />

(GDP) grew 1.7% from the previous<br />

quarter on a seasonally and calendaradjusted<br />

basis, the Turkish Statistical<br />

Institute (TurkStat) said.<br />

A surge in GDP growth in the second<br />

half of the year that surpassed Turkey’s<br />

potential rate was driven by a near<br />

doubling of lending by state banks to face<br />

down the initial virus wave.<br />

The Turkish lira firmed to 7.3175 against<br />

the U.S. dollar after the GDP data and was<br />

1.5% stronger than close.<br />

Commenting on the data, Treasury and<br />

Finance Minister Lütfi Elvan pointed out<br />

that Turkey was one of the few countries<br />

to end 2020 with positive growth.<br />

The country outperformed all emerging<br />

market (EM) and G-20 peers except China,<br />

which grew 6.5% in the last quarter and<br />

2.3% in the whole of 2020.<br />

World economies mostly contracted<br />

and tumbled into recessions last year,<br />

with emerging and developing nations<br />

shrinking by some 2.4%, according to the<br />

International Monetary Fund (IMF).<br />

Only Turkey, China and Egypt were among<br />

those seen growing, the IMF said.<br />

In a Reuters poll, GDP was forecast to have<br />

expanded 7.1% year-on-year in the fourth<br />

quarter, despite new curfews and curbs<br />

on the service sector to address a second<br />

COVID-19 wave, and 2.3% for the whole<br />

year.<br />

The median of 20 forecasts in a Bloomberg<br />

survey was for a 6.9% expansion.<br />

A panel of 21 economists polled by<br />

Anadolu Agency (AA) had projected a 2.2%<br />

growth. Last year, the government had<br />

forecast GDP growth of 0.3%.<br />

Economists’ forecast for the last quarter<br />

was 7% on average, ranging from 5% to<br />

8.3%.<br />

Below are highlights of the GDP report<br />

released by TurkStat:<br />

•Financial sector activity drove growth<br />

in 2020, surging 21.4%, the TurkStat data<br />

showed. The agricultural sector rose 4.8%<br />

while the industry sector was up 2%.<br />

<strong>March</strong> <strong>2021</strong> 46

•Among the two hit hardest by the<br />

outbreak, service sectors dropped by 4.3%<br />

and the construction industry was down<br />

3.5%.<br />

•The expansion was also driven by a rise<br />

in household consumption, estimated<br />

to account for about two-thirds of the<br />

economy, which jumped 8% year-on-year.<br />

•Gross fixed capital formation, a measure<br />

of investment by businesses, was up an<br />

annual 10.3%. Government spending<br />

increased 6.6%, its largest annual gain since<br />

the first quarter of 2019.<br />

•Turkey’s GDP in current prices dropped to<br />

some $717.1 billion last year, down from<br />

$760.8 billion, the data showed.<br />

•The GDP per capita fell to $8,599 last year<br />

from $9,127 in 2019. It was $10,597 in<br />

2017.<br />

•The economy registered a growth of 6.3%<br />

in the third quarter of last year after a<br />

contraction of 10.3% in the second quarter<br />

as the coronavirus’s impact started to be<br />

felt in earnest. The GDP had expanded<br />

4.5% in the first quarter. An infographic<br />

showing Turkey’s quarterly GDP growth.<br />

(By Ayla Coşkun / Daily Sabah)<br />

Faced with a second COVID-19 wave, the<br />

government imposed new measures at<br />

the end of last year but sought to free up<br />

supply and production chains.<br />

Ankara is considering lifting some of the<br />

latest virus restrictions as of this month.<br />

President Recep Tayyip Erdoğan was due<br />

to announce gradual normalization steps<br />

following the Cabinet meeting in the capital<br />

Ankara.<br />

Analysts say the economy should expand<br />

by roughly 5% this year despite the tight<br />

monetary policy.The Central Bank of the<br />

Republic of Turkey (CBRT), which has<br />

repeatedly said it would target inflation<br />

more strongly under new Governor Naci<br />

Ağbal, has raised its policy rate by 675<br />

basis points to 17% since November to<br />

cool inflation. Credit has dropped off<br />

dramatically ever since. The benchmark<br />

rate was held steady in January and<br />

February meetings. Inflation is expected to<br />

have risen to more than 15% last month,<br />

polls showed as fruit and vegetable prices<br />

continue to exert upward pressure. It<br />

edged higher to stand at 14.97% in January.<br />

Ensuring price stability is Turkey’s main<br />

priority in <strong>2021</strong>, Minister Elvan said.<br />

“Our policies fighting inflation will pave<br />

the way for more qualified and sustainable<br />

investment, production and growth,” he<br />

stated.<br />

The central bank expects inflation to come<br />

down to 9.4% by the end of <strong>2021</strong>. However,<br />

it said changes of weightings in the<br />

inflation basket will have an upside impact<br />

on annual inflation until mid-<strong>2021</strong>.<br />

The central bank said the changes were<br />

projected to increase inflation by 0.5 points<br />

by April, then die out toward the end of the<br />

year.<br />

A separate data showed that Turkish<br />

factory activity grew at a slower pace in<br />

