Insurance and Interconnectedness in the Financial Services Industry

Insurance and Interconnectedness in the Financial Services Industry

Insurance and Interconnectedness in the Financial Services Industry

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

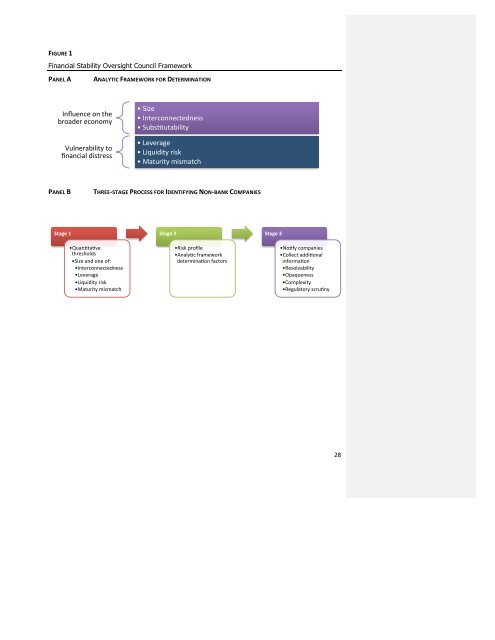

FIGURE 1<br />

F<strong>in</strong>ancial Stability Oversight Council Framework<br />

PANEL A ANALYTIC FRAMEWORK FOR DETERMINATION<br />

Influence on <strong>the</strong><br />

broader economy<br />

Vulnerability to<br />

f<strong>in</strong>ancial distress<br />

• Size<br />

• <strong>Interconnectedness</strong><br />

• Subsytutability<br />

PANEL B THREE-‐STAGE PROCESS FOR IDENTIFYING NON-‐BANK COMPANIES<br />

Stage 1<br />

• Quanytayve<br />

thresholds<br />

• Size <strong>and</strong> one of:<br />

• <strong>Interconnectedness</strong><br />

• Leverage<br />

• Liquidity risk<br />

• Maturity mismatch<br />

• Leverage<br />

• Liquidity risk<br />

• Maturity mismatch<br />

Stage 2<br />

• Risk profile<br />

• Analyyc framework<br />

determ<strong>in</strong>ayon factors<br />

Stage 3<br />

• Noyfy companies<br />

• Collect addiyonal<br />

<strong>in</strong>formayon<br />

• Resolvability<br />

• Opaqueness<br />

• Complexity<br />

• Regulatory scruyny<br />

28