Asian Sky Quarterly 2021 Q3

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ASIA-PACIFIC MOOD & INTENTIONS<br />

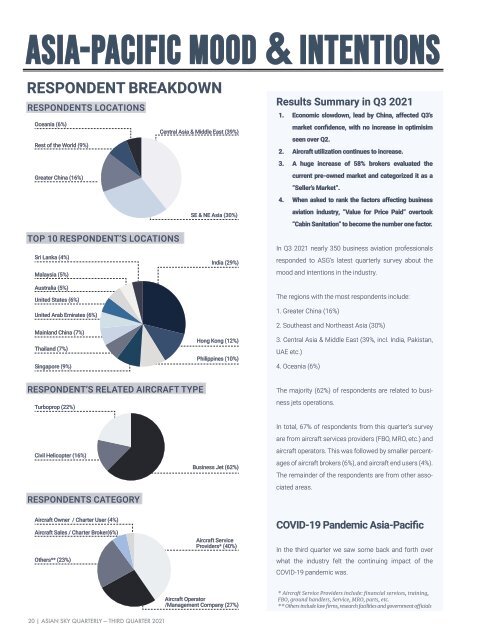

RESPONDENT BREAKDOWN<br />

RESPONDENTS LOCATIONS<br />

Oceania (6%)<br />

Central Asia & Middle East (39%)<br />

Rest of the World (9%)<br />

Greater China (16%)<br />

TOP 10 RESPONDENT’S LOCATIONS<br />

Sri Lanka (4%)<br />

Malaysia (5%)<br />

SE & NE Asia (30%)<br />

India (29%)<br />

Results Summary in <strong>Q3</strong> <strong>2021</strong><br />

1. Economic slowdown, lead by China, affected <strong>Q3</strong>’s<br />

market confidence, with no increase in optimisim<br />

seen over Q2.<br />

2. Aircraft utilization continues to increase.<br />

3. A huge increase of 58% brokers evaluated the<br />

current pre-owned market and categorized it as a<br />

“Seller’s Market”.<br />

4. When asked to rank the factors affecting business<br />

aviation industry, “Value for Price Paid” overtook<br />

“Cabin Sanitation” to become the number one factor.<br />

In <strong>Q3</strong> <strong>2021</strong> nearly 350 business aviation professionals<br />

responded to ASG’s latest quarterly survey about the<br />

mood and intentions in the industry.<br />

Australia (5%)<br />

United States (6%)<br />

United Arab Emirates (6%)<br />

Mainland China (7%)<br />

Thailand (7%)<br />

Singapore (9%)<br />

Hong Kong (12%)<br />

Philippines (10%)<br />

The regions with the most respondents include:<br />

1. Greater China (16%)<br />

2. Southeast and Northeast Asia (30%)<br />

3. Central Asia & Middle East (39%, incl. India, Pakistan,<br />

UAE etc.)<br />

4. Oceania (6%)<br />

RESPONDENT’S RELATED AIRCRAFT TYPE<br />

Turboprop (22%)<br />

The majority (62%) of respondents are related to business<br />

jets operations.<br />

Civil Helicopter (16%)<br />

RESPONDENTS CATEGORY<br />

Business Jet (62%)<br />

In total, 67% of respondents from this quarter’s survey<br />

are from aircraft services providers (FBO, MRO, etc.) and<br />

aircraft operators. This was followed by smaller percentages<br />

of aircraft brokers (6%), and aircraft end users (4%).<br />

The remainder of the respondents are from other associated<br />

areas.<br />

Aircraft Owner / Charter User (4%)<br />

Aircraft Sales / Charter Broker(6%)<br />

Others** (23%)<br />

Aircraft Service<br />

Providers* (40%)<br />

COVID-19 Pandemic Asia-Pacific<br />

In the third quarter we saw some back and forth over<br />

what the industry felt the continuing impact of the<br />

COVID-19 pandemic was.<br />

Aircraft Operator<br />

/Management Company (27%)<br />

* Aircraft Service Providers include: financial services, training,<br />

FBO, ground handlers, Service, MRO, parts, etc.<br />

** Others include law firms, research facilities and government officials<br />

20 | ASIAN SKY QUARTERLY — THIRD QUARTER <strong>2021</strong>