February as new orders contracted slightly,<br />

although manufacturers continued to<br />

expand production and add staff.<br />

The Purchasing Managers’ Index (PMI) for<br />

the manufacturing sector fell to 51.7 in<br />

February from 54.4 a month earlier, data<br />

from the Istanbul Chamber of Industry<br />

(ISO) and IHS Markit showed, staying above<br />

the 50 mark that separates expansion from<br />

contraction.<br />

Signs of improvements in demand led<br />

manufacturers to expand production<br />

despite a slowdown in new business and<br />

issues with the supply of raw materials.<br />

Higher output and planned new production<br />

lines led firms to take on more staff, the<br />

panel said, extending the current sequence<br />

of job creation to nine months.<br />

Input costs and output prices continued<br />

to rise but at a slower pace mainly due<br />

to higher raw material costs, with a<br />

strengthening of the lira helping lead to<br />

softer inflationary pressures.<br />

“Although there were signs of softening<br />

new order inflows in February, the overall<br />

Turkey PMI remained in positive territory<br />

as firms shrugged off a pause in new order<br />

growth and continued to raise production<br />

and employment,” said Andrew Harker,<br />

economics director at IHS Markit.<br />

“There was also good news on the inflation<br />

front. Although supply issues are causing<br />

higher raw material prices globally, an<br />

appreciation of the Turkish lira has helped<br />

to mitigate these pressures,” Harker<br />

concluded.<br />

<strong>March</strong> <strong>2021</strong><br />

48

Turkish exporters<br />

break a new record,<br />

automotive exports<br />

lead the way<br />

Turkish Exporters Assembly (TİM), which<br />

is the only umbrella organization of 100<br />

thousand exporters with 61 Exporters’<br />

Association and 27 sectors, announced the<br />

temporary foreign trade data for February<br />

with the participation of Trade Minister<br />

Ruhsar Pekcan and members of the TİM<br />

Women’s Council, at a meeting in Ankara.<br />

According to the General Trading System<br />

(GTS), exports in February reached 16<br />

billion 12 million dollars, an increase of<br />

9.6 percent compared to the same month<br />

of the previous year, making the highest<br />

February export in history.<br />

Evaluating February export figures, TİM<br />

Chairman İsmail Gülle said, “After January,<br />

which we closed with a record in exports,<br />

the export family also showed a very<br />

successful performance in February. We<br />

have closed the last three months in a<br />

succession with a record. In February,<br />

our exports amounted to 16 billion 12<br />

million dollars, up 9.6 percent from the<br />

same month last year. In January and<br />

February 2020, we made a good start and<br />

set successive records. Likewise, we are<br />

proud of the record renewal in the first two<br />

months of <strong>2021</strong>. Hopefully, we will reach<br />

200 billion dollars, which is much higher<br />

than our export target of 184 billion dollars<br />

for <strong>2021</strong>. Our exporters continue to work,<br />

produce, export without slowing down.<br />

We believe that the maximum benefit<br />

of our country from the change in global<br />

supply chains will be possible by frequently<br />

meeting our exporters with buyers from all<br />

over the world.”<br />

Gülle said that 1,538 companies exported<br />

for the first time in February and that<br />

these companies, which had just started to<br />

export, exported 70 million 480 thousand<br />

dollars last month, and 40,616 companies<br />

in total exported in February.<br />

Emphasizing that 22 sectors increased<br />

their exports in February compared to the<br />

same month last year, Gülle said, “While<br />

our automotive sector, which exports 2<br />

billion 536 million dollars, maintains its<br />

leadership; Our Chemicals sector, which<br />

reached 1 billion 679 million dollars, was<br />

second and our ready-to-wear sector,<br />

which reached 1 billion 517 million dollars,<br />

was third. The sectors that achieved<br />

the strongest increase performance of<br />

February were Mining, which reached<br />

415.6 million dollars with an increase of<br />

47 percent, Defense and Aerospace, which<br />

reached 233.2 million dollars with an<br />

increase of 34 percent. The Ornamental<br />

Plants sector reached 16.3 million dollars<br />

with an increase of 25 percent. If we look<br />

at the dramatic increases in our sectors in<br />

February; Our steel industry increased its<br />

exports to Brazil by 2 thousand 333 percent<br />

and its exports to the United Kingdom<br />

by 510 percent. Our Electrical-Electronic<br />

sector increased its exports to Uzbekistan<br />

by 470 percent in February. Our Chemicals<br />

exports increased by 418 percent to<br />

Nigeria.”<br />

Stating that since May last year, they have<br />

been held 55 virtual trade delegations and<br />

10 virtual fairs in 50 countries, Gülle said,<br />

“Hopefully, we plan to continue our physical<br />

delegations in the summer months. With<br />