Asian Sky Quarterly 2021Q1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMMENTARY: GLOBAL JET CAPITAL<br />

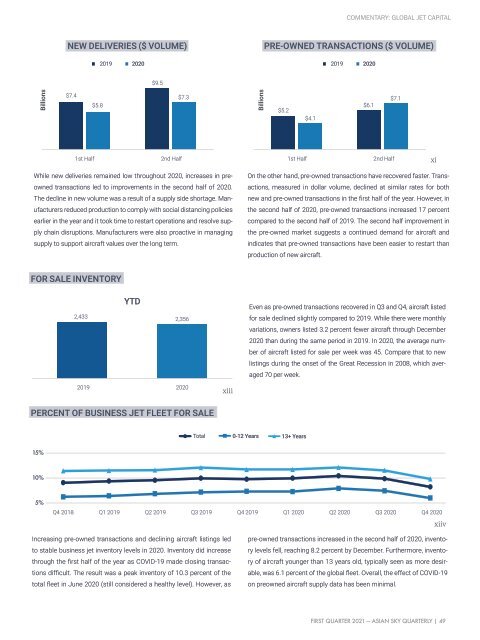

NEW DELIVERIES ($ VOLUME)<br />

PRE-OWNED TRANSACTIONS ($ VOLUME)<br />

2019 2020 2019 2020<br />

$9.5<br />

Billions<br />

$7.4<br />

$5.8<br />

$7.3<br />

Billions<br />

$5.2<br />

$4.1<br />

$6.1<br />

$7.1<br />

1st Half 2nd Half 1st Half 2nd Half<br />

xi<br />

While new deliveries remained low throughout 2020, increases in preowned<br />

transactions led to improvements in the second half of 2020.<br />

The decline in new volume was a result of a supply side shortage. Manufacturers<br />

reduced production to comply with social distancing policies<br />

earlier in the year and it took time to restart operations and resolve supply<br />

chain disruptions. Manufacturers were also proactive in managing<br />

supply to support aircraft values over the long term.<br />

On the other hand, pre-owned transactions have recovered faster. Transactions,<br />

measured in dollar volume, declined at similar rates for both<br />

new and pre-owned transactions in the first half of the year. However, in<br />

the second half of 2020, pre-owned transactions increased 17 percent<br />

compared to the second half of 2019. The second half improvement in<br />

the pre-owned market suggests a continued demand for aircraft and<br />

indicates that pre-owned transactions have been easier to restart than<br />

production of new aircraft.<br />

FOR SALE INVENTORY<br />

2,433<br />

YTD<br />

2,356<br />

Even as pre-owned transactions recovered in Q3 and Q4, aircraft listed<br />

for sale declined slightly compared to 2019. While there were monthly<br />

variations, owners listed 3.2 percent fewer aircraft through December<br />

2020 than during the same period in 2019. In 2020, the average number<br />

of aircraft listed for sale per week was 45. Compare that to new<br />

listings during the onset of the Great Recession in 2008, which averaged<br />

70 per week.<br />

2019 2020<br />

xiii<br />

PERCENT OF BUSINESS JET FLEET FOR SALE<br />

Total 0-12 Years 13+ Years<br />

15%<br />

10%<br />

5%<br />

Q4 2018<br />

Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020<br />

xiiv<br />

Increasing pre-owned transactions and declining aircraft listings led<br />

to stable business jet inventory levels in 2020. Inventory did increase<br />

through the first half of the year as COVID-19 made closing transactions<br />

difficult. The result was a peak inventory of 10.3 percent of the<br />

total fleet in June 2020 (still considered a healthy level). However, as<br />

pre-owned transactions increased in the second half of 2020, inventory<br />

levels fell, reaching 8.2 percent by December. Furthermore, inventory<br />

of aircraft younger than 13 years old, typically seen as more desirable,<br />

was 6.1 percent of the global fleet. Overall, the effect of COVID-19<br />

on preowned aircraft supply data has been minimal.<br />

FIRST QUARTER 2021 — ASIAN SKY QUARTERLY | 49