Comprehensive Annual Financial Report 2020

The Comprehensive Annual Financial Report includes all funds of the city. This report includes all government activities, organizations, and functions for which the City is financially accountable.

The Comprehensive Annual Financial Report includes all funds of the city. This report includes all government activities, organizations, and functions for which the City is financially accountable.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

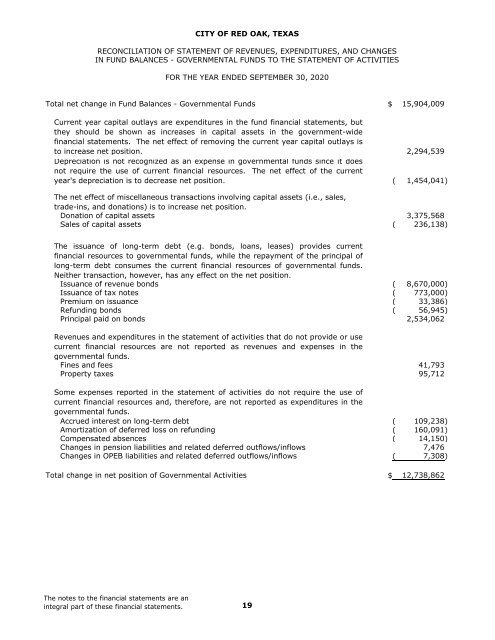

CITY OF RED OAK, TEXAS<br />

RECONCILIATION OF STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES<br />

IN FUND BALANCES - GOVERNMENTAL FUNDS TO THE STATEMENT OF ACTIVITIES<br />

FOR THE YEAR ENDED SEPTEMBER 30, <strong>2020</strong><br />

Total net change in Fund Balances - Governmental Funds $ 15,904,009<br />

Current year capital outlays are expenditures in the fund financial statements, but<br />

they should be shown as increases in capital assets in the government-wide<br />

financial statements. The net effect of removing the current year capital outlays is<br />

to increase net position. 2,294,539<br />

Depreciation is not recognized as an expense in governmental funds since it does<br />

not require the use of current financial resources. The net effect of the current<br />

year's depreciation is to decrease net position. ( 1,454,041)<br />

The net effect of miscellaneous transactions involving capital assets (i.e., sales,<br />

trade-ins, and donations) is to increase net position.<br />

Donation of capital assets 3,375,568<br />

Sales of capital assets ( 236,138)<br />

The issuance of long-term debt (e.g. bonds, loans, leases) provides current<br />

financial resources to governmental funds, while the repayment of the principal of<br />

long-term debt consumes the current financial resources of governmental funds.<br />

Neither transaction, however, has any effect on the net position.<br />

Issuance of revenue bonds ( 8,670,000)<br />

Issuance of tax notes ( 773,000)<br />

Premium on issuance ( 33,386)<br />

Refunding bonds ( 56,945)<br />

Principal paid on bonds 2,534,062<br />

Revenues and expenditures in the statement of activities that do not provide or use<br />

current financial resources are not reported as revenues and expenses in the<br />

governmental funds.<br />

Fines and fees 41,793<br />

Property taxes 95,712<br />

Some expenses reported in the statement of activities do not require the use of<br />

current financial resources and, therefore, are not reported as expenditures in the<br />

governmental funds.<br />

Accrued interest on long-term debt ( 109,238)<br />

Amortization of deferred loss on refunding ( 160,091)<br />

Compensated absences ( 14,150)<br />

Changes in pension liabilities and related deferred outflows/inflows 7,476<br />

Changes in OPEB liabilities and related deferred outflows/inflows ( 7,308)<br />

Total change in net position of Governmental Activities $ 12,738,862<br />

The notes to the financial statements are an<br />

integral part of these financial statements. 19