You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

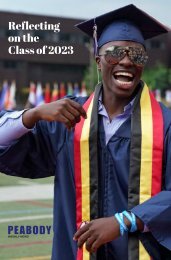

Tellers tend to their customers' banking needs at National Grand Bank in Marblehead.<br />

PHOTOS: SPENSER HASAK<br />

Fiercely independent<br />

BY MIKE SHANAHAN<br />

Change comes slowly to<br />

National Grand Bank, the<br />

190-year-old Marblehead<br />

institution that is one of the few truly<br />

independent banks still on the North<br />

Shore. But you get a sense that is<br />

exactly how the bank — and its nearly<br />

225 shareholders — like things. Stable,<br />

conventional and predictable.<br />

Those characteristics have served the<br />

bank well since its founding in 1831<br />

as Grand Bank, a name that is less<br />

presumptuous than it might sound when<br />

you consider the source of its initial<br />

deposits. The bank began as a refuge for<br />

the hard-earned profits of Marblehead’s<br />

principal trade at the time — fishermen<br />

who farmed the sea in a place called<br />

the Grand Banks, an abundant fishing<br />

ground nearly 1,000 miles east of<br />

Marblehead, off Newfoundland. The<br />

“National” was added to the name when<br />

the bank got its federal charter in 1864.<br />

Fishing was a serious engine of the<br />

New England economy in the 1830s —<br />

so much so that Marblehead was one<br />

of the 60 largest cities in the United<br />

States at the time. The Grand Bank<br />

came to be because the local fleet wanted<br />

more control over their finances, a local<br />

institution which avoids speculation<br />

and would be there for them in good<br />

times and in bad. That philosophy hasn’t<br />

changed much in the intervening years.<br />

The bank takes pride in the fact that<br />

when you call its headquarters during<br />

working hours a real person answers every<br />

call. And you will not find the bank leading<br />

the charge on changes in technology,<br />

either. Sure, they have services like online<br />

banking and mobile deposits, but they don’t<br />

feel the need to be first in implementing<br />

innovation. The last “tweet” on their<br />

Twitter account was posted in 2014.<br />

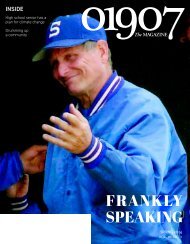

“We prefer to let the big guys sort out<br />

the technology challenges and then we<br />

follow,” NGB president Jim Nye explains.<br />

“You don’t come to a bank our size with<br />

our culture expecting us to be on the<br />

The mantra that National Grand Bank CEO Jim Nye lives by.<br />

cutting edge of technology, and we’re<br />

comfortable with that. You come because<br />

you know us, we know you, and we can<br />

be trusted.”<br />

And while other banks are bent on<br />

growth through new branches, new<br />

products and acquisitions, that’s not<br />

NGB’s style, either. In fact, they lasted<br />

131 years in their first headquarters<br />

building on Hooper Street before they<br />

made a bold move in 1962 by buying the<br />

abandoned Boston & Maine Railroad<br />

station on Pleasant Street, where they<br />

built their current quarters in 1963. For<br />

all those years, the bank operated with a<br />

single banking office.<br />

“We’re centrally located in a small<br />

town — we think it’s helpful for our<br />

customers to have us all here in one<br />

place. If there is a question or a problem<br />

we can walk down the hall and come up<br />

with a solution,” said Nye. “Marblehead<br />

is our market. We don’t need growth for<br />

growth’s sake.”<br />

That said, the bank did open its first<br />

“branch” in 2002 when the new high<br />

school opened at Tent’s Corner. Inspired<br />

by a suggestion from longtime business<br />

education teacher Joan Stomatuk,<br />

the bank operates a limited service<br />

branch, operated by students under the<br />

supervision of the bank’s Matt Martin.<br />

But don’t expect to see any additional,<br />

traditional branches. As Nye pointed out,<br />

“Expansion is not on our agenda.”<br />

The agenda for the bank is managed<br />

by an unusually active Board of<br />

Directors. The group of six directors,<br />

plus Nye, meets every other Tuesday to<br />

personally review the details and approve<br />

most loans. Competitive institutions<br />

generally delegate that responsibility to<br />

management, but that’s not the practice<br />

at NGB. Like the bank, the board is<br />

very stable. Its last new member joined<br />

in 2014, and two current directors have<br />

served since the 1980s.<br />

“Our board knows our customers and<br />

knows our market, so they help us make<br />

better lending decisions,” explained Nye.<br />

“And if a customer gets into trouble, they