Comprehensive Annual Financial Report 2020

The Comprehensive Annual Financial Report includes all funds of the city. This report includes all government activities, organizations, and functions for which the City is financially accountable.

The Comprehensive Annual Financial Report includes all funds of the city. This report includes all government activities, organizations, and functions for which the City is financially accountable.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

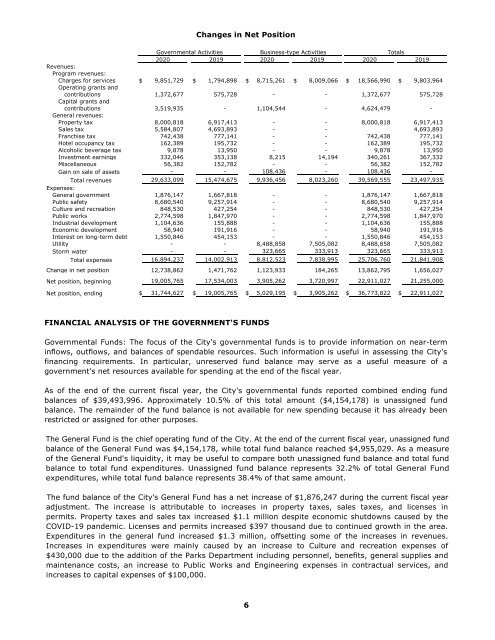

Changes in Net Position<br />

Governmental Activities Business-type Activities Totals<br />

<strong>2020</strong> 2019 <strong>2020</strong> 2019 <strong>2020</strong> 2019<br />

Revenues:<br />

Program revenues:<br />

Charges for services $ 9,851,729 $ 1,794,898 $ 8,715,261 $ 8,009,066 $ 18,566,990 $ 9,803,964<br />

Operating grants and<br />

contributions 1,372,677 575,728 - - 1,372,677 575,728<br />

Capital grants and<br />

contributions 3,519,935 - 1,104,544 - 4,624,479 -<br />

General revenues:<br />

Property tax 8,000,818 6,917,413 - - 8,000,818 6,917,413<br />

Sales tax 5,584,807 4,693,893 - - 4,693,893<br />

Franchise tax 742,438 777,141 - - 742,438 777,141<br />

Hotel occupancy tax 162,389 195,732 - - 162,389 195,732<br />

Alcoholic beverage tax 9,878 13,950 - - 9,878 13,950<br />

Investment earnings 332,046 353,138 8,215 14,194 340,261 367,332<br />

Miscellaneous 56,382 152,782 - - 56,382 152,782<br />

Gain on sale of assets - - 108,436 - 108,436 -<br />

Total revenues 29,633,099 15,474,675 9,936,456 8,023,260 39,569,555 23,497,935<br />

Expenses:<br />

General government 1,876,147 1,667,818 - - 1,876,147 1,667,818<br />

Public safety 8,680,540 9,257,914 - - 8,680,540 9,257,914<br />

Culture and recreation 848,530 427,254 - - 848,530 427,254<br />

Public works 2,774,598 1,847,970 - - 2,774,598 1,847,970<br />

Industrial development 1,104,636 155,888 - - 1,104,636 155,888<br />

Economic development 58,940 191,916 - - 58,940 191,916<br />

Interest on long-term debt 1,550,846 454,153 - - 1,550,846 454,153<br />

Utility - - 8,488,858 7,505,082 8,488,858 7,505,082<br />

Storm water - - 323,665 333,913 323,665 333,913<br />

Total expenses 16,894,237 14,002,913 8,812,523 7,838,995 25,706,760 21,841,908<br />

Change in net position 12,738,862 1,471,762 1,123,933 184,265 13,862,795 1,656,027<br />

Net position, beginning 19,005,765 17,534,003 3,905,262 3,720,997 22,911,027 21,255,000<br />

Net position, ending $ 31,744,627 $ 19,005,765 $ 5,029,195 $ 3,905,262 $ 36,773,822 $ 22,911,027<br />

FINANCIAL ANALYSIS OF THE GOVERNMENT'S FUNDS<br />

Governmental Funds: The focus of the City's governmental funds is to provide information on near-term<br />

inflows, outflows, and balances of spendable resources. Such information is useful in assessing the City's<br />

financing requirements. In particular, unreserved fund balance may serve as a useful measure of a<br />

government's net resources available for spending at the end of the fiscal year.<br />

As of the end of the current fiscal year, the City's governmental funds reported combined ending fund<br />

balances of $39,493,996. Approximately 10.5% of this total amount ($4,154,178) is unassigned fund<br />

balance. The remainder of the fund balance is not available for new spending because it has already been<br />

restricted or assigned for other purposes.<br />

The General Fund is the chief operating fund of the City. At the end of the current fiscal year, unassigned fund<br />

balance of the General Fund was $4,154,178, while total fund balance reached $4,955,029. As a measure<br />

of the General Fund's liquidity, it may be useful to compare both unassigned fund balance and total fund<br />

balance to total fund expenditures. Unassigned fund balance represents 32.2% of total General Fund<br />

expenditures, while total fund balance represents 38.4% of that same amount.<br />

The fund balance of the City's General Fund has a net increase of $1,876,247 during the current fiscal year<br />

adjustment. The increase is attributable to increases in property taxes, sales taxes, and licenses in<br />

permits. Property taxes and sales tax increased $1.1 million despite economic shutdowns caused by the<br />

COVID-19 pandemic. Licenses and permits increased $397 thousand due to continued growth in the area.<br />

Expenditures in the general fund increased $1.3 million, offsetting some of the increases in revenues.<br />

Increases in expenditures were mainly caused by an increase to Culture and recreation expenses of<br />

$430,000 due to the addition of the Parks Department including personnel, benefits, general supplies and<br />

maintenance costs, an increase to Public Works and Engineering expenses in contractual services, and<br />

increases to capital expenses of $100,000.<br />

6