Asian Sky Quarterly 2021Q1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMMENTARY: GLOBAL JET CAPITAL<br />

OEM BACKLOGS<br />

Q4 Backlog at Major Business Jet OEMs<br />

Bombardier Gulfstream Dassault Cessna Embraer<br />

USD Millions<br />

$30,569<br />

$33,303<br />

$27,369<br />

Q4 2018 Q4 2019 Q4 2020<br />

viii<br />

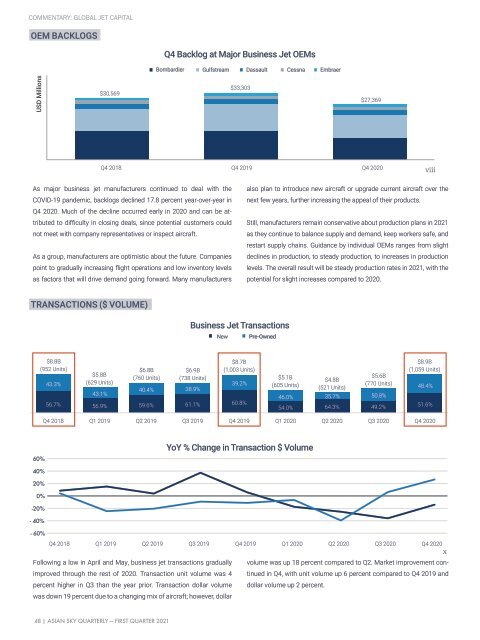

As major business jet manufacturers continued to deal with the<br />

COVID-19 pandemic, backlogs declined 17.8 percent year-over-year in<br />

Q4 2020. Much of the decline occurred early in 2020 and can be attributed<br />

to difficulty in closing deals, since potential customers could<br />

not meet with company representatives or inspect aircraft.<br />

As a group, manufacturers are optimistic about the future. Companies<br />

point to gradually increasing flight operations and low inventory levels<br />

as factors that will drive demand going forward. Many manufacturers<br />

also plan to introduce new aircraft or upgrade current aircraft over the<br />

next few years, further increasing the appeal of their products.<br />

Still, manufacturers remain conservative about production plans in 2021<br />

as they continue to balance supply and demand, keep workers safe, and<br />

restart supply chains. Guidance by individual OEMs ranges from slight<br />

declines in production, to steady production, to increases in production<br />

levels. The overall result will be steady production rates in 2021, with the<br />

potential for slight increases compared to 2020.<br />

TRANSACTIONS ($ VOLUME)<br />

Business Jet Transactions<br />

New<br />

Pre-Owned<br />

$8.8B<br />

$8.7B<br />

$8.9B<br />

(952 Units) $6.8B<br />

$6.9B (1,003 Units)<br />

(1,059 Units)<br />

$5.8B<br />

(760 Units) (738 Units)<br />

$5.1B<br />

$5.6B<br />

43.3% (629 Units)<br />

$4.8B<br />

39.2% (605 Units)<br />

(770 Units)<br />

48.4%<br />

40.4%<br />

38.9%<br />

(521 Units)<br />

43.1%<br />

46.0%<br />

35.7%<br />

50.8%<br />

56.7% 56.9% 59.6% 61.1%<br />

60.8% 54.0%<br />

64.3%<br />

49.2%<br />

51.6%<br />

Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020<br />

60%<br />

YoY % Change in Transaction $ Volume<br />

40%<br />

20%<br />

0%<br />

-20%<br />

- 40%<br />

- 60%<br />

Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020<br />

x<br />

Following a low in April and May, business jet transactions gradually volume was up 18 percent compared to Q2. Market improvement continued<br />

improved through the rest of 2020. Transaction unit volume was 4<br />

in Q4, with unit volume up 6 percent compared to Q4 2019 and<br />

percent higher in Q3 than the year prior. Transaction dollar volume dollar volume up 2 percent.<br />

was down 19 percent due to a changing mix of aircraft; however, dollar<br />

48 | ASIAN SKY QUARTERLY — FIRST QUARTER 2021