Comprehensive Annual Financial Report 2020

The Comprehensive Annual Financial Report includes all funds of the city. This report includes all government activities, organizations, and functions for which the City is financially accountable.

The Comprehensive Annual Financial Report includes all funds of the city. This report includes all government activities, organizations, and functions for which the City is financially accountable.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

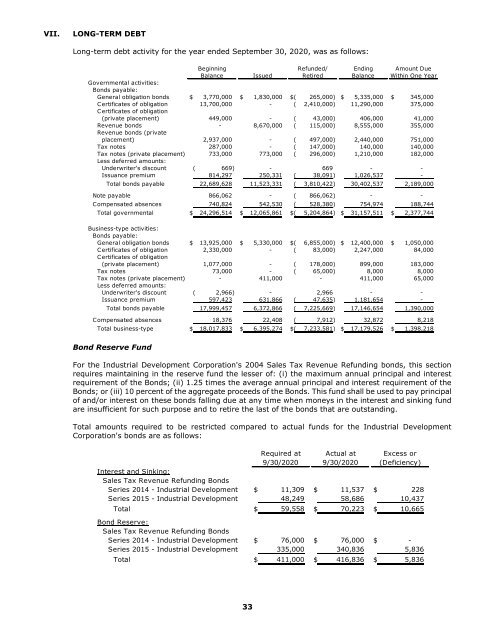

VII.<br />

LONG-TERM DEBT<br />

Long-term debt activity for the year ended September 30, <strong>2020</strong>, was as follows:<br />

Beginning Refunded/ Ending Amount Due<br />

Balance Issued Retired Balance Within One Year<br />

Governmental activities:<br />

Bonds payable:<br />

General obligation bonds $ 3,770,000 $ 1,830,000 $( 265,000) $ 5,335,000 $ 345,000<br />

Certificates of obligation 13,700,000 - ( 2,410,000) 11,290,000 375,000<br />

Certificates of obligation<br />

(private placement) 449,000 - ( 43,000) 406,000 41,000<br />

Revenue bonds - 8,670,000 ( 115,000) 8,555,000 355,000<br />

Revenue bonds (private<br />

placement) 2,937,000 - ( 497,000) 2,440,000 751,000<br />

Tax notes 287,000 - ( 147,000) 140,000 140,000<br />

Tax notes (private placement) 733,000 773,000 ( 296,000) 1,210,000 182,000<br />

Less deferred amounts:<br />

Underwriter's discount ( 669)<br />

- 669 - -<br />

Issuance premium 814,297 250,331 ( 38,091) 1,026,537 -<br />

Total bonds payable 22,689,628 11,523,331 ( 3,810,422) 30,402,537 2,189,000<br />

Note payable 866,062 - ( 866,062)<br />

- -<br />

Compensated absences 740,824 542,530 ( 528,380) 754,974 188,744<br />

Total governmental $ 24,296,514 $ 12,065,861 $( 5,204,864) $ 31,157,511 $ 2,377,744<br />

Business-type activities:<br />

Bonds payable:<br />

General obligation bonds $ 13,925,000 $ 5,330,000 $( 6,855,000) $ 12,400,000 $ 1,050,000<br />

Certificates of obligation 2,330,000 - ( 83,000) 2,247,000 84,000<br />

Certificates of obligation<br />

(private placement) 1,077,000 - ( 178,000) 899,000 183,000<br />

Tax notes 73,000 - ( 65,000)<br />

8,000 8,000<br />

Tax notes (private placement) - 411,000 - 411,000 65,000<br />

Less deferred amounts:<br />

Underwriter's discount ( 2,966)<br />

- 2,966 - -<br />

Issuance premium 597,423 631,866 ( 47,635) 1,181,654 -<br />

Total bonds payable 17,999,457 6,372,866 ( 7,225,669) 17,146,654 1,390,000<br />

Compensated absences 18,376 22,408 ( 7,912) 32,872 8,218<br />

Total business-type $ 18,017,833 $ 6,395,274 $( 7,233,581) $ 17,179,526 $ 1,398,218<br />

Bond Reserve Fund<br />

For the Industrial Development Corporation's 2004 Sales Tax Revenue Refunding bonds, this section<br />

requires maintaining in the reserve fund the lesser of: (i) the maximum annual principal and interest<br />

requirement of the Bonds; (ii) 1.25 times the average annual principal and interest requirement of the<br />

Bonds; or (iii) 10 percent of the aggregate proceeds of the Bonds. This fund shall be used to pay principal<br />

of and/or interest on these bonds falling due at any time when moneys in the interest and sinking fund<br />

are insufficient for such purpose and to retire the last of the bonds that are outstanding.<br />

Total amounts required to be restricted compared to actual funds for the Industrial Development<br />

Corporation's bonds are as follows:<br />

Required at Actual at Excess or<br />

9/30/<strong>2020</strong> 9/30/<strong>2020</strong> (Deficiency)<br />

Interest and Sinking:<br />

Sales Tax Revenue Refunding Bonds<br />

Series 2014 - Industrial Development $ 11,309 $ 11,537 $<br />

228<br />

Series 2015 - Industrial Development 48,249 58,686 10,437<br />

Total $ 59,558 $ 70,223 $ 10,665<br />

Bond Reserve:<br />

Sales Tax Revenue Refunding Bonds<br />

Series 2014 - Industrial Development $ 76,000 $ 76,000 $ -<br />

Series 2015 - Industrial Development 335,000 340,836 5,836<br />

Total $ 411,000 $ 416,836 $ 5,836<br />

33