Jeweller - April 2022

Diamond disruption: How the Russia-Ukraine conflict is changing global trade High time for change: Where to for watch brands after Baselworld? Darkness & light: Uncover the mysteries of black and white gemstones

Diamond disruption: How the Russia-Ukraine conflict is changing global trade

High time for change: Where to for watch brands after Baselworld?

Darkness & light: Uncover the mysteries of black and white gemstones

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

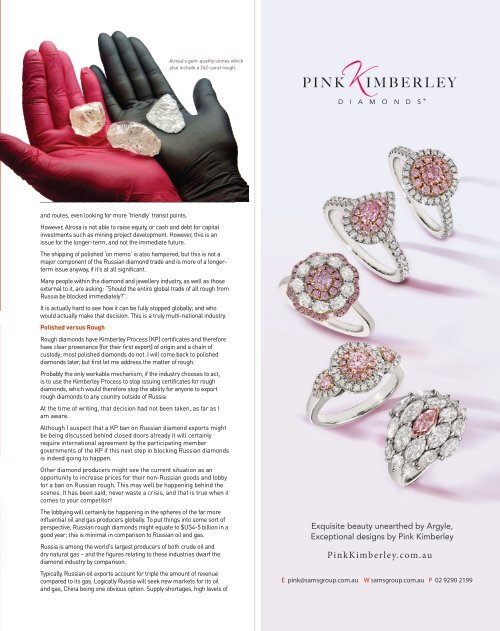

Alrosa's gem-quality stones which<br />

also include a 242-carat rough.<br />

and routes, even looking for more ‘friendly’ transit points.<br />

However, Alrosa is not able to raise equity, or cash and debt for capital<br />

investments such as mining project development. However, this is an<br />

issue for the longer-term, and not the immediate future.<br />

The shipping of polished ‘on memo’ is also hampered; but this is not a<br />

major component of the Russian diamond trade and is more of a longerterm<br />

issue anyway, if it’s at all significant.<br />

Many people within the diamond and jewellery industry, as well as those<br />

external to it, are asking: “Should the entire global trade of all rough from<br />

Russia be blocked immediately?”.<br />

It is actually hard to see how it can be fully stopped globally; and who<br />

would actually make that decision. This is a truly multi-national industry.<br />

Polished versus Rough<br />

Rough diamonds have Kimberley Process (KP) certificates and therefore<br />

have clear provenance (for their first export) of origin and a chain of<br />

custody; most polished diamonds do not. I will come back to polished<br />

diamonds later, but first let me address the matter of rough.<br />

Probably the only workable mechanism, if the industry chooses to act,<br />

is to use the Kimberley Process to stop issuing certificates for rough<br />

diamonds, which would therefore stop the ability for anyone to export<br />

rough diamonds to any country outside of Russia.<br />

At the time of writing, that decision had not been taken, as far as I<br />

am aware.<br />

Although I suspect that a KP ban on Russian diamond exports might<br />

be being discussed behind closed doors already it will certainly<br />

require international agreement by the participating member<br />

governments of the KP if this next step in blocking Russian diamonds<br />

is indeed going to happen.<br />

Other diamond producers might see the current situation as an<br />

opportunity to increase prices for their non-Russian goods and lobby<br />

for a ban on Russian rough. This may well be happening behind the<br />

scenes. It has been said, never waste a crisis, and that is true when it<br />

comes to your competitor!<br />

The lobbying will certainly be happening in the spheres of the far more<br />

influential oil and gas producers globally. To put things into some sort of<br />

perspective, Russian rough diamonds might equate to $US4-5 billion in a<br />

good year; this is minimal in comparison to Russian oil and gas.<br />

Russia is among the world's largest producers of both crude oil and<br />

dry natural gas – and the figures relating to these industries dwarf the<br />

diamond industry by comparison.<br />

Typically, Russian oil exports account for triple the amount of revenue<br />

compared to its gas. Logically Russia will seek new markets for its oil<br />

and gas, China being one obvious option. Supply shortages, high levels of<br />

Exquisite beauty unearthed by Argyle,<br />

Exceptional designs by Pink Kimberley<br />

PinkKimberley.com.au<br />

E pink@samsgroup.com.au W samsgroup.com.au P 02 9290 2199