Insurance and Interconnectedness in the Financial Services Industry

Insurance and Interconnectedness in the Financial Services Industry

Insurance and Interconnectedness in the Financial Services Industry

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

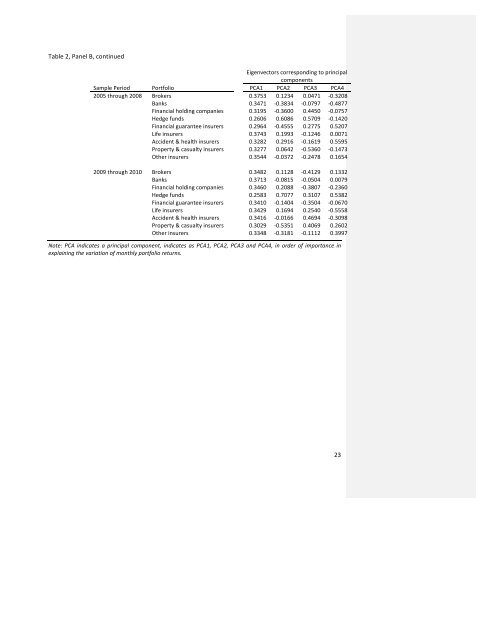

Table 2, Panel B, cont<strong>in</strong>ued<br />

Eigenvectors correspond<strong>in</strong>g to pr<strong>in</strong>cipal<br />

components<br />

Sample Period Portfolio PCA1 PCA2 PCA3 PCA4<br />

2005 through 2008 Brokers 0.3753 0.1234 0.0471 -‐0.3208<br />

Banks 0.3471 -‐0.3834 -‐0.0797 -‐0.4877<br />

F<strong>in</strong>ancial hold<strong>in</strong>g companies 0.3195 -‐0.3600 0.4450 -‐0.0757<br />

Hedge funds 0.2606 0.6086 0.5709 -‐0.1420<br />

F<strong>in</strong>ancial guarantee <strong>in</strong>surers 0.2964 -‐0.4555 0.2775 0.5207<br />

Life <strong>in</strong>surers 0.3743 0.1993 -‐0.1246 0.0071<br />

Accident & health <strong>in</strong>surers 0.3282 0.2916 -‐0.1619 0.5595<br />

Property & casualty <strong>in</strong>surers 0.3277 0.0642 -‐0.5360 -‐0.1473<br />

O<strong>the</strong>r <strong>in</strong>surers 0.3544 -‐0.0372 -‐0.2478 0.1654<br />

2009 through 2010 Brokers 0.3482 0.1128 -‐0.4129 0.1332<br />

Banks 0.3713 -‐0.0815 -‐0.0504 0.0079<br />

F<strong>in</strong>ancial hold<strong>in</strong>g companies 0.3460 0.2088 -‐0.3807 -‐0.2360<br />

Hedge funds 0.2583 0.7077 0.3107 0.5382<br />

F<strong>in</strong>ancial guarantee <strong>in</strong>surers 0.3410 -‐0.1404 -‐0.3504 -‐0.0670<br />

Life <strong>in</strong>surers 0.3429 0.1694 0.2540 -‐0.5558<br />

Accident & health <strong>in</strong>surers 0.3416 -‐0.0166 0.4694 -‐0.3098<br />

Property & casualty <strong>in</strong>surers 0.3029 -‐0.5351 0.4069 0.2602<br />

O<strong>the</strong>r <strong>in</strong>surers 0.3348 -‐0.3181 -‐0.1112 0.3997<br />

Note: PCA <strong>in</strong>dicates a pr<strong>in</strong>cipal component, <strong>in</strong>dicates as PCA1, PCA2, PCA3 <strong>and</strong> PCA4, <strong>in</strong> order of importance <strong>in</strong><br />

expla<strong>in</strong><strong>in</strong>g <strong>the</strong> variation of monthly portfolio returns.<br />

23