My Forsyth _ Spring 2023

Women in Business, Homeownership, Finances, Food, Health & Wellness, and Architecture are just a few of the articles you'll find in the latest issue of your community magazine. Sit back and enjoy. Happy reading!

Women in Business, Homeownership, Finances, Food, Health & Wellness, and Architecture are just a few of the articles you'll find in the latest issue of your community magazine. Sit back and enjoy. Happy reading!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

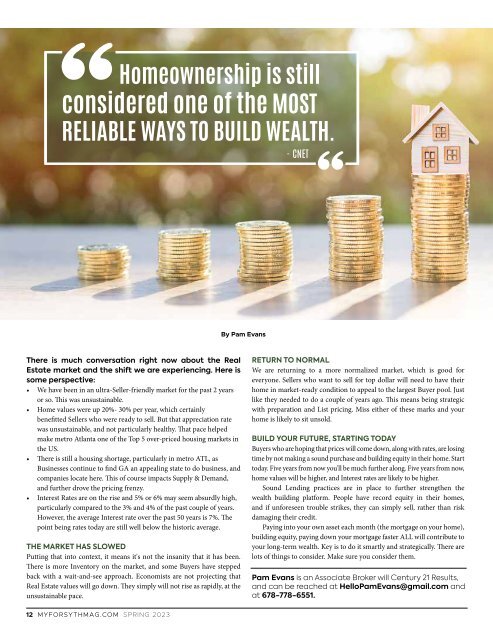

Homeownership is still<br />

considered one of the MOST<br />

RELIABLE WAYS TO BUILD WEALTH.<br />

- CNET<br />

By Pam Evans<br />

There is much conversation right now about the Real<br />

Estate market and the shift we are experiencing. Here is<br />

some perspective:<br />

• We have been in an ultra-Seller-friendly market for the past 2 years<br />

or so. This was unsustainable.<br />

• Home values were up 20%- 30% per year, which certainly<br />

benefitted Sellers who were ready to sell. But that appreciation rate<br />

was unsustainable, and not particularly healthy. That pace helped<br />

make metro Atlanta one of the Top 5 over-priced housing markets in<br />

the US.<br />

• There is still a housing shortage, particularly in metro ATL, as<br />

Businesses continue to find GA an appealing state to do business, and<br />

companies locate here. This of course impacts Supply & Demand,<br />

and further drove the pricing frenzy.<br />

• Interest Rates are on the rise and 5% or 6% may seem absurdly high,<br />

particularly compared to the 3% and 4% of the past couple of years.<br />

However, the average Interest rate over the past 50 years is 7%. The<br />

point being rates today are still well below the historic average.<br />

THE MARKET HAS SLOWED<br />

Putting that into context, it means it's not the insanity that it has been.<br />

There is more Inventory on the market, and some Buyers have stepped<br />

back with a wait-and-see approach. Economists are not projecting that<br />

Real Estate values will go down. They simply will not rise as rapidly, at the<br />

unsustainable pace.<br />

RETURN TO NORMAL<br />

We are returning to a more normalized market, which is good for<br />

everyone. Sellers who want to sell for top dollar will need to have their<br />

home in market-ready condition to appeal to the largest Buyer pool. Just<br />

like they needed to do a couple of years ago. This means being strategic<br />

with preparation and List pricing. Miss either of these marks and your<br />

home is likely to sit unsold.<br />

BUILD YOUR FUTURE, STARTING TODAY<br />

Buyers who are hoping that prices will come down, along with rates, are losing<br />

time by not making a sound purchase and building equity in their home. Start<br />

today. Five years from now you'll be much further along. Five years from now,<br />

home values will be higher, and Interest rates are likely to be higher.<br />

Sound Lending practices are in place to further strengthen the<br />

wealth building platform. People have record equity in their homes,<br />

and if unforeseen trouble strikes, they can simply sell, rather than risk<br />

damaging their credit.<br />

Paying into your own asset each month (the mortgage on your home),<br />

building equity, paying down your mortgage faster ALL will contribute to<br />

your long-term wealth. Key is to do it smartly and strategically. There are<br />

lots of things to consider. Make sure you consider them.<br />

Pam Evans is an Associate Broker will Century 21 Results,<br />

and can be reached at HelloPamEvans@gmail.com and<br />

at 678-778-6551.<br />

12 MYFORSYTHMAG.COM SPRING <strong>2023</strong